WeChat Pay follows Alipay in allowing foreign visitors to make payments in China

Chinese payments giant WeChat Pay can now be used by foreign visitors to pay for goods and services in China.

The Chinese payments giant has partnered with Visa, MasterCard, American Express, Discover Global Network, and JCB to allow foreign visitors to link their credit cards to WeChat Pay. This marks the first time that foreign visitors will be able to use international credit cards to pay with WeChat Pay in China.

Previously, WeChat Pay only supported users that had mainland Chinese bank cards, savings cards, and credit cards.

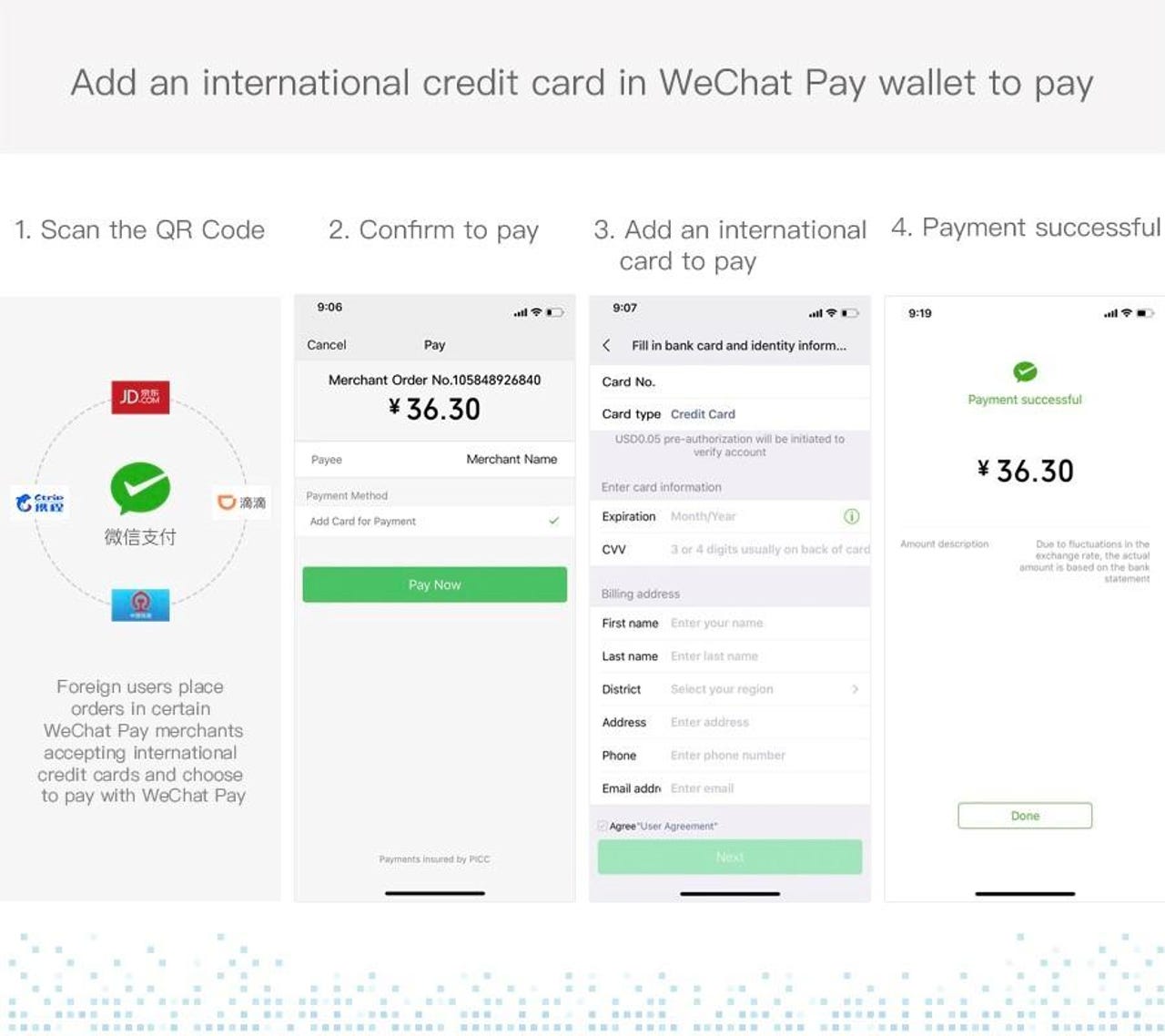

To sign up for the newly-expanded service, WeChat Pay users can add international credit cards directly to their digital wallets on the WeChat app.

The payment method is currently only available for a limited number of services, however, with Tencent saying it could be used to purchase railway tickets on China Railway 12306, hail for a ride via Didi, or make online purchases via JD.com and Ctrip, among other payment scenarios.

WeChat Pay's announcement comes shortly after Alipay earlier this week allowed people to use international credit cards to top up a prepaid card.

The payment offering for WeChat Pay differs from Alipay, as WeChat Pay will allow users to make payments directly through its digital wallet, while Alipay is providing users with a prepaid card that can be topped up with international cards instead.

For Alipay's prepaid card, the minimum amount users would have to top up is 100 yuan, with the balance amount being limited to 2,000 yuan. Any remaining funds left at the end of the 90 days would be refunded.

The moves to open up access to WeChat Pay and Alipay will enable the Chinese vendors to tap the potential market of 30.5 million international visitors who travelled to China last year. This figure was 4.7% higher than 2018, according to Ant Financial, citing government stats. It added that tourists also were spending more across various sectors such as hospitality, shopping, and food, forking out 5.1% more last year to hit $73.1 billion.

As the two dominant mobile payment services providers in China, Alipay owns more than 53% market share in China's mobile payment market in Q1 2019 while Tencent's mobile payment owns about 40%, local research firm iResearch said in a note in July.

Tencent also announced a partnership with cloud-based communication platform Symphony that will see WeChat be integrated into Symphony's systems.

This will enable Symphony users to connect and conduct business using either of the two applications, meaning Symphony users can now interact with WeChat users in China while meeting the country's financial regulatory requirements.

"Our global markets and private wealth management customers need a solution that can provide companies with a secure and compliant way to connect to the Weixin community. Our partnership brings together our trusted collaboration and workflow platform with Tencent's Weixin ecosystem," said David Gurle, founder and CEO of Symphony.

With the integration of WeChat, Symphony claims that its users will be able to communicate with clients on WeChat in real-time while maintaining compliance and governance policies.

Separately, Tencent Cloud Computing has also partnered with Serverless to unveil three open-source, Serverless Framework projects that they tout will make it easier to deploy certain serverless uses cases onto the Tencent Cloud: REST APIs, static websites, and Express.js apps.

The pair also have plans to invest resources into developing support for additional serverless use cases, tightening integration between Serverless Framework Pro and Tencent Cloud, and enabling the full lifecycle management of serverless applications on Tencent Cloud.

Related Coverage

Alipay open to foreign visitors for first time

Previously available only to consumers with a Chinese bank account and local mobile number, Alibaba's e-wallet now can be used by short-term visitors to mainland China over a period of 90 days.

China has 'no timetable' for digital currency launch: People's Bank of China governor

Earlier remarks from a Chinese central bank official had indicated that China was ready to launch its own digital currency.

Over 800 million WeChat users sent digital monetary gifts during Lunar New Year

The record number came after the Chinese technology giant announced last month that daily active users of its popular WeChat service exceeded 1 billion.

Western tech brands are recognized in China, but their products are rarely used

Western tech companies have established themselves in the consciousness of the Chinese public. Their products, not so much!

Mobile payments such as Apple Pay and Samsung Pay are hot, but many consumers still prefer cash (TechRepublic)

A recent poll revealed that serious cybersecurity concerns are at the root of consumers' confidence in mobile-only payments.