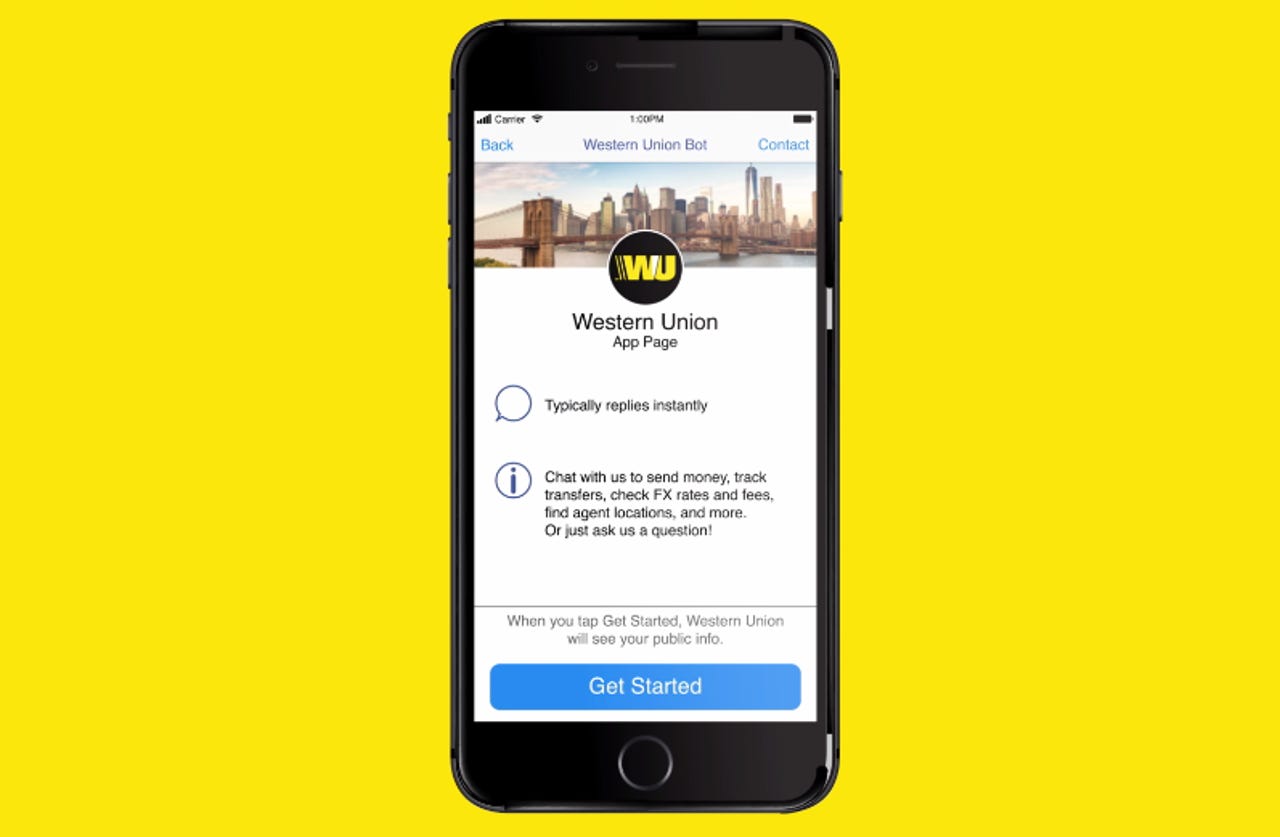

Western Union debuts Messenger money transfer bot at F8

Western Union's Messenger chatbot has effectively all the capabilities of its flagship app.

Western Union on Tuesday announced it's developed a money transfer bot for Facebook Messenger, enabling its US users to send money via the messaging platform to more than 200 countries and territories using 130 different currencies.

The bot gives Western Union customers access to its cross-border money transfer platform, which is embedded inside Messenger. It also offers users real-time foreign exchange rates and automated customer support, effectively bringing all of the capabilities of its flagship app directly to Messenger. Western Union is also bringing all of its money laundering and fraud detection capabilities to the bot.

Western Union already has seven million Facebook followers, and meeting them in Messenger was the logical next move, Odilon Almeida, president of Global Money Transfer at Western Union, told ZDNet.

"It's about being present whenever and wherever the consumer wants us to," he said.

More than 1.2 billion people are now actively using Messenger on a monthly basis, and the use of messaging apps is only expected to grow in the coming years.

Customers interested in transferring money simply search within Messenger for Western Union. They can then send money to a bank account, or to one of half a million Western Union locations around the world, where someone can pick it up.

Western Union debuted the bot at the F8 Facebook Developer Conference in San Jose, Calif., where Facebook is putting strong emphasis on the Messenger platform. Messaging platforms -- which along with Messenger, include Facebook-owned WhatsApp and Asia-based messaging services like WeChat and KakaoTalk -- have been moving beyond simple social conversations and are more frequently deployed for business-related reasons. Ultimately, messaging services could replace mobile home screens as a portal to the internet.

Financial services already have a large presence on messenger apps, and Messenger in particular. Facebook recently announced it has enhanced Messenger's peer-to-peer payments capabilities, enabling users in the app to send or receive money between groups of people. Earlier this month, it rolled out M, a limited version of its AI assistant that offers help with a handful of specific tasks, including paying or requesting money.

Almeida sounded optimistic about the expansion of Facebook's Messenger platform, declaring that "the future is for open platforms."

"It's not about developing everything, it's about the alignment of the best companies in the market to extend your offering," he said. "It's about opening the platform to connect other services and really making it easy for partners to engage."

And while Facebook is giving Western Union another avenue for engagement, Western Union can help Facebook expand the reach of Messenger, Almeida suggested.

"We are in 200 countries... We are every place, and Facebook knows that," he said.

Western Union blurs the line between cash and digital with Messenger bot