Is it Dell's time to shine vs. HP?

There will be an interesting compare and contrast exercise as both Dell and Hewlett Packard report earnings Thursday. HP's quarter performance is largely known since the company announced its results along with the ouster of former CEO Mark Hurd. Dell's results, due to its focus on the enterprise, may look better than HP's when it comes to growth.

Dell is expected to report earnings of 30 cents a share on revenue of $15.2 billion for its fiscal second quarter. Gross margins are expected to be about 17.7 percent. HP is expected to report earnings of $1.07 a share on revenue of $30.46 billion for its fiscal third quarter with gross margins of about 23.5 percent. The elephant in the room for both companies is PC demand. Reports from the supply chain front in Asia indicate that PC demand is slowing. However, much of the angst around PC sales revolve around consumers. Dell makes most of its money from corporate customers.

Stifel Nicolaus analyst Aaron Rakers sets the scene:

Despite increased/justifiable angst over PC demand dynamics over the past few weeks (largely consumer driven), our checks have remained net-positive on Dell’s trends for F2Q11. We remain optimistic with regard to a gradual corporate PC upgrade cycle and Dell’s execution and share gains in the x86 server market (capitalizing on a lead with Nehalem-EX platforms; industry checks point to some availability slippage at HP). We expect Dell’s results to outperform HP in both PC and servers.

Meanwhile, Dell's focus on the enterprise means it has more runway for Windows 7 upgrades.

Microsoft reported that about 15% of PCs ran Win7 OS exiting June, vs. 10% exiting March. Dell noted less than 5% of commercial PC customers had migrated to Win7/Office 2010 exiting F1Q11.

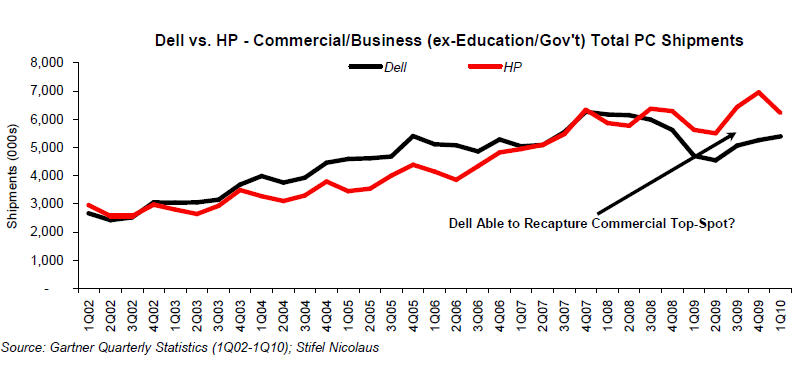

In fact, Rakers notes that Dell could become the top enterprise PC dog if the stars line up well.

Not all analysts are upbeat about Dell's prospects. Susquehanna Financial analyst Jeffrey Fidacaro acknowledges that server growth may propel Dell, but the company's quarter will still take a hit if consumer PC sales slip. Server sales will be a tailwind for Dell for the rest of the year.

Barclays Capital analyst Ben Reitzes adds that it's unlikely the Dell significantly outperformed HP on profit margins. In any case, all eyes will be on Dell's outlook for the second half amid signs of economic uncertainty.

Related: