Western Digital: Cloud, data center storage demand strong amid buildout

Western Digital's third quarter results and fourth quarter outlook highlighted how cloud demand for storage is insatiable and the broader market is mixed.

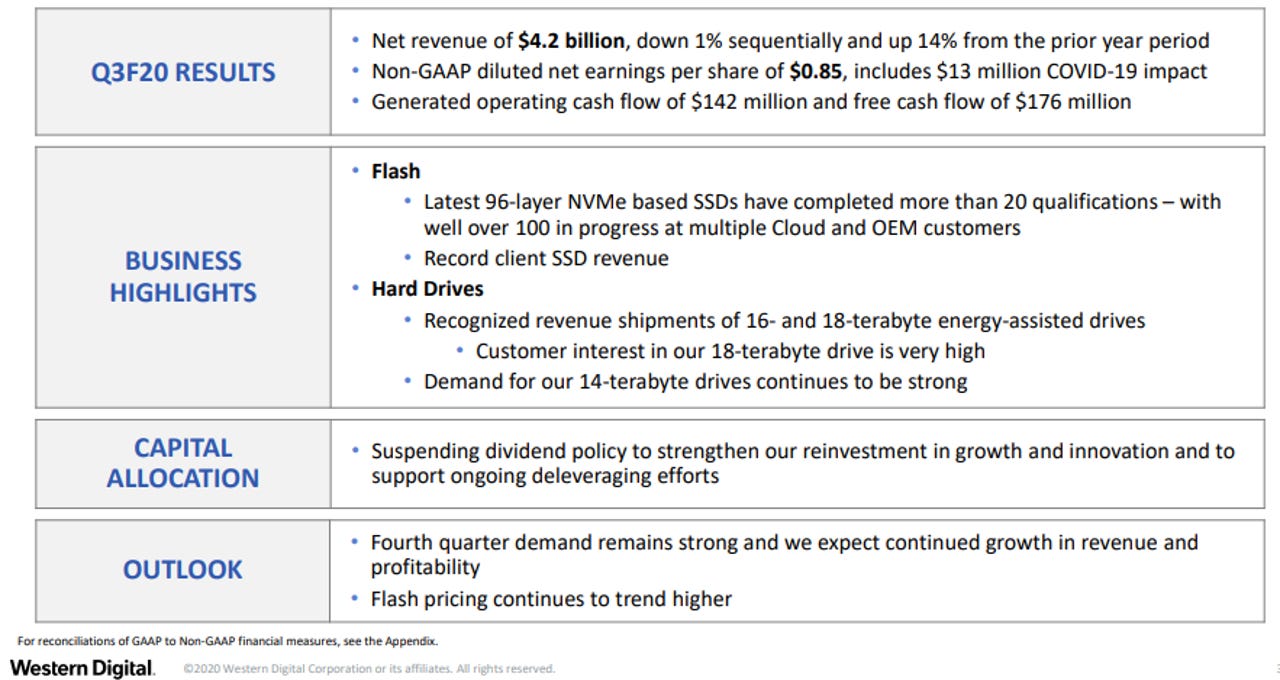

In the third quarter, Western Digital reported a third quarter profit of $17 million, or 6 cents a share, on revenue of $4.17 billion, up 14% from a year ago. Non-GAAP earnings were 85 cents a share.

While those results were stronger than expected, the outlook had a few moving parts. Western Digital's guidance had a wide range due to the COVID-19 pandemic. In addition, Western Digital suspended its dividend.

- Micron highlights how COVID-19 pandemic is shifting IT demand

- SSD reliability in the enterprise: This survey yields a few surprises

For the fourth quarter, Western Digital projected revenue between $4.25 billion and $4.45 billion with non-GAAP earnings between $1 to $1.40 a share. Wall Street was expecting non-GAAP earnings of $1.22 a share on revenue of $4.31 billion.

In the third quarter, Western Digital's client device sales were up 13% due to work from home moves. Data center sales were up 22% due to cloud demand.

As for the outlook, CEO David Goeckeler said Western Digital will face headwinds due to closed retailers and reopenings that will revolve around curbside pickup and less volume. Other takeaways include:

Cloud demand for storage is strong. Goeckeler said the ability to tap into cloud storage via API call is driving demand. "The cloud is democratizing the access to the most sophisticated technology; everybody can have it now through an API call. And that's just causing just a huge wave of investment and technological change and advancement for every company, every industry for all of us," he said.

Remote work is driving storage demand too. "The current environment has accelerated the movement to the cloud, transforming the way businesses operate, students learn, and the way friends and families Connect. These trends will continue to drive innovation and data storage growth for a number of years," said Goeckeler, who added the company saw record client SSD revenue due to remote work.

Hard drive density may be hitting a wall. Goeckeler was asked about Western Digital's 18TB drive and said:

It's getting harder and harder to drive more density, but we have an enormous amount of R&D in this area. And we're going to invest aggressively to make sure we maintain our lead in areal density. And I think you'll hear more from us coming up about that.

Edge computing may drive flash storage demand as much as mobile computing. "On the flash side, you've got the edge and endpoints and what's happening there and they're becoming more sophisticated. Networks are getting faster with much more capable end points. That's driving the flash side of the business," said Goeckeler.