Facebook files for IPO as Wall Street drools

Well, it's official. Facebook has filed its S-1 papers with the U.S. Securities and Exchange Commission, in what is the most highly anticipated initial public offering since Google's.

The IPO values Facebook at $5 billion, according to the company's SEC filing. It did not specify how many shares it would offer, nor which exchange it would list its shares on.

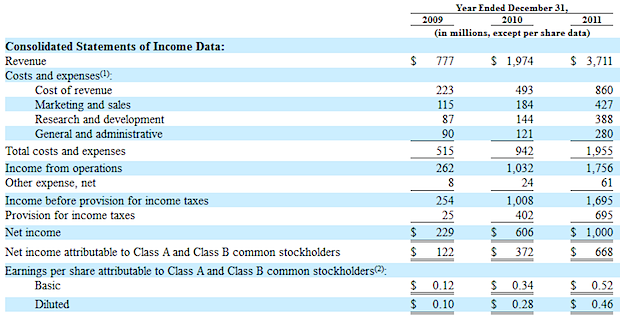

Facebook reported net income of $1 billion on revenue of $3.71 billion for the year ended December 31st. Profits attributed to shareholders (class A and B) were $668 million.

- CNET: Facebook finally files for IPO

- CBS News: Facebook seeks $5 billion IPO

Other key facts from the prospectus:

- 179 million users in U.S.

- 229 million users in Europe from December 31st, 2011;

- 483 million daily active users (daily average over the month ended);

- 435 million mobile users in December

- 2.7 billion likes/comments per day;

- 250 million photos uploaded per day;

- 100 billion friendships.

Interestingly, a breakdown of the top brass and who owns what: Mark Zuckerberg owns 28.4 percent of Facebook, while co-founder Dustin Moskovitz owns just 7 percent. This makes the two billionaires many times over. However, chief operating officer Sheryl Sandberg owns less than 1 percent –-- which is even less than chief financial officer David Ebersman, who was instrumental in Facebook getting this far.

The big question of the day can't be answered. What is Facebook ultimately worth? The best guess out of the media today is that the social network is worth $82 billion --- based on tracked figures over the past events --- which falls well within the market estimates

Andy Borowitz noted earlier on Twitter: "The only way Facebook is worth $100 billion is if all of those sheep in FarmVille are real."

Those who were hoping for Facebook to rocket to the top of the IPO ship will be disappointed. Google's initial public offering may have been a meagre $1.67 billion in comparison, but Infineon AG floated at more than $5.8 billion in 2000. The Facebook IPO is a major event for Wall Street, which is currently being hit by layoffs as firms downsize.

But remember, this is only the filing stage. We have to wait until May --- a rough guesstimate --- to see how well the company fares in the public trading limelight.

But unlike Facebook dependents --- like Zynga, which dropped by over 10 percent below its IPO price during its first trading day in December --- it is expected Facebook's share price will soar. According to the filing, Zynga is around 12 percent of Facebook's business.

If Facebook's shares go up, it also bodes well for its dependents, too.

Related:

- Between the Lines: Facebook's IPO: Is Zuckerberg-Page the new Jobs-Gates?

- WSJ: Facebook set to declare IPO next week

- Zynga shares slump 10 percent below IPO in first day

- CBS News: Facebook prepares for life in public

- What will Facebook's IPO filing reveal?

- Friending Facebook: Last Facebook valuation before IPO filing: $83.5 billion

- Facebook to file $5 billion IPO?

- Facebook’s IPO will create over 1,000 millionaires

- Tom Foremski: Facebook IPO: Timing is everything

- Facebook IPO to be much smaller: valuation could soar beyond $100bn