Taking the pulse of Oracle customers

R 'Ray' Wang, Forrester analyst and often a firm buyer advocate has brought out a report suggesting that demand for Oracle applications ' The Red Stack' remains strong. From the report:

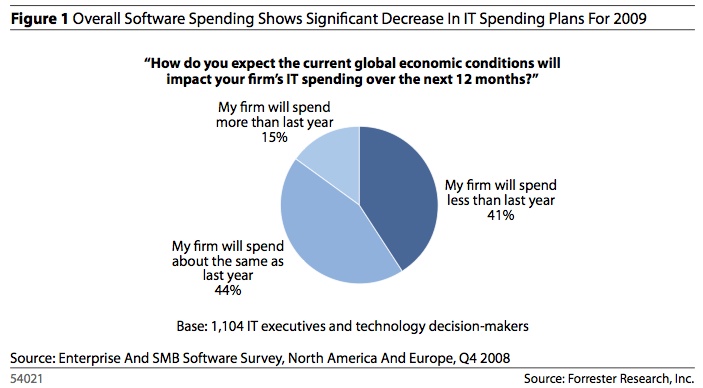

Though recent survey results in Forrester’s latest Business Data Services Software Survey of 1,104 decision- makers show that 41% plan to reduce IT spending from what they spent last year, the survey’s results regarding Oracle spending buck overall trends. In fact, only 23% of surveyed respondents plan to spend less on Oracle apps, and 67% plan to spend the same or more.

That was a surprise to me. In email conversation with Ray and Vinnie Mirchandani, Vinnie suggested that since the market data was collected in Q4, 2008, market conditions have continued to deteriorate:

Realize it takes a while to tabulate the results, but I would suggest if you did the survey today ( so 3 months later) it would be another 10 basis points of customers plan to spend less with Oracle

The economy has deteriorated further, and based on several calls I have had with incumbent Oracle customers in the last two weeks, the anger/frustration/impatience is growing by the day. It was always under the surface but it is getting more overt and Oracle sales is trying its old games - show us license demand before we go to Safra [Catz, Oracle CFO] and ask for maintenance relief.

Ray concurred. According to Forrester, this gets reflected in a higher likelihood of license audit:

Savvy sales reps often use audit threats to begin a conversation about potential overutilization to drive new license sales. Forrester has heard from at least a dozen clients this quarter about audit threats. However, Forrester data shows that only 6% of audits show compliance issues, while 21% show ownership of significant shelfware. As discussions regarding vendor-led audits begin, applications pros who have done their own audit can turn the tables and use this as an entry point for discussing reduction of shelfware.

Given the gladitorial nature of software sales and that Oracle is within two and a half months of its fiscal years end where it traditionally does a lot of business, Forrester's advice should be heeded. Searching for alternatives like saas/on-demand might seem a viable strategy or using a third party maintenance company like Spinnaker or RiminiStreet might offer relief. But that may not be enough. Back to Vinnie who has an array of Oracle customers:

The only consistency I can report is growing angst and a fear that even if they diversify to a new SaaS or even a legacy vendor, Oracle may acquire them in a couple of years.

Fear? Is this how Oracle rules its customer ranks? It's not the first time I've heard the 'F' word used with regard to Oracle. Its customers try and be as independent as possible through the users groups. But ultimately it will be the CFO's that cut checks and the lawyers that read contracts who get to decide how much tax they are going to continue paying Oracle (and SAP for that matter.)

I continue to wonder how many more quarters of seeing Oracle posting operating margins in the 40% range before those same customers realize just how much they are contributing to Oracle's coffers in return for? Or maybe it will be simpler than that. Through a link from Eddie Awad's OraNA Oracle news aggregator, I came across this insightful post that discusses saas and cloud computing:

...business focused IT folks who understand the model and can actively suggest new approaches to rationalise cost will do well. Those that put barriers in the way will do very badly, especially if those barriers are placed their to maintain a comfortable status quo.

The key for IT is to understand the business model, understand the business services and then understand where IT adds real value and where it should simply be a utility, then plan against that utility. That means cloud and SaaS will figure largely in how you build, deploy and manage those business services because differentiation is not important.

I note that Oracle has started to get saas religion. Will this be a turning point? We'll see.