Level 3 to acquire Global Crossing for $3 billion

Level 3 Communications said Monday it will buy Global Crossing in a stock swap valued at $3 billion.

The merger illustrates how the telecom market is rapidly consolidating. AT&T gobbled up T-Mobile just last month.

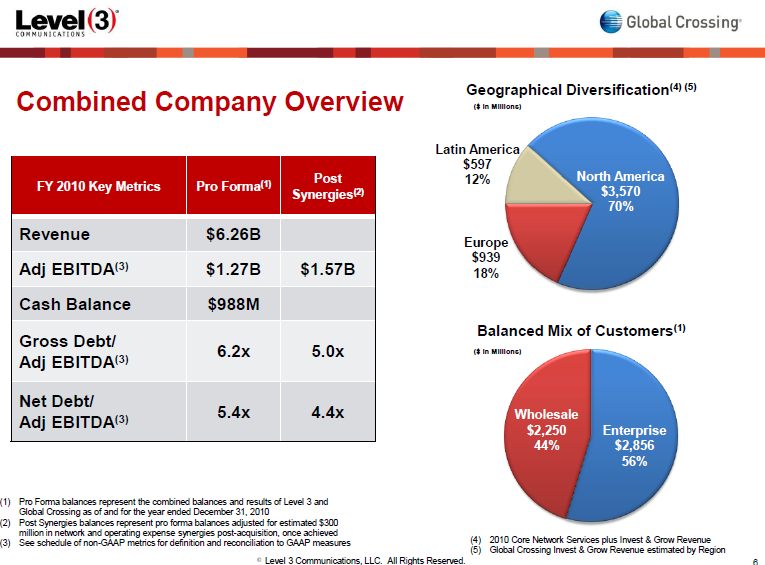

With the combination, Level 3 will operate networks in 50 countries with connections to 70 countries overall. The combined companies have more than $6 billion in annual revenue with adjusted EBITDA of $1.57 billion after cost savings.

Under the terms of the deal, Global Crossing shareholders get 16 shares of Level 3 for every share they own. The deal is values Global Crossing at $23.04 a share.

According to the companies, the new Level 3 will be able to cater to the local, national and global markets. It can also better target the enterprise.

Level 3 CEO Jim Crowe said in a statement that there's a "complementary fit between the two companies’ networks, service portfolios and customers." Level 3 said it expects to boost earnings via $2.5 billion in total synergies. Of that sum, 39 percent are network savings and another 49 percent from operating expenses. The companies only expect to save 12 percent of that $2.5 billion from the capital spending cuts.

One item to watch in this deal will be the impact on Level 3's content delivery business. Level 3 won Netflix over Akamai and Global Crossing could give the company a much larger footprint. The upshot: Akamai may increasingly look like a nice takeover target for a large telecom player.

Jeff Storey, president of Level 3, said on a conference call:

The whole CDN capability that -- both around the world now to really capitalize on the content markets, over the top, broadcast producer services, you will optimize the IP back bone as a result of that CDN capability but allow us to address opportunities with enterprise customers that heretofore we have not had a good offering so I see a significant opportunity there. And then let me round it out with the whole data center solution set which I think as talked to CIOs in the market today, the whole idea of a bit of a turnkey solution for transport hosting cloud-type services et cetera really does become the type of solution that a CIO need to simplify their business operation combined capability of the two companies around the world now will certainly make that a huge opportunity from a revenue point of view.