T-Mobile delivers Q3 subscriber growth at a cost

The company's third quarter results tell the tale. The company delivered third quarter earnings of $138 million, or 15 cents a share, on revenue of $7.8 billion, up 7 percent from a year ago.

Here's the catch: Wall Street was looking for earnings of 29 cents a share. T-Mobile's results were lowered due to the shutdown of MetroPCS' CDMA network.

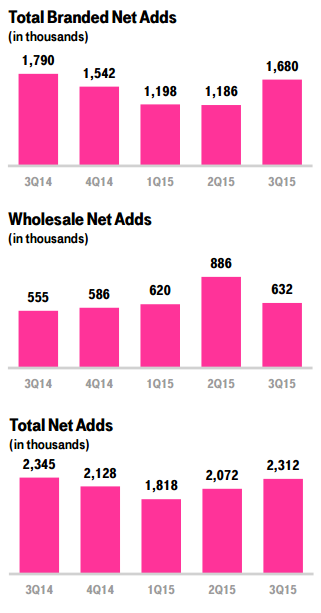

The game for T-Mobile is obvious: Grab customers and monetize them in the future. Indeed, T-Mobile's third quarter results reversed a loss a year ago. As noted by CNET's Roger Cheng, T-Mobile's 843,000 smartphone customer additions handily outstrips the growth of Verizon and AT&T.

That growth is helping T-Mobile's results. T-Mobile said that it will add between 3.8 million and 4.2 million branded postpaid net customers in 2015. For 2015, T-Mobile is expecting adjusted EBITDA to be about $6.8 billion to $7.2 billion, which is in line with prior projections. T-Mobile also expects to be free cash flow positive for the fourth quarter and 2015.

But a few analysts are already citing weak spots. Jefferies analyst Mike McCormack noted that T-Mobile's average revenue per user was down 3.7 percent from a year ago due to promotions.

For now, T-Mobile is a turnaround story and it's hard to deny its momentum. T-Mobile is running circles around the competition. However, 2016 will be a year of higher expectations. It's one thing to make an unprofitable company profitable. It's quite another to sustainably growth the bottom line and improve profit margins.

T-Mobile has a model that attracts customers via promotions and data friendly plans. Rivals like Verizon and AT&T have been mimicking those plans. For T-Mobile's rivals, the goal is to keep customers and add to them over time. T-Mobile can continue to beat up Sprint, but that battle between the No. 3 and No. 4 wireless carriers isn't going to be bottom line friendly.

At some point, T-Mobile will have to engineer even better financials. T-Mobile ended Sept. 30 with $2.63 billion in cash and equivalents, down from $5.31 billion as of Dec. 31, 2014. Those demands will likely be the true test for the Uncarrier model.