Citrix, VMware duel over cloud visions

A Citrix executive this week took direct aim at VMware, which is dominating the virtualization space, and said there's a big risk of cloud infrastructure lock-in.

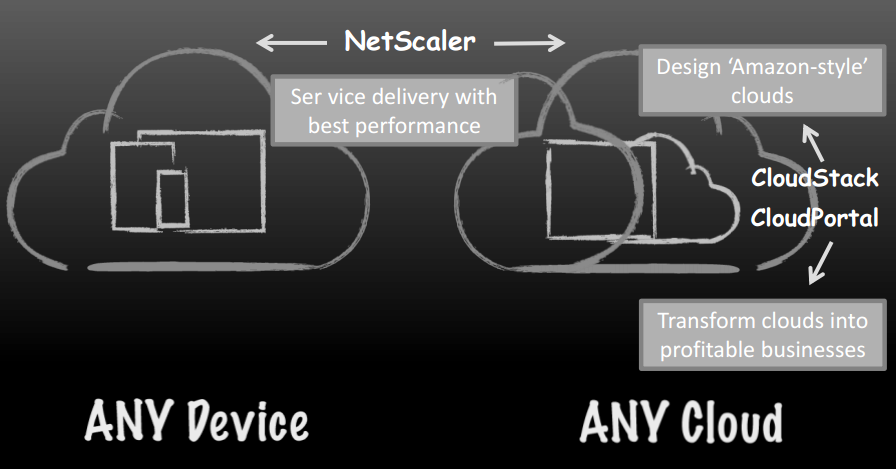

The two companies compete in virtualization as well as application management. Citrix has acquired Cloud.com and has a large portfolio of tools to build out services on demand (see slides right). However, VMware's momentum continues unabated.

This is the VMware state of mind: I've got the enterprise data center locked up with vSphere and as long as I can go get vCloud out in every service provider, I'll become the next monopoly and extract rents from the industry for the next decade. Great for VMware, not so good for the rest of the industry or for customers. And that's obviously why Citrix is so aggressive and so vested in preventing that outcome. We don't think that's good for anybody. And frankly, there are enough organizations out there on the customer side of the world and large vendors who also recognize the undesireableness, if that's a word, of that outcome.

And.

We are talking to one enterprise organization, large financial services business, that said, look, we're now spending more money with VMware than we are with Microsoft. And that's a pretty large statement and we're only 50% virtualized. I can't get to the 80% target I want to if I continue down an exclusive path that is like the left side of the page. I need to look more like an Amazon style cloud. So they started to go build one of those and when you actually cost that out and it worked out to about 80% cheaper. Just factors cheaper. And it was because at every layer of the cost equation you're taking out massive costs. So you take out -- so first at the infrastructure layer, the kind of hardware that you use in a cloud, on the right side of the page, is dramatically different than on the left. You’ll never walk into a Google data center or an Amazon data center and find an expensive EMC SAN. Promise. Won’t happen. That's just not what you use. And so the infrastructure costs are dramatically lower.

The software costs, you're not paying premium rents to the likes of a VMware for closed, proprietary software. And so yes, Citrix is going to make money on that software layer, but it will be at a dramatically lower cost point because it will be open source based.

Dholakia's argument was interesting because he framed the cloud debate as two silos. On one side, there's the VMware architecture and then there's the open source (Amazon-style) approach. The two sides will co-exist, but ultimately an open cloud approach wins. Dholakia almost positioned VMware as a future mainframe---a technology that is still around, but has seen its day.

Many enterprises see lock-in risk with VMware, but the big question is whether the company will suffer in the future. For instance, SAP and Oracle customers have complained about lock-in for decades yet they still pay maintenance fees every year.

At the Goldman Sachs conference, VMware CFO Mark Peek was more diplomatic. Peek said that Citrix and VMware often occupy different spaces in the industry.

Peek was asked about comments from Citrix CFO David Henshall, who speaking at the Goldman conference noted that the company isn't invited to go toe-to-toe VMware on the virtualization front. When Citrix and VMware both battle for the same customer, Henshall was confident about his company's chances.

Peek said he could say the same thing about Citrix, which was portrayed as being more about thin clients and desktop virtualization. VMware is in desktop virtualization, but Citrix has a large installed base.

"Citrix has a significant installed base and I think there are a lot of deals where we probably don't know that we weren't invited to the party because -- and it's also a different buyer," said Peek.