How will smartphone market share figures be impacted by launch of Verizon iPhone?

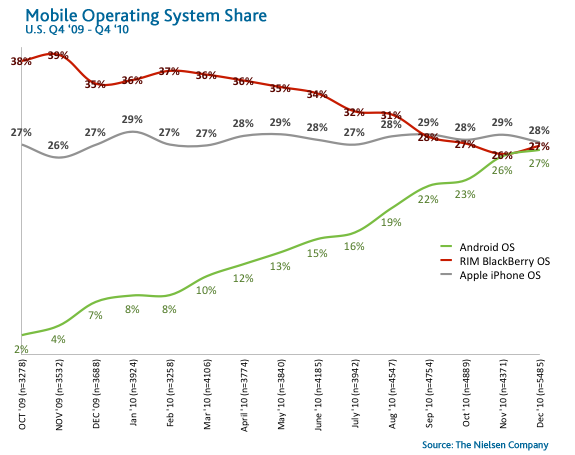

One of Nielsen's just-released regular reports is chock full of colorful graphs that paint a picture of how the the three biggest mobile OS providers - Apple's iOS, Google's Android and RIM's Blackberry - have been dividing the U.S. market.

Two of those charts, however, really stuck out. The first plots the current market share percentage of each of the systems - and I have to admit that the numbers were a bit surprising to me. The second is one that shows which OS the "recent acquirers" - those who bought a smartphone in the last six months - were choosing.

Before I break them down, I should note that these charts run from the beginning of the fourth quarter in 2009 to the end of the fourth quarter in 2010, representing a 15-month period.

- Any way you slice and dice it, Android's growth sure does look impressive, growing from 2 percent to 27 percent in 15 months. Considering that Android devices come in many different shapes, sizes, colors and brand names, as well as being available through all of the large carriers, it's no wonder that the OS was on the fast track to grab share.

- Blackberry just can't seem to get any love. Even the launch of a new OS - Blackberry 6 - on a couple of high-profile devices wasn't enough to keep it from sliding in market share.

- And then there's the iPhone, steady in that 26-29 percent range. The big question, of course, is what will happen to the chart when Verizon starts selling the iPhone next week. More on that below.

The other thing to take into consideration here is how much the actual smartphone market has grown in that same amount of time. I was really surprised that Nielsen didn't include a chart for that, as well, seeing as how it's an important part of the equation. But, in a Mobile Snapshot report in November, Nielsen said the smartphone market had grown from 30 percent at the end of the third quarter in 2009 to 41 percent a year later.

That's something to think about as we look at this other chart - the one that plots the "recent acquirers."

- The Android line looks the same in both charts, which makes sense because the OS was growing from the nearly no share at all. Plus, the Droid marketing campaign - as well as a number of high-profile launches - were in full-swing.

- Blackberry also a steeper decline on this chart, compared to the other. Some might argue that interest waned as smartphone buyers waited for the release of the new OS. But when that day came in August 2010, the share among new buyers continued to dip, dropping to a low of 19 percent in November.

- As for the iPhone, the dip is worth noting - again, considering that the market itself had grown 11 percent in a year's time. Granted, that dip in the Spring makes sense as the iPhone 4 was released in late June (and July saw a nice rebound.) What's interesting is that, in the months after the release, the share of "recent acquirers" stayed flat while the market grew.

It would stand to reason that Apple was simply holding its own, growing at the same pace as the market. But what about all of those iPhone 4s that Apple was selling? Well, iPhone sales in the holiday quarter were up 86 percent but was Asia Pacific and Japan that saw the greatest gains - more than 50 percent each - while the Americas only grew 15 percent. And, let us not forget that iPhone lovers everywhere were eager to upgrade to the next version, indicating that these sales were part of the overall market growth.

And bringing it all back home, that helps explain why Apple was relatively flat in the first chart while the market was growing.

Finally, all of this could be a moot point starting in about one week. When Verizon Wireless finally starts selling the iPhone, I predict that Chart No. 2 will see a pretty noticeable skew from Apple. What's still unclear is what impact it will have on the other players.

Will Android - which is also expecting some pretty major smartphone launches this year - take the hit for Apple's expected success? Or will Blackberry take an even greater beating?

As for Chart No. 1, that asterisk to the equation comes into play again. How many of the Verizon iPhone sales next week and beyond will be to existing smartphone owners? Certainly, the smartphone market will continue to grow - but don't expect it to skew at the same angle as the iPhone market share line will.

This is where the competition really starts to get intense.