Symantec, ESET, McAfee rank first in Windows anti-malware market share

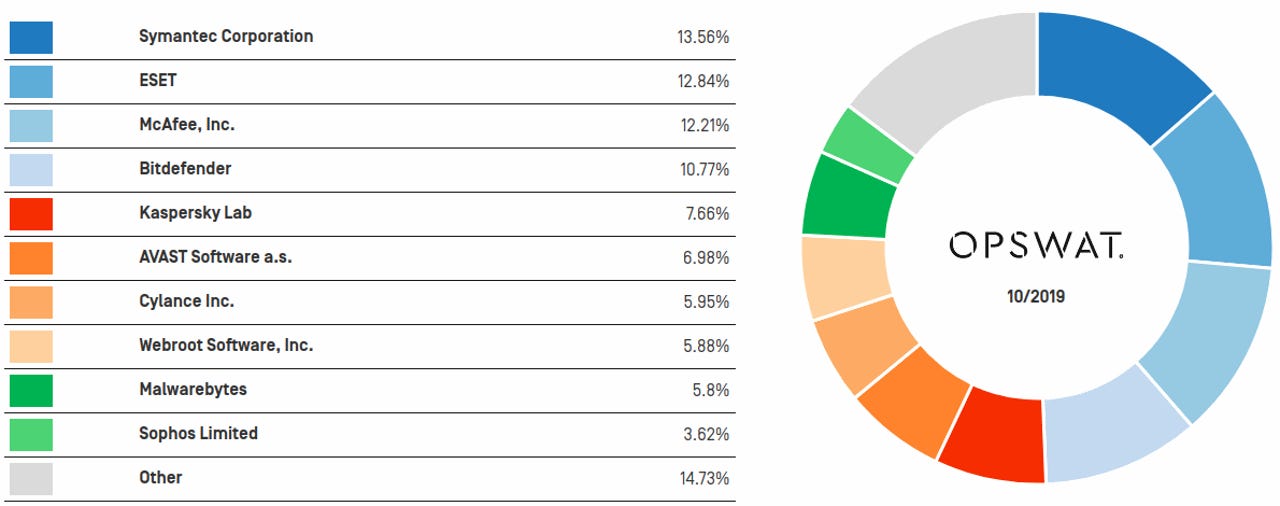

OPSWAT Windows anti-malware market share, October 2019

Antivirus programs from Symantec, ESET, and McAfee are today's most popular Windows-based anti-malware products, according to usage data gathered by enterprise software vendor OPSWAT.

For more than five years, OPSWAT has been collecting data and publishing monthly market share reports for the Windows anti-malware market.

The company says it collects its data from more than 30,000 enterprise and home systems where customers installed its free apps.

According to its latest report, published at the end of October, Symantec is today's top anti-malware vendor, with a market share of 13.56%, followed by ESET with 12.84%, and McAfee with 12.21%.

Other vendors listed in the top 10 include Bitdefender (10.77%), Kaspersky (7.66%), Avast (6.98%), Cylance (5.95%), Webroot (5.88%), Malwarebytes (5.8%), and Sophos (3.62%).

No Windows Defender... because

The OPSWAT report excludes Windows Defender data outright, as the product is installed by default on almost all modern Windows systems.

The company also admits that its report is not fully representative of the entire anti-malware market.

"Users sampled may not be representative of the general population," it said. "While our free products have international reach, their use is not commensurate with worldwide population distribution. Only English-language versions of our free products are available, so countries with higher numbers of English speakers are expected to use these applications at higher rates."

But, currently, OPSWAT's data is the only report giving insight into today's Windows anti-malware market, based on which some basic observations can be made.

For starters, we can see there's no big gap between the top four ranked vendors, all bunched together within a 3% point difference.

There's also no company dominating the market as we often see in other industry verticals. This is somewhat typical for the entire cyber-security field, where most of the niche markets -- like email gateway security, firewalls, and VPNs -- are also fragmented between an assortment of vendors, rather than being in the firm grasp of one big market player.

In a more than three-decades-old market, this is a spectacularly good state of affairs, since a diversified vendor ecosystem is the most obvious sign of a healthy and competitive market.

One vendor's rise and fall

And another sign of a healthy market is the fact that it never stands still. Over the years, the Windows anti-malware ecosystem has been in full flux. Vendors have often switched at the top, and market shares have risen and dropped dramatically.

Nothing shows this better than Avast's rise and fall through the rankings in the past four years.

An OPSWAT report from January 2014 had Avast with a 13.2% market share, way above its competition. That grew to 15% by December 2015. Its rise only continued in the next two years. By June 2017, Avast had amassed a whopping 20.48% of the market, thanks to its 2016 acquisition of fellow anti-malware vendor AVG.

Things started unraveling after that point, for reasons unknown. By December 2018, Avast's market share had dropped to 17.42%. It is unclear what triggered this downfall, but over the next ten months, Avast dropped to a meager 6.98%, ranking sixth in a top that it once used to rule.

OPSWAT Windows anti-malware market share, December 2015

Avast's fall in the rankings triggered a steady shift at the top. The leading spot switched hands three times in the past year, from Avast to McAfee in March 2019, then to ESET in June, and then to Symantec in August.

This only comes to prove that in the ethereal world of anti-malware products, companies will often move from one product to another if they feel they're not getting the proper protections.

There's still room to innovate and make room for new products on the market. The best example of this is Cylance's appearance in the latest OPSWAT report, a company that relies on an AI-driven approach to run what it calls "predictive security products."

Enterprise decision-makers are often influenced by the latest trendy technologies, and many will experiment with up-and-coming technologies in the search for better protection.

OPSWAT said its report should not be used to make decisions "on which anti-malware vendors are the best or to compare these vendors in terms of quality or performance," but instead be used only as informational points.