Lenovo strategy pays off, remains upbeat on outlook and tablet plans

Lenovo's strategy to defend mature markets such as the U.S. and Europe, hold its market share in China and grow aggressively in emerging markets is paying off nicely even as rivals struggle. The company reported strong quarterly earnings, shipped 81,000 LePad tablets in China and was upbeat about its ThinkPad tablets.

The Chinese PC vendor---best known for its ThinkPad franchise---is riding a corporate upgrade cycle and said that it is seeing no signs of a slowdown. Lenovo executives, who detailed fiscal first quarter results late Wednesday, said on a conference call that the company is firing on all cylinders. The tone from Lenovo was markedly different than comments about macroeconomic uncertainty from the likes of Dell and NetApp.

On a conference call, Lenovo Wong Wai Ming said:

Despite the current volatility in the global financial markets which might have an impact on the global economy, we remain confident on continuing our trend of outperforming the worldwide PC markets. We are executing our protect and attack strategy well. As a result, our core businesses are performing well and our strategic investment are laying the foundation for future growth. We will continue to benefit from growth in China in emerging markets as well as to continue corporate refreshment cycle in the mature markets.

By market, China accounted for $2.8 billion of sales, or 47.9 percent of the total. Lenovo has 31.7 percent of the Chinese PC market. Emerging market revenue was $1 billion, or 17.5 percent of sales. mature markets were led by $2.1 billion in sales from the U.S. Lenovo PC shipments surged 30.8 percent in North America.

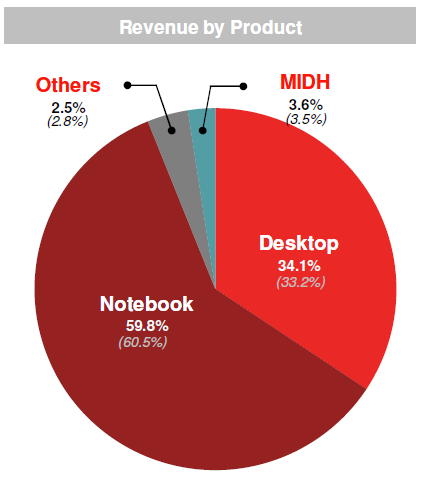

Laptops generated most of Lenovo's sales---59.8 percent of the total.

In addition, Lenovo is moving to improve its margins by becoming more efficient. For instance, Lenovo was using IBM's IT systems for markets outside of China. Lenovo has consolidated on one technology platform around the world to have one system of record. Lenovo's IT spend for its units is now set at a flat rate based on revenue contribution.

"Lenovo remains optimistic on its outlook despite the ongoing weak U.S. market and debt crisis in western Europe," said Jonathan Ng, an analyst at CIMB, a Hong Kong based investment firm. "We believe this optimism is premised on ability to gain market share, strength of corporate spending and above industry growth in emerging markets.

The plan ahead

On Lenovo's conference call, executives outlined growth initiatives. In China, Lenovo's plan is to own 20 percent of the tablet market. The company is also entering the smartphone market.In the U.S., Lenovo will launch its ThinkPad tablet, which is designed to bridge corporate and consumer needs. Meanwhile, Lenovo is also planning to hop on Intel's Ultrabook bandwagon, according to CNET News. Lenovo sees that ultrabook as a natural evolution of the laptop.

The primary growth focus for Lenovo, however, is mobile on its home turf. Lenovo CEO Yang Yuanqing said:

We sold over 80,000 LePad in China last quarter and are still ramping up. Globally we have launched our family of Idea and Think Tablets targeting different customer segments. Meanwhile LePhone sales outgrew the market at [72%] year on year. Last week we launched our new smartphone, the LePhone A60, to address the aimed at RMB1000 market in China. This is an excellent product at the price point.

Specifically, Lenovo moved 81,000 LePads in the fiscal first quarter.

Overall, Lenovo is looking to seed these emerging categories as it continues to gain from the corporate upgrade cycle in traditional PCs. Fortunately for Lenovo, the corporate upgrade cycle still has legs. Rory Read, chief operating officer at Lenovo, said:

As that corporate upgrade cycle plays out, Read said the plan is to have LenovoWe believe that we're about half way through that corporate refresh and we believe the opportunity for us to continue to benefit from it will continue through the end of the year and potentially much further than that. We believe that the mature market allows us to hit a record share in our worldwide commercial notebooks at - now reaches number two - and we're number one in notebook in large enterprise and public sector in the relationship segment.

We've launched three additional tablets on the worldwide marketplace in July; one in the consumer segment, one in the commercial segment with the Think Tablet, and then across, later in the year the Windows Tablet. The uptake on all of those products have been very positive in terms of pre-orders and the feedback that we have gotten. Particularly interesting is the Think Tablet, which takes into consideration the kinds of design and customer feedback we have gotten for over a year now from our customers, around manageability, support and ability to introduce that tablet effectively into the enterprise infrastructure. We think we're well positioned to benefit from these product launches in coming quarters.

Lenovo's bet is that it can leverage its commercial ThinkPad strength into sales of the Think Tablet. "We believe that we can leverage the strength that we're generating in the commercial segment on the worldwide base in order to expand that tablet and get a further penetration," said Read. "We believe by leveraging (market share) that should help us penetrate the commercial tablet space with the Think Tablet which is, we believe, is quite differentiated in the market space."

Related: