Zebra acquires Reflexis Systems for $575 million, sees Q2 bottom and solid Q3 backlog, orders

Zebra Technologies said it will acquire Reflexis Systems, which provides workforce management software, for $575 million as it reported second quarter earnings that were hit by "a recessionary enterprise spending environment."

The company, which has branched out from its core business of mobile computing and asset tracking to workforce distancing amid the COVID-19 pandemic, said Reflexis will bolster its footprint in retail, food service, hospitality and banking.

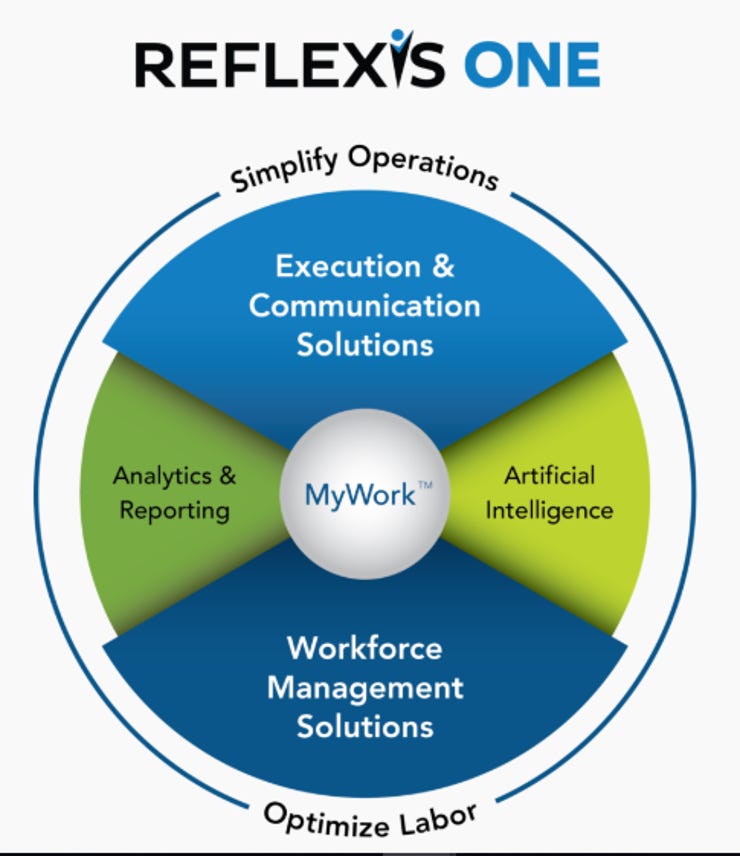

Reflexis' applications are led by Reflexis ONE, which manages tasks and measures customer engagement as well as productivity. Reflexis is a Zebra integration partner already. Reflexis has a task manager suite, workforce scheduling, AI staff planning and mobility, cloud and analytics tools and will give Zebra more software revenue.

- Zebra rolls out MotionWorks Proximity so enterprises can track worker social distancing, COVID-19 contact tracing

- NRF 2020: Retailers ponder cloud choices, Zebra launches SmartSight, Micro-markets in focus

- What does the new normal look like post COVID-19? 15 CXOs answer

The plan for Zebra is to use Reflexis to target frontline workers, which are already a core audience for Zebra. Reflexis will complement Zebra Prescriptive Analytics, Workforce Connect and SmartCount applications.

Reflexis had revenue of $66 million in 2019. Zebra said it would fund the purchase, which won't impact the company's earnings in the first year and add to profits after, with cash on hand and credit.

As for second quarter results, Zebra reported second quarter revenue of $956 million, down 12.9% from a year ago, with net income of $100 million, or $1.85 a share. Non-GAAP earnings in the quarter were $2.41 a share. Wall Street was looking for non-GAAP second quarter earnings of $2.28 a share on revenue of $940 million.

Zebra CEO Anders Gustafsson said the company managed costs well and entered the third quarter with "solid order backlog and encouraging pipeline of large orders." He added:

"We have clearly been in a recessionary enterprise spending environment which is having a disproportionate impact on smaller customers. We believe our sales bottomed in Q2 and second half trends will improve. We continue to be very optimistic regarding our longer-term prospects as secular trends to digitize and automate workflows accelerate as a result of the pandemic."

Zebra said its third quarter sales are likely to decline 3% to 7% from a year ago due to the COVID-19 pandemic and impact on business. Non-GAAP earnings will be between $2.65 a share to $2.95 a share in the third quarter. For 2020, Zebra said sales and free cash flow will be lower than 2019 but expects conditions to improve in the second half.

Also: