Apple, Android dominate smartphone mindshare: Are consumers, developers equally fickle?

Consumers and developers have spoken---via surveys---and Apple and Google's Android rule the smartphone roost on both the consumer and developer side of the equation. However, sentiment surveys tend to be fickle.

Typically, consumer sentiment surveys on Wall Street vary based on everything from headlines, global instability, gas prices and unemployment. Multiple factors go into whether a consumer feels good or not.

Smartphone surveys aren't as complicated, but a few bad headlines about Motorola's Xoom can get consumers to back off Android a bit. Apple's enthusiasm may vary based on worries about tracking data. Sentiment is a complicated brew.

With that in mind, Tuesday's data provided some insight into the state of the smartphone market.

We'll start with the consumer side of the equation since developers follow the users---and the money that goes with making apps for a large crowd.

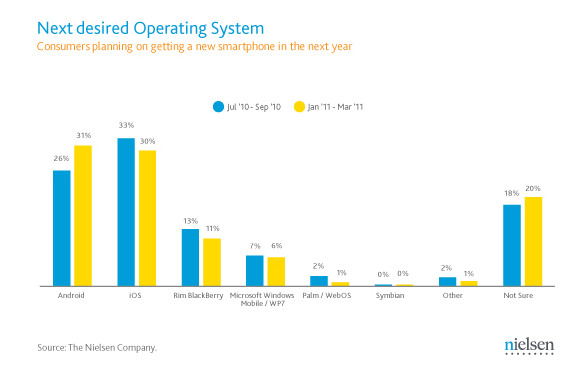

Nielsen reports that Android smartphones have edged out Apple as the preferred OS among devices buyers. According to Nielsen's latest data, 31 percent of consumers planning to buy a smartphone said Android was their preferred OS. Apple's iOS slipped to 30 percent with RIM down to 11 percent. About 20 percent of consumers are up for grabs.

Nielsen also reports that 50 percent of recent smartphone acquirers bought an Android device. Twenty five percent bought the Apple iOS followed by RIM (15 percent) and Microsoft Windows (7 percent).

On the developer side of the smartphone equation, Appcelerator and IDC rolled out the results of their joint survey. In a nutshell:

- Developers are focusing on Apple over worries about Android fragmentation. Ninety one percent of developers are very interested in the iPhone and 86 percent are very interested in the iPad.

- Developers are worried about Android's ability to power tablets. Developer interest in Android phones was cited by 85 percent of the 2,700 respondents and tablets came in at 71 percent. Fragmentation, weak traction in tablets and multiple Android stores were cited as risks.

- Only 29 percent of developers were very interested in Windows Phone 7 and Blackberry interest was 27 percent.

- Microsoft is a distant No. 3 platform among developers.

What could change the developer equation? Apple could get more share if Android tablets continue to falter. Nokia could give Windows Phone 7 a lift. However, all developers are strapped for time and resources.

The overall conundrum: There's a chicken and egg issue in smartphones and consumer interest---and money---is likely to stoke developer interest.