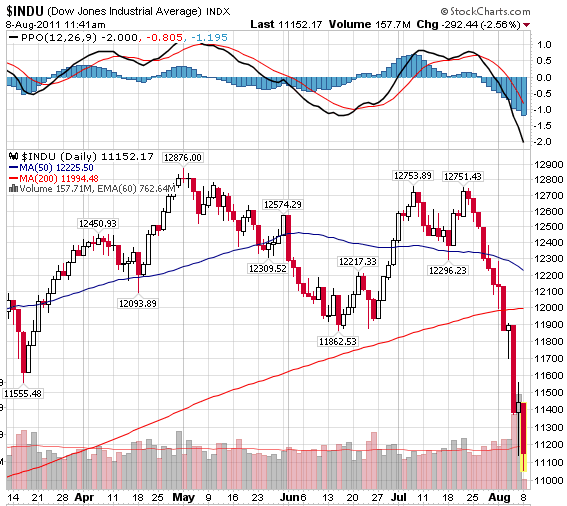

Market meltdown likely to hit tech spending

When the stock market tanks in a short period of time, technology spending often goes with it.

Simply put, there will be a round of downward revisions for technology spending in the next few weeks barring some miraculous rebound in the economy. Is it too early to call a soft patch for technology? Not really.

- Market tanks.

- Shares of companies follow.

- Companies get cautious.

- Spending and investment slows.

- Economy pulls back.

- Cycle repeats.

In this environment some technology projects---new data centers, cloud computing, software as a service and automation---make the cut. Other technology efforts such as PC upgrades may not.

Now the latest round of tech earnings highlighted how enterprise spending continued to chug along. Consumers were a bit flighty, but businesses were investing in technology. However, Juniper Networks recently noted that it was seeing a few economic hiccups. Cisco has been seeing warning signs amid its own execution issues. And Forrester Research was ready to cut its IT spending forecast based on debt ceiling talks. The U.S. raised its debt ceiling, but Standard & Poor’s downgraded the country's rating. That move is a first and while the merits of the downgrade are debated, the fact that the U.S. balance sheet is a mess isn't.

Also: Forrester: U.S. debt ceiling showdown will affect IT spending

What's a chief financial officer to do amid this mess? Pull back on spending---big time. Given that the CFO controls the technology budget it's just a matter of time before IT spending take a hit.

In addition, the tech supply chain may already be wrestling with inventory issues. Mirae Asset, a Hong Kong research firm, said the technology industry is facing an inventory glut amid weak demand. In a research report, Mirae said:

Prior to this study, we thought inventory issues in the tech supply chain were limited to upstream semiconductor companies, mainly triggered by the earthquake in Japan in March. Companies ordered more than they needed because concerns on component shortages. Our study indicated that downstream companies (including EMS companies, distributors/retailers and handset makers) too hold inventory levels similar to the previous financial crisis during 4Q08 and 1Q09. We attribute this to the end-market slowdown over the last 2-3 months.

Indeed, Mirae has a table that highlights days of inventory across various supply chain players. Here's a sample.

- Qualcomm had 50.9 days of inventory in the second quarter, the highest since the first quarter of 2009.

- AU Optronics, which makes LCD panels, had 45.9 days of inventory in the second quarter, up from 43.3 days in the first quarter. Those tallies are the highest since the third quarter of 2008. LG Display has a similar situation.

- Contract equipment manufacturers---Flextronics, Sanmina-SCI, Jabil and others all have high inventory levels.

- Retailers and distributors---Ingram Micro, Tech Data and Best Buy all have inventory levels that are lofty.

- On the handset side of the equation, Nokia, RIM and Motorola are at inventory levels dating back to the fourth quarter of 2008 and first quarter of 2009.

Add it up and the tech sector appears to be destined for rough sledding.

Related:

- MoneyWatch: Analysis: It's Time to Worry About the Economy

- MoneyWatch: Post Downgrade, Both the U.S. and S&P Are Defiant

- CBS News: S&P lowers Fannie, Freddie, others tied to U.S.