Google's $350 ETF makes sense to bean counters; Annoys customers

From an accounting standpoint, Google's $350 "equipment recovery fee" on the new Nexus One smartphone makes perfect sense. As the seller of the phone, Google is discounting the price of the phone with a service plan contract - just like the carriers would if you bought it from them. (Techmeme)

But the difference is that, with the carriers, the only thing you get dinged with is the early termination fee on the service plan if you bail out early. No one bills you another $350 because you should have paid $499 for your device instead of the $149 you got it for when you agreed to the contract. And after 30 days, no carrier is going to take a phone back a return anyway. It's yours to keep, sell, link to a pre-paid plan, whatever.

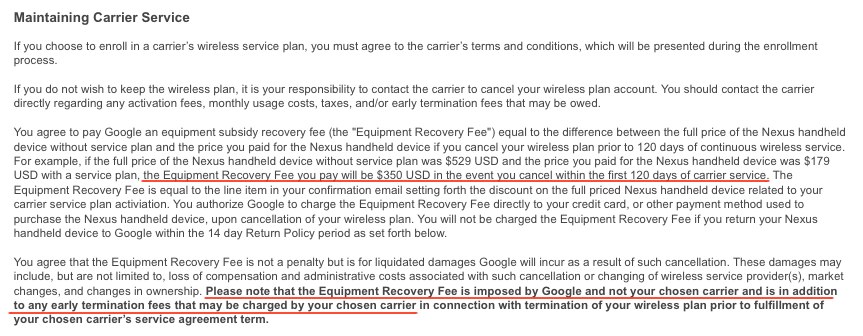

But if Google didn't charge the fee, anyone could - in theory - buy the $179 phone with T-Mobile service, immediately cancel the T-Mobile service, pay the early termination fee of $200 and walk away with a nice new unlocked free-and-clear Nexus One phone for $379, instead of $529. This screen grab is from the Nexus One Terms, which is different from the T-Mobile terms you would have to agree to first, as part of the signup process.

Makes sense, right? From an accounting standpoint, sure.

From a marketing and public relations standpoint, however, it's a nightmare.

Google is already on shaky ground with this new push to be the online retailer of its mobile phones because It has no real customer service operation. What support it does offer usually comes in the form of FAQs, help forums and e-mail correspondence. That may be fine for the techies. But when you're dealing with everyday consumers, that's not going to cut it. Consumers needs real people to interact with - either at a store or on the phone. That's not in Google's DNA.

Also see: Google, Nexus One and the customer service risk

Now, add to that mix a perception that consumers will get dinged twice - once by T-Mobile and again by Google - if they change their mind about the Nexus One within the first four months. Forget about the fact that carriers only give you 30 days to change your mind, not four months, and then usually hit you with a restocking fee on a return. That's irrelevant when you're dealing with perceptions.

A Google spokesperson told the Wall Street Journal that the fee is a way for the company to recoup the subsidy it gives contract customers, adding that this is " standard practice for third-party resellers of T-Mobile and other operators."

Selling phones independent of carriers and running the sales operation online may be a great way for Google to do business, but is it really that beneficial for the customer who's doing the shopping and spending the money? So far, it doesn't look like it.

I have become a fan of Android in recent months and am looking forward to more apps and more functionality as the OS improves from one version to the next. I hope Google keeps working hard behind the scenes to make the mobile OS an industry leader.

But maybe getting into the mobile device retail business wasn't the best move. Or maybe it's a matter of being too much, too soon. Regardless, Google - and customers - would be better off if the company stuck to Android enhancements and left the sales to someone else.

Related: Google's Nexus One: Is it super? And is there a market for a superphone?