Evernote considers IPO options: 'No rush' from Zynga's book

Evernote, the company behind the cloud-based note-taking application, is to consider its public offering options as it continues to grow at a rapid rate.

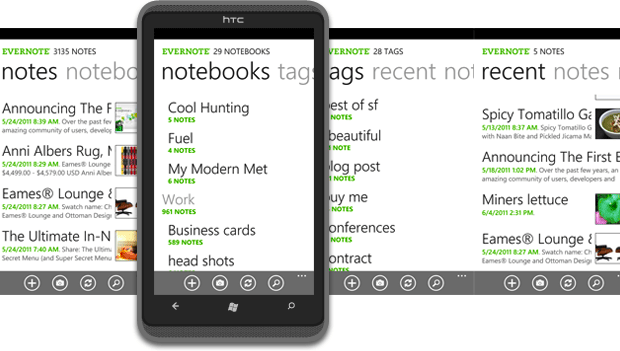

Popular with students, Evernote allows users across a variety of mobile devices, PCs and Macs, to capture notes, pictures and other content and synchronise it with other devices, and accessible on the web.

Evernote Phil Libin told Reuters that while there is "no rush" to offer the company on the public market -- the same words used by sources close to Zynga last month when discussing its own public offering.

Libin said the company would keep its eyes open on the current and future market, and decide in good time to give the best for its shareholders and users.

Libin said the offering is "inevitable", looking at going public by 2013, by which point the markets should have levelled out.

Because of the market drops and further uncertainty over the federal economic situation, Evernote is 'doing a Zynga', which last month was cited to delay its IPO until the markets steady out.

Evernote is reported to have generated $16 million in annualised revenue over the 12 months, partly through signing up 40,000 new users per day. It has nearly half a million users paying for premium access, the main source of revenue for the ever-growing company, besides capital investment of $50 million in July.

Revenue continues to spin for the 2008-founded company, describing it as "growing exponentially and accelerating".

But Evernote would need to err on the side of caution when proposing its public offering, taking into account Zynga held back until "at least Labor Day" -- which has now passed -- but continues to look towards November until the markets stabilise.

Zynga, famed for its FarmVille game on Facebook, decided to delay its IPO late last month, to a time in the future when the markets did not look so bleak.

It should not, therefore, come as a surprise that Evernote, and no doubt others, are looking to delay any public floating for the time being. Post the U.S. government's credit rating downgrading, the markets have struggled to recoup.

But Evernote, still a tiny company with just over 100 employees, is looking to hire four-times that by the time it floats, in the United States, Russia and further afield.

Related:

- Evernote continues to grow after landing $50 million in funding

- FarmVille maker Zynga planning to delay IPO

- The inherent flaws with ‘FarmVille-esque’ social gaming

- Evernote update optimizes the Android tablet experience

- Microsoft has higher credit rating than U.S. government

- Evernote now available to everyone in free and premium flavors