Twilio's Q3 solid, Q4 outlook weak amid torrid growth rates

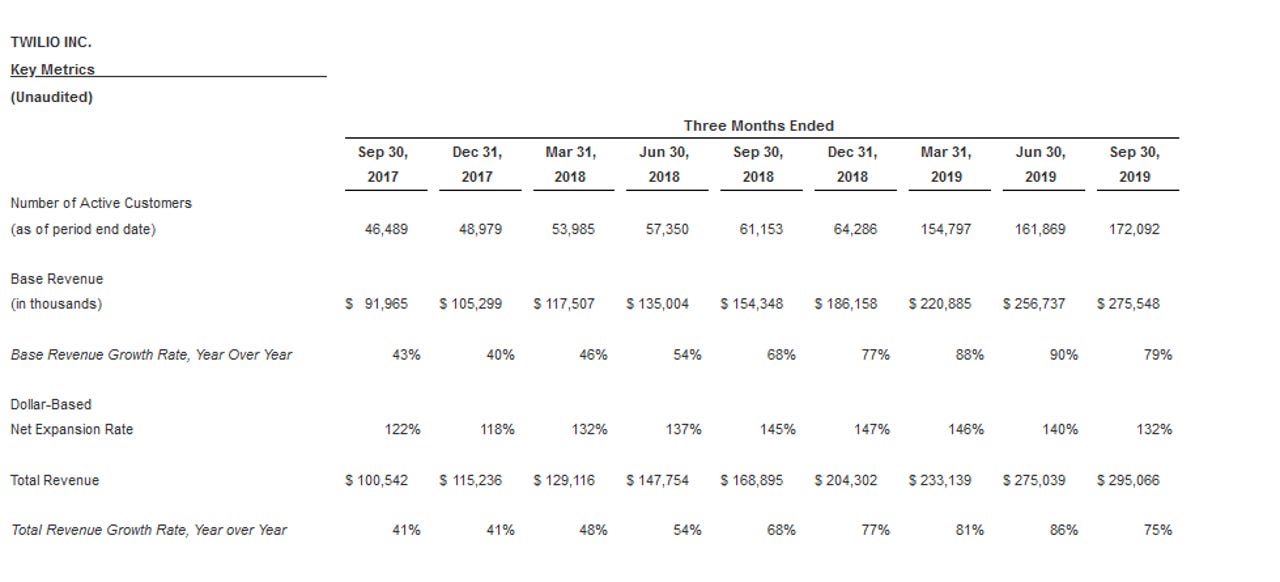

Twilio's revenue in the third quarter jumped 75% from a year ago as the company had more than 172,000 active customer accounts. But the outlook for the fourth quarter was weaker than expected.

The cloud communications as a service provider reported a net loss of 64 cents a share on revenue of $295.1 million. Non-GAAP earnings were 3 cents a share.

Wall Street was looking for third quarter non-GAAP earnings of a penny a share on revenue of $287.8 million.

Twilio offers a bevy of communications services and its roadmap makes the company more of a customer engagement platform. Twilio in the quarter launched Twilio Conversations, a unified API for multiple communications channels, SendGrid Ads and Media Streams.

- Verified by Twilio will tell you who's calling -- and why

- How Twilio SendGrid uses machine learning to thwart phishing attacks

- Zoom, Slack, and Twilio see expense account love from businesses, says Expensify

For the fourth quarter, Twilio projected revenue between $311 million to $314 million and non-GAAP earnings of a penny a share to 2 cents a share. For the year, Twilio is projecting revenue of about $1.114 billion to $1.117 billion with non-GAAP earnings of 16 cents a share to 17 cents a share.

That guidance was lower than Wall Street was expecting. Analysts were projecting fourth quarter revenue of $322 million and full year sales of $1.117 billion. Twilio's outlook for non-GAAP earnings fell short of the 7 cents a share expected in the fourth quarter and 17 cents a share for the year.

Related: