Yahoo: Major businesses have stabilized; update on Microsoft deal

Yahoo delivered a bit of a surprise for its third-quarter earnings, beating Wall Street’s expectations handily and offering signs that CEO Carol Bartz is turning the company around.

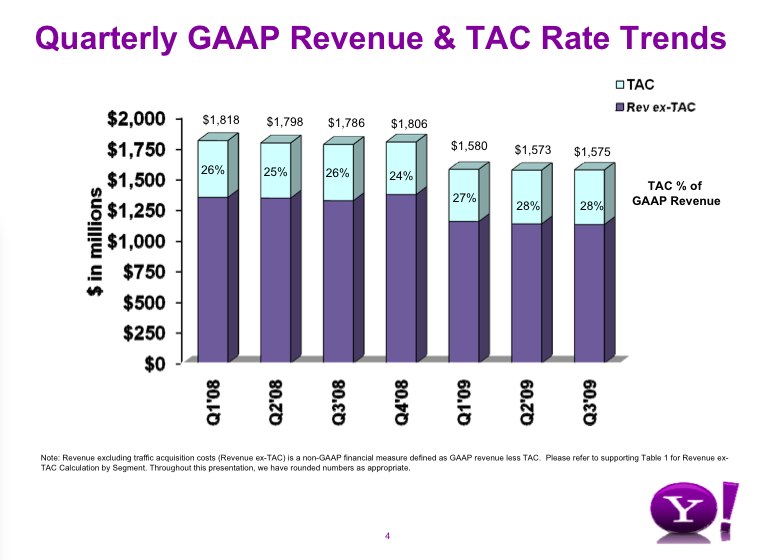

For the quarter, the company reported net income of $186 million, or 13 cents per share, on revenue of $1.58 billion. Adjusted for expenses, income was $213 million, or 15 cents per share. Analysts had been expecting earnings of 7 cents per share on revenue of $1.12 billion. Revenue was down 12 percent from the year-ago quarter - before Bartz took the reins of a troubled company in need of a rebound - but was flat, compared to the most recent quarter. (Statement, Techmeme)

In a statement, Bartz said:

With revenue coming in above our guidance and flat sequentially, we had a solid third quarter that signals our major businesses have stabilized. With new products like Yahoo! homepage, our brand revitalization campaign and expansion in the Middle East through Maktoob.com, our execution is improving and we're focused on what we do best - being the center of people's online lives.

Earlier this year, Bartz said that a comparison of Yahoo to Google was an inappropriate one - and the company has spent much of the past few months playing up the Yahoo experience, from enhancements to the home page and Yahoo Mail to a new brand marketing campaign that highlights the importance of the user and his/her experience. And then there was that long-anticipated search deal with Microsoft.

A call with analysts today was led by CFO Tim Morse, who said that Bartz "came down with something" and asked him to take the call. Plus, he said, the company is hosting an analyst's day next week and expects to see many of those same folks for a broader conversation about the company.

Beyond the third quarter financials, Morse also offered an update on the Microsoft deal, driving home the new way of thinking about search at Yahoo. He said that Yahoo isn't interested in enhancing the algorithms that lead to results but rather innovating the search experience for users without spending billions "to keep up in the arms race to generating search results.

Consider his PC analogy: If you think of basic search as an Intel chip that's used by the Dells, HPs and Apples of the world, the real differentiation comes not at the chip level but in the different user experiences added to it. Yahoo wants to innovate on top of the results provided by Microsoft.

He said the two companies still believed that the deal can be closed early next year, following regulatory approval. He pointed to an endorsement yesterday from the American Association of Advertising Agencies but said that timing would hard to predict because the companies don't know when approval might come. The good news, he said, is that Yahoo has previous experience in a big transition from the Panama implementation. And, he said with a chuckle, so does Microsoft, as many of the Yahoo employees who worked on Panama now work for Microsoft.

Shares of Yahoo were down slightly for the day, closing at $17.17 in regular trading. Shares were on the rise in after-hours trading.