Isis mobile payment system changes direction

Google might pull ahead in the race for mobile payments leader as the Isis mobile payment system seems to have hit a roadblock.

Isis first popped onto the scene last fall as a joint venture between the trifecta of domestic mobile carriers: AT&T, T-Mobile and Verizon Wireless. Poor Sprint had been left out, but given the latest turn of events, maybe that's a good thing.

Originally the plan was that the service would allow users to make purchases just with a smartphone, and then the fees would accumulate on the user's phone bill rather than being charged to a credit card.

Now, Isis will be used a bit differently. According to The Wall Street Journal:

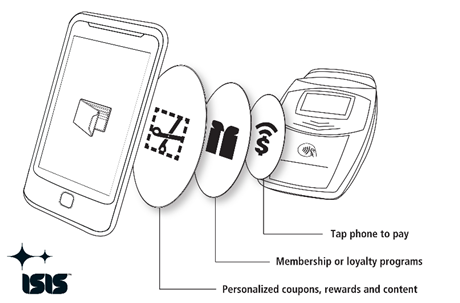

Now, the group has adopted the less ambitious goal of setting up a "mobile wallet" that can store and exchange the account information on a users' existing Visa, MasterCard or other card, people familiar with the matter said. The carriers are scrambling to find other ways to make money from the transactions.

To get as many users as possible, the carriers are now in talks with Visa and MasterCard to have them participate in the system they will embed in phones, people familiar with the matter said.

So much for replacing the credit card companies. In this case, that old cliché seems to apply. The mobile carriers couldn't beat credit cards before even getting this program off the ground, so they've joined them...or rather turned to them for help. However, it's probably the smartest move that the carriers could make in such a situation without letting Isis fold altogether.

Mobile payments are taking off rapidly as NFC technology is becoming more of a popular idea for smartphones. It's already started in other ways, such as mobile apps. While it doesn't require a credit card, users can already buy Starbucks coffee just by holding up a barcode that is tethered to a gift card. It's a great way not only to make purchases easier (perhaps too easy...), but it's also useful for keeping track of regular customers, rewards points and more.

However, the idea of not using a credit card and letting the charges accumulate on a phone bill seems rather streamlined. It would be interesting if the carriers go back to that idea eventually just to see how the two concepts would compete.

Would you prefer charges from purchases to go to your phone bill or your credit card bill?

Related coverage on ZDNet: