Will the death of Twitter's buy button be the end of social commerce?

Shopping and social media are two of the biggest draws of the internet, so it seemed like fate when the two worlds began to merge with the advent of the buy button.

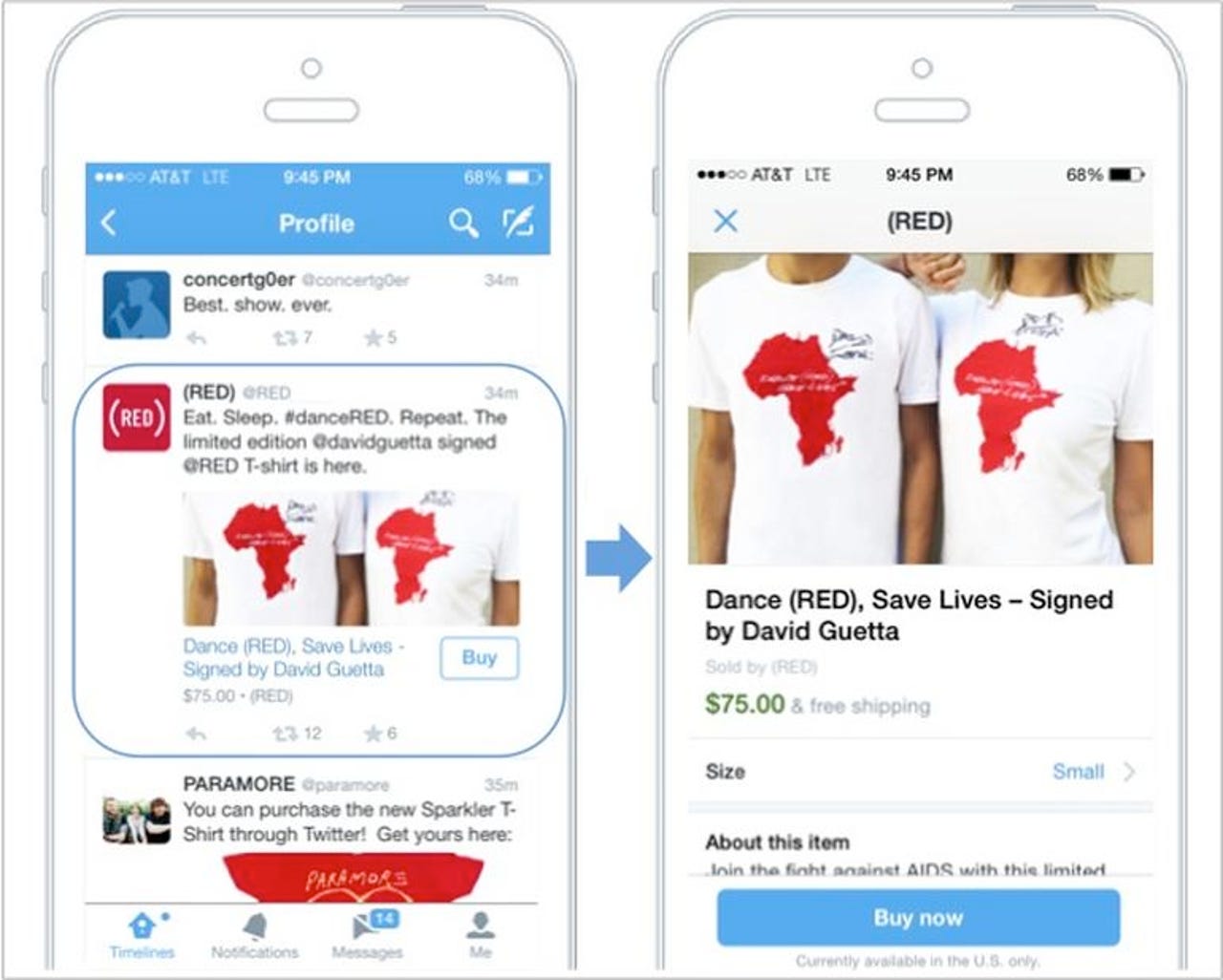

Starting in 2014, platforms such as Twitter, Facebook and Pinterest began developing some variation of a tool that would encourage people to make in-the-moment purchases on social media.

But despite the most noble of engineering efforts, not all social media platforms make for sensible shopping destinations. Which is why it came as no surprise this week when Twitter decided to end its e-commerce ambitions and focus on its core product.

According to a report from Buzzfeed, Twitter recently disbanded its commerce team working on buy buttons, with some members getting absorbed into other teams and others leaving the company altogether. A Twitter spokesperson told Buzzfeed the company has actually increased investment in commerce by reallocating buy button resources into dynamic product ads.

Twitter began its buy button endeavor under former CEO Dick Costolo, and at the time the company championed the concept as a way for brands to turn their Twitter followers into paying customers. But since co-founder Jack Dorsey took over last October, the company made it clear that it would be focusing on its core strengths going forward.

Dorsey envisions Twitter as a place for live interactions and he has set out to streamline the current Twitter experience in an effort to attract new users and appease the ones it already has.

Simply put, Dorsey realized no one was going to Twitter to buy stuff. But that doesn't mean the idea of social commerce is dead entirely.

According to Walker Sands' 2015 Future of Retail Study, 32 percent of consumers said they were likely to make a purchase via social media in the last year. Yet when asked specifically about Twitter, only six percent of consumers said they were likely to make a purchase on the micro-blogging social network. This suggests that maybe the problem isn't buy buttons or social commerce, but Twitter specifically.

"Twitter lacks signals that can be used to target their ads effectively," said Greg Stevens, EVP of media and sales for MyWebGrocer. "There isn't enough purchase intent being expressed by consumers on Twitter, and without sufficient insights into consumer intent, it becomes difficult to effectively win sales."

But on a visual-heavy social network such as Pinterest, where users go to save links to items they're interested in, the path to purchase is much more clear.

According to a study by market research firm Millward Brown, 93 percent of Pinterest users have used the platform to plan for purchases, and 87 percent have purchased something because of Pinterest.

By Pinterest's own account, merchants using Buyable Pins (there are more than 20,000 of them) are getting new customers, making more sales and seeing better mobile conversion rates.

Featured

In other words, unlike Twitter, Pinterest has no intention of getting out of the social commerce game.

"Since our launch one year ago, we are happy with the growth of our Buyable Pins program," Pinterest said in an emailed statement to ZDNet. "People are discovering and buying products from merchants they know and new merchants they found on Pinterest. We have a fully staffed team supporting Buyable Pins and we're continuing to invest in the growth of the program."

One of Pinterest's technology partners on the Buyable Pins feature is e-commerce infrastructure provider Shopify. Much like Pinterest, Shopify also maintains a bullish outlook on the future of buy buttons on the social web.

"We believe in the long-term viability of 'buy buttons', as one quarter of Shopify merchants have already connected their products to either Facebook, Pinterest or Twitter to help drive sales, increase website traffic, and broaden awareness," said Satish Kanwar, director of product at Shopify.

"We see more than two thirds of online store traffic coming from mobile, and mobile orders now outpacing desktop," he added. "This tells us that merchants will continue to grow their commerce strategies on these types of social channels, and start to take advantage of new opportunities with messaging channels."

Looking at the big picture with buy buttons, it's still hard to predict whether the concept will have long-term success. Analysts, meanwhile, fall on both sides of the coin.

Longtime Morgan Stanley analyst and Kleiner Perkins partner Mary Meeker, in her 2015 Internet Trends Report, posited that buy buttons would eventually take off because they are optimized for seamless shopping on mobile phones.

Forrester e-commerce analyst Sucharita Mulpuru carries a more cautious outlook and says that because very few buy button implementations have actually launched at scale, the energy surrounding the technology is premature. Out of the main players looking to implement buy buttons across the web, Mulpuru expects Google to be most successful.

"The real game-changer will be when Google puts the buy button on the desktop, which is and will be the predominant way to buy digitally in the foreseeable future."