Global IT purchases to decline in 2009; BRIC and 'tech 12' analyzed

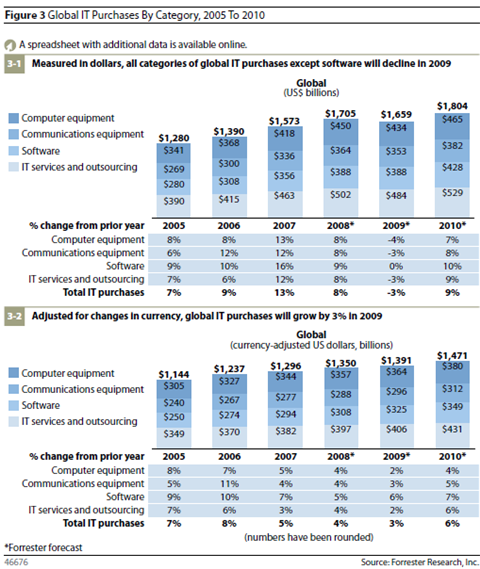

Global IT purchases will equate to $1.66 trillion in 2009, down 3 percent from 2008. Software purchases be flat in 2009 relative to 2008, but continue to do better than other categories in tech spending. And Australia spends the most on IT relative to gross domestic product relative with the U.S. a close second.

Those are some of the key takeaways from a Forrester report picking apart global demand in 2009.

The report is a solid overview for two primary reasons:

- It puts so-called BRIC countries in perspective. BRIC is Brazil, Russia, India and China and those countries get a lot of play during CEO presentations on tech earnings calls.

- It also shows that the tech sector still depends on the "tech 12," established markets that deliver account for most of the revenue but yield slowing growth.

Forrester analyst Andrew Bartels notes in the report:

Global purchases of IT goods and services — or from the other perspective IT vendors’ revenues — will equal $1.66 trillion in 2009, declining by 3% after an 8% rise in 2008. A declining US dollar boosted 2008 growth rates, but a stronger dollar will hurt growth measured in dollars in 2009. Growth in a weighted average of local currencies will be 3%. IT purchases will recover in 2010, growing by 9% in US dollars and 6% in local currencies. Recessions in the US and many industrial countries will be the main cause of a 2009 slump, with currency fluctuations a secondary factor. Western and Central Europe and Canada and Latin America will have the weakest growth, at 1.3% and 1.2%, respectively, in local currencies. The US tech market will do a bit better, with 1.6% growth. Asia Pacific and the oil-exporting area of Eastern Europe, the Middle East, and Africa will do the best, but growth there will still be weak, at 3.1% and 5.4%, respectively.

In other words, it's highly unlikely that emerging markets can bail tech vendors out in 2009.

More important that the overall figures is the breakdown on where tech budgets will flow. In a nutshell, hardware will take a big hit.

Here's the breakdown:

Under the surface are the following estimates from Forrester:

- U.S. IT purchases will be about 2 percent for 2009, but a recession domestically will pull down Latin America and Canada spending. Total IT spending growth will be 1 percent across the Americas with a sharp rebound in 2010 to 9 percent. The U.S. will account for 34 percent of all IT spending across the globe in 2009.

- Western Europe IT purchases will fall 7 percent in 2009, offsetting a 7 percent gain in 2008. Meanwhile, Eastern Europe, the Middle East and Africa will only show 2 percent growth in 2009, down from 23 percent in 2008.

- Asia Pacific IT spending will decline 2 percent measured in U.S. dollars.

- BRIC companies are only one-seventh of the global IT spend. And these countries won't be spending much in 2009 with global tech purchase creeping up 1 percent.

And the biggest shocker of the report was the tech spending as a percentage of GDP. The U.S. was among the top, but Australia and New Zealand are big tech spenders relative to GDP. Here's a look at the top few countries. The Forrester report has a lot more.