Unit 4 sees return to growth

Unit 4 (better known as Unit 4 Agresso) is reporting a return to growth in its 4th quarter but is cautious about the 2010 outlook. By the numbers:

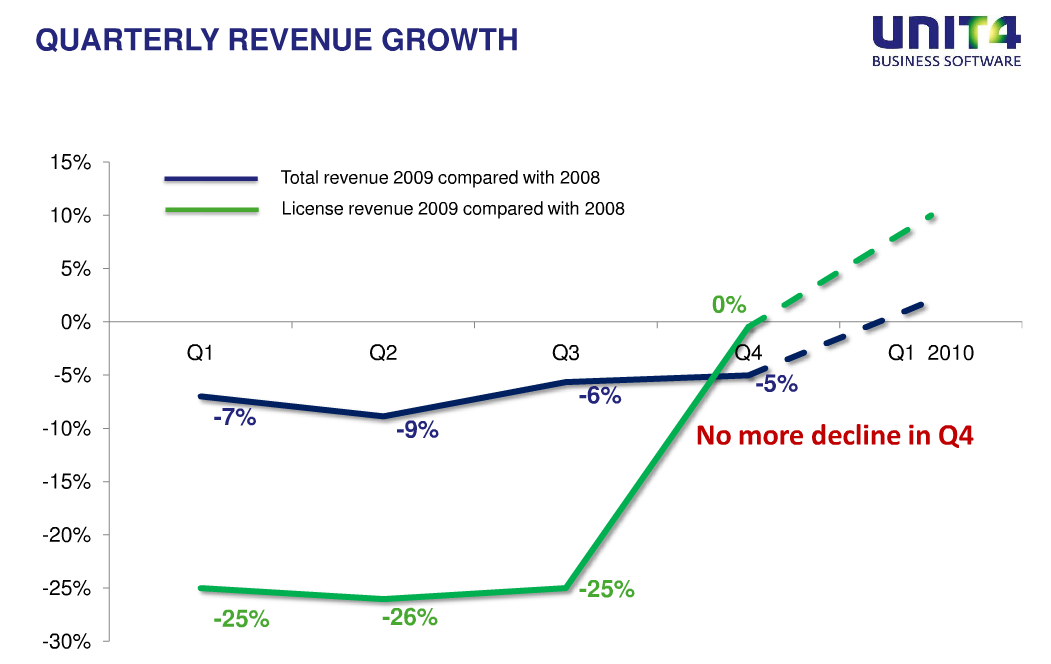

4th quarter:

- Revenue declined slightly; by 5% to $139 million (Q4 2008: $146.5 million)

- EBITDA rose by 19% to $37.3 million (Q4 2008: $31.1 million)

- The EBITDA margin climbed to a level of 26.8% (Q4 2008: 21.4%)

- Licence revenue returned to growth in December (+10% compared with December 2008)

Full year:

- Total 2009 revenues declined by 4% to $516.5 million (2008: $535.8 million)

- Including restructuring costs, EBITDA rose by 7% to an amount of $102.2 million (2008: $95.4 million)

- The EBITDA margin grew to a level of 19.8% (2008: 17.8%)

- Net profit attributable to shareholders of UNIT4 improved by 58% to $26.4 million (2008: $16.7 million)

- Strongly improved (operational) cash flow through working capital management: $93.8 million (2008: $76.5 million)

[Illustration above shows numbers in euros]

Unit 4 is transitioning towards a subscription based model. This helps it avoid the lumps and bumps of relying on large license based sales in the last quarter but doesn't insulate it from the general impact of economic cycles. It also concentrates on public sector which is widely thought to be in stringent cost cutting mode. Here, the company is more confident as it continues to roll out shared services that drive revenue but provide customers with a lowered TCO.

For the first time, Unit 4 made reference to FinancialForce, its SaaS accounting joint venture withSalesforce.com. In 2009, the company invested an extra €3 million. 2010 will see that spend rise a further €4 million, much of which will be concentrated on US sales and marketing. It did not however provide a breakdown of SaaS revenues which I suspect is because they are minimal.

The company continues to make significant wins against SAP, Oracle and Microsoft but there was very little apparent replacement. It was asked to confirm German deals where it has seen 450% growth in EBITDA but declined. Unit 4 joins a growing list of competitors that see Germany as a target for disaffected SAP customers.