Amazon's Q1 stronger than expected; Is it the Kindle effect?

Amazon's first quarter sales and earnings were much better than expected as the company touted its Kindle ecosystem.

The company reported first quarter earnings of $130 million, or 28 cents a share, on revenue of $13.18 billion, up 34 percent from a year ago. Earnings were down 35 percent from a year ago, but well ahead of estimates.

Wall Street was expecting Amazon to report first quarter earnings of 7 cents a share on revenue of $12.9 billion. Going into the earnings report, analysts were worried about gross margins and slowing media sales.

Amazon acknowledged that it was hurt by currency rates.

The company touted its Kindle and Amazon Prime services. Amazon CEO Jeff Bezos said that the Kindle is the top e-reader and added that Prime subscribers get a free library of books. Kindle Fire remains the top seller on Amazon.com.

Amazon CFO Tom Szkutak elaborated a bit on the Kindle Fire effect:

In terms of the Kindle Fire, we are pleased with the growth that we are seeing. And customers are buying a lot of content and you are seeing that when you look at particularly in North America look at our North American media growth from Q4 two Q1, you are seeing that accelerate. We are very pleased with what's happening and we are going to continue to add more and more content for customers across all of our digital categories, and we think we have a great value proposition for customers today and we are going to continue to make that better over time.

As for the outlook, Amazon gave a wide range for the second quarter. The company projected revenue to be between $11.9 billion and $13.3 billion. Operating income will range from a loss of $260 million to a gain of $40 million. Wall Street is expecting second quarter revenue of $12.82 billion.

Szkutak said the company will continue to invest heavily in infrastructure. On a conference call, he said:

Our Q1 2012 capital expenditures were $386 million. The increase in capital expenditures reflects additional investments in support of continued business growth consisting of investments in technology infrastructure including the Amazon Web services and additional capacity to support our film and operations. -- fulfillment operations.

Shares jumped 10 percent in afterhours trading.

By the numbers:

- Amazon product sales were $11.25 billion. Services sales were $1.94 billion in the first quarter.

- Technology and content expenses were $945 million, up from $579 million a year ago.

- Fulfillment expenses were $1.29 billion, up from $855 million a year ago.

- 56 percent of Amazon's first quarter sales were in North America with international representing 44 percent.

- Other revenue---Amazon Web Services---was $500 million in the first quarter, up from $311 million a year ago.

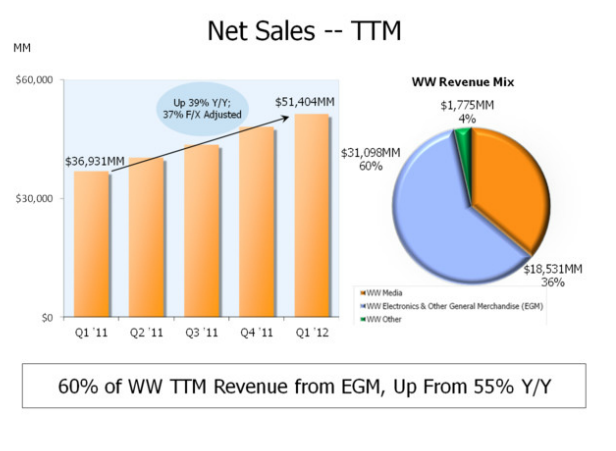

Here's the breakdown of revenue by product group.