HP holds it together in Q4, but cuts outlook

Hewlett-Packard delivered a fourth quarter that was better-than-expected and allayed concerns about the company and whether it could stabilize the business amid uncertainty.

The company reported fourth quarter earnings of $239 million, or 12 cents a share, on earnings of $32.1 billion. In the year ago quarter, HP reported earnings of $2.5 billion, or $1.10 a share, on revenue of $33.3 billion. Non-GAAP earnings for the fourth quarter were $1.17 a share. Wall Street was looking for earnings of $1.13 a share on revenue of $32.05 billion.

The non-GAAP figure for HP includes costs of $2.1 billion, or $1.05 a share, to wind down the company's webOS business and restructure amid other things. HP said: "Fourth quarter non-GAAP earnings information excludes after-tax costs of $2.1 billion, or $1.05 per diluted share, related to the wind down of HP's webOS device business, impairment of goodwill and purchased intangible assets, amortization of purchased intangible assets, restructuring charges and acquisition-related charges." Simply put, HP is still struggling, but has gotten off the mat.

The WebOS shutdown included the following charges:

- A charge to operating income of $788 million associated with the wind down of the WebOS device business. This charge included a net revenue reduction of $142 million related to the sales incentive programs, $548 million in cost of sales due to supplier related obligations and inventory reserves, and $98 million in operating expenses and restructuring charges.

- HP took an impairment expense of $885 million against the carrying value of goodwill and purchased intangible assets related to the acquisition of Palm.

HP CEO Meg Whitman on her earnings call debut said:

We need to get back to doing what we do really well, being the reliable, trusted partner with whom our customers want to work and delivering the reliable, consistent results that all of you can count on.

For fiscal 2011, HP reported earnings of $7.1 billion, or $3.32 a share, on revenue of $127.2 billion, up 1 percent from a year ago.

As for the outlook, HP projected non-GAAP earnings of 83 cents a share to 86 cents a share for the fiscal first quarter. Wall Street was looking for earnings of $1.11 a share. For fiscal 2012, HP projected non-GAAP earnings of at least $4 a share. Wall Street was looking for earnings of $4.54 a share, but few analysts believed those figures.

Whitman said HP needed "to get back to the business fundamentals in fiscal 2012." CFO Cathie Lesjak said the company was "remaining cautious heading into FY12."

Related: HP's future: All eyes on the outlook for 2012

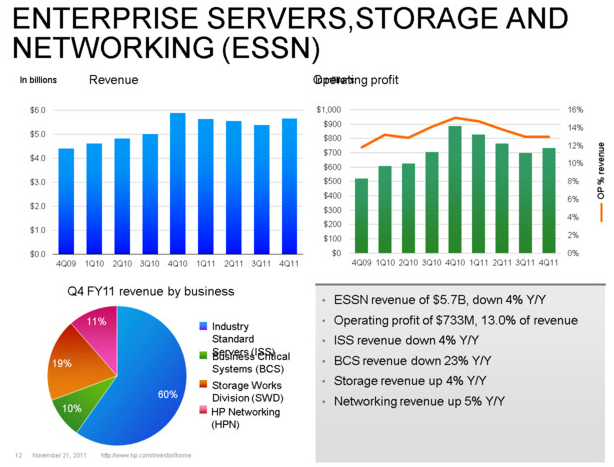

Digging into HP's results by business unit highlights a few worrisome trends. For starters, HP's enterprise server, storage and networking unit is sucking wind as both operating earnings and revenue fell.

Imaging and printing operating income in the fourth quarter was $808 million, down from $1.22 billion a year ago. HP's printing business is a smaller cash cow than it used to be. In fact, ink supply revenue was down 14 percent in the fourth quarter.

Meanwhile, HP services sales were up, but earnings from operations fell to $1.18 billion in the fourth quarter, down from $1.5 billion a year ago.

Add it up and HP's PC unit almost appears to be the least of its worries. HP's PC unit operating income was $578 million, up from $568 million a year ago. The trouble spots are highlighted below.

By the numbers:

- Americas revenue for the fourth quarter was $14.5 billion, down 4 percent from a year ago. Europe, Middle East and Africa revenue was $11.7 billion, down 6 percent from a year ago. Asia Pacific revenue was $6 billion, up 3 percent from a year ago. Revenue from outside the U.S. represents 65 percent of HP's total sales.

- HP's enterprise servers, storage and networking sales fell 4 percent from a year ago. Standard server revenue fell 4 percent and business critical systems (Itanium) sales fell 23 percent. Storage revenue was up 4 percent.

- HP software revenue was up 28 percent from a year ago.

- The PC unit, which is staying at HP, held the fort with a 2 percent revenue decline. Consumer PC sales fell 9 percent.

- Imaging and printing revenue fell 10 percent in the fourth quarter.

- Services revenue was $9.3 billion, up 2 percent from a year ago.

- HP generated $2.4 billion in cash flow in the fourth quarter.

- Inventory was $7.5 billion, up 4 days from a year ago to 27 days.

Related:

HP keeps its PC business: Price war, crumbling profit margins next | HP: We’re keeping the PC unit | HP making another run at tablets with Windows 8 |

- HP: Is it a broken company?

- HP CEO Whitman pushing for PC unit decision by end of the year

- No quick fixes at HP, say analysts

- HP’s biggest challenge vs. IBM, Oracle: Continuity

- HP CEO Whitman: PC spin-off still in play, Autonomy deal too

- HP’s CEO carousel continues: Whitman officially in, Apotheker out