AT&T, Verizon prepped to step up enterprise games

While most of the attention surrounding the quarterly financial reports of AT&T and Verizon naturally revolve around the iPhone, mobile broadband and Android devices the companies are increasingly talking up their enterprise capabilities.

The business-to-business talk is long overdue and indicate that telecom executives are upbeat about corporate spending. Verizon talks business service and cloud computing via its acquisition of Terremark. AT&T has a more business services spin to its wireline business. In between, iPhone 4S net subscriber additions, there's a healthy outlook for enterprise spending.

This enterprise optimism isn't exactly showing up in the financial figures for these two telecom giants. Why? The enterprise services businesses are in flux. Voice and traditional corporate services are declining at a rapid clip. On the flip side, strategic, cloud and VPN services are growing. At some point, the fast growing businesses will overcome those in decline.

Also: AT&T's Q4: 7.6 million iPhones activated | CNET: AT&T CEO doesn't hold back in criticism of FCC | Verizon rides iPhone 4S, LTE in Q4 at expense of profit margins | Verizon nabs CloudSwitch to pursue global cloud strategy | Verizon steps up its cloud game, buys Terremark for $1.4 billion

AT&T CEO Randall Stephenson and CFO John Stephens highlighted the enterprise unit on Thursday during the company's fourth quarter conference call. Sure, Stephenson ripped the FCC, but in between his rant was a lot of chatter about advanced IP services.

Stephens said:

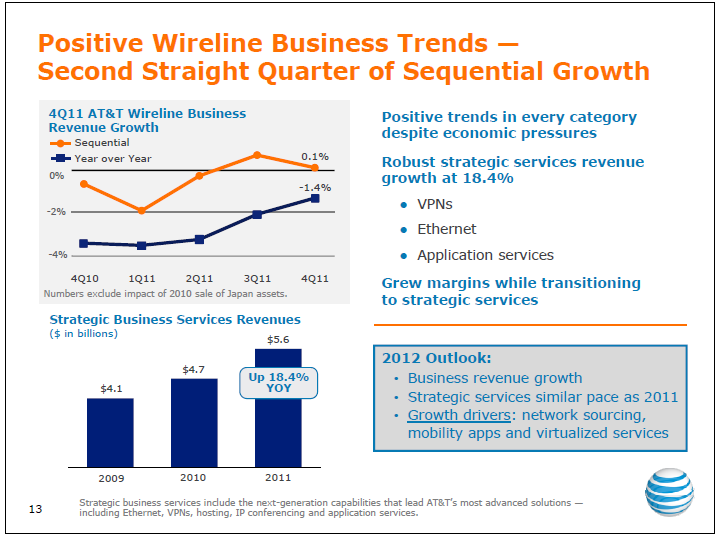

For the second quarter in a row we had sequential revenue growth thanks to growth in our strategic business services such as Ethernet, VPNs, and application services, which were up 18.4 percent for the year and is now nearly a $6 billion business. We are seeing positive trends in almost every part of the business. Our global enterprise business had its second straight quarter of year-over-year to data growth.

Stephenson added:

Thanks to growth in network sourcing, mobility applications, and virtualized services. As we said, we expect this growth with little left from the macro economy...Our business customers moving aggressively to VPN solutions and we continue to run midteens type growth rates on VPN. The other is Ethernet and native Ethernet solutions. Once you put the VPN in place, customers are buying more and more applications and services that ride on top of that, whether it be videoconferencing, telepresence and so forth, we are having a lot of success there. What I would remind you is that these strategic services are growing at this 17% clip and what we are seeing is still a very sluggish economy. This is not a high-growth economy. These businesses tend to invest in telecom as they hire people.

Translation: If the economy rebounds at all, Stephenson will be talking a lot more about enterprise services.

For its part, Verizon appears to be more upbeat on enterprise services, especially its acquisition of Terremark. That purchase gave Verizon a foothold in the cloud services market and allowed the company to hand its data centers over to Terremark to boost efficiency.

According to Verizon, Terremark and the addition of Cloudswitch later gave the company the ability to offer network, data center security and cloud infrastructure services.

Verizon CFO Fran Shammo said:

Strategic Services continued to drive the year-over-year improvement in Global Enterprise revenue, led by very strong growth in advanced services such as managed network, call center, IP communications and our cloud offerings. In the fourth quarter, these services totaled $2 billion, up 14.7% year-over-year, representing just over half of Global Enterprise revenue.

As we've seen for the last several quarters, the growth in Strategic Services outpaced the decline in core enterprise services. Terremark revenues were up about 10% sequentially in the fourth quarter and roughly 18% year-over-year.

Within our Global Enterprise Solutions, we are focused on shifting our product mix to higher gross service offerings and we continued to gain traction here. In less strategic areas, like core voice, data and hardware, we've continued to look for ways to improve overall margin profitability.

You can see where this is headed. Both AT&T and Verizon have the sizzle with smartphones, but enterprise services could very well be the meat of their results in upcoming years.