Visa launches Aussie micropayment service

Credit card giant Visa today launched its new Australian-developed micropayment service payclick, with iTunes and BigPond customers able to use the new service from this morning.

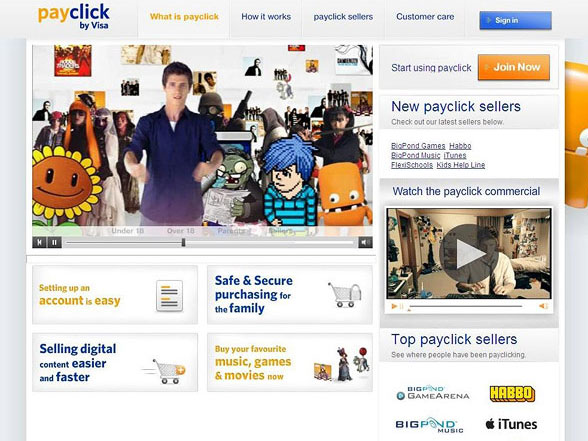

(Credit: Visa)

The payclick accounts are free to sign up for people over the age of 18 and can be funded from Visa, MasterCard or regular bank accounts. People under 18 can access payclick via the "sponsored accounts" feature that allows parents to sign their kids up for an account that the parent can make regular payments into, similar to an allowance. The payclick service also allows parents to view the transactions their kids are making.

"Payclick is designed to meet growing consumer demand for digital content, such as music, games and movies," Greg Storey, general manager of payclick said at the launch. "Payclick accounts are suitable for the different needs of family members, including those under 18."

This market of teen consumers who have relied on iTunes or BigPond gift cards, or special Visa debit cards to make their online purchases, are the main focus for the payclick service. The simplicity of the service of making a payment with a "click" — without having to enter personal or financial details — is aimed at the kids, while the ability to monitor a child's purchasing habits online is a benefit being pushed for the parents. Parents who have created sponsored accounts for their children will be able to view their child's transaction history live online, or receive a daily update.

The accounts will be unable to overdraw, and will need a minimum of $20 to start up. There is a cap on the account's limit of around $1000 that can be deposited.

Visa has secured six merchants so far for the service: the Apple iTunes store, BigPond Music, BigPond Games, FlexiSchools and Habbo as online retailers, and people can use payclick to donate money to the Kids Helpline charity.

Online merchants who use payclick as a payment method on their website will pay a fee for the service, according to Storey, but he stressed the service was not mimicking eBay's PayPal service.

"We're focused on the low value digital online transaction," he said.

While the focus now is on payments for digital downloads, Storey said the service has the potential to be expanded to payments for goods bought online or even micropayments for media companies to charge per article view online.

"Payclick would be ideal in that environment and we've prepared payclick to be very competent and very simple to use for what appears to be a growing market," he said. "Whether they are publishers, broadcaster or people bringing content online, we're making payclick available for them to prepare for that process."

Research conducted by Investment Trends shows there will be an estimated $646 million made in micropayments — payments below $20 — in Australia in 2010. This figure is expected to increase to around $1 billion by 2012.

The service is only available within Australia through the six merchants currently signed on, but Storey said Visa plans to expand the service globally in the future.