Meet the new Comcast-NBCU: Content meets conduit everywhere; Will it work?

Comcast said Thursday that it has officially acquired a controlling stake in NBC Universal in a deal valued at $30 billion. Comcast will have an arsenal of cable channels, a huge distribution network, a movie studio and a top 10 Web presence with 82 million monthly unique visitors. Now the hard part: Leveraging these assets.

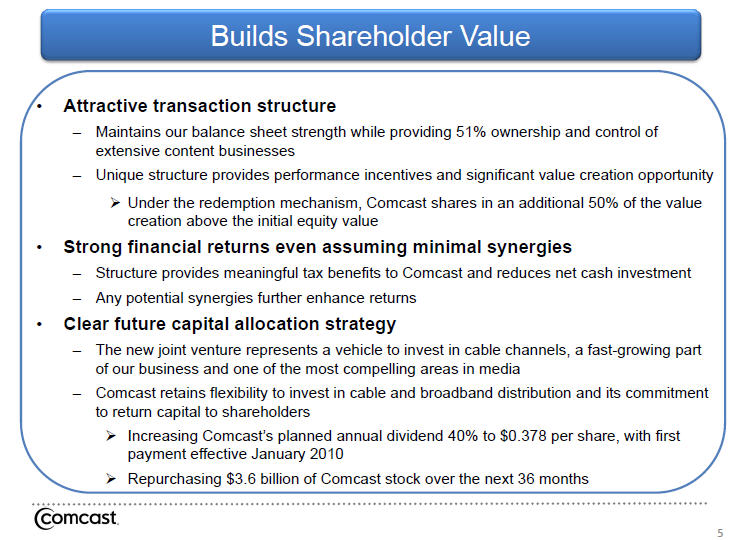

But as Comcast CEO Brian Roberts said on a conference call (statement, Techmeme, presentation): "There's more upside than downside buying it today." In the end, Roberts got a good deal, "buying at low point in cyclical changes," and had a willing seller in General Electric. "It's a reasonable risk and that's how you get excess returns," added Roberts.

First the details:

- Comcast will own 51 percent of NBCU in a joint venture with GE holding the rest.

- NBCU deal valued at $30 billion. Comcast will contribute properties valued at $7.25 billion and pay GE $6.5 billion in cash.

- Jeff Zucker, NBCU's head honcho, will run the venture, based in New York.

- NBCU will have a bevy of cable channels such as USA, Bravo, CNBC and Versus. These properties will have two revenue streams, cable affiliate fees and online revenue. Cable still drives most of the joint company's revenue and earnings.

- Roberts talked the financials and gave Wall Street a lot of goodies to allay any worries. Biggest perk: Comcast raised its dividend. And the deal is immediately accretive to earnings.

- Comcast will be able to tap multiple demographics and can chase interactive television and powerhouse content such as Olympics coverage. Executives talked about launching new properties and creating video on demand bundles.

Now the big questions: Will this deal work when history is littered with botched media mergers and attempts at vertical integration? Will there be culture clashes? Will regulators approve? And what's the big overriding strategy online and offline?

The short answers:

- If anyone can make a media merger work it's Roberts, who has a lot of experience with large acquisitions and isn't ego driven. He's a good business man who will let NBCU operate as its own. Comcast executives said this deal is more like Time Warner buying Turner than Time Warner buying AOL. Roberts said the deal was good standing on its own without any synergy assumptions. How many media executives have you heard break out terms like IRR (internal rate of return)?

- Culture clashes? NBCU employees will be stoked to go to Comcast relative to GE. There's a better match with working with a company that has cable pipes and content than one that make airplane engines and wind turbines. "I think we're going to merge quite well," said Roberts. Here's the team:

- As for the regulatory issues, the Comcast-NBCU deal doesn't rewrite the TV industry. The deal will get scrutiny, but everyone I've asked thinks regulators will approve. "We believe this is an approvable transaction," said Roberts.

- The cable strategy is the same as it always is for Comcast. Grow margins. With NBCU's library and channels Comcast won't have to negotiate with all of these properties. There's a lot of savings there. Comcast is also likely to bundle these content assets for TV Everywhere. Distribution helps content. The company talked a lot about new distribution models. "We're big believers in trying new things," said Stephen Burke, chief operating officer.

Later in the conference call there was an interesting exchange about TV Everywhere and Hulu. "Right now NBCU is distributing its free broadcast content on Hulu, but has been careful about putting cable content out there," said Burke, who added that the move made sense. "Cable content would go out to TV Everywhere. Hulu and TV Everywhere are complimentary," said Burke. An executive also noted that Hulu premium wasn't in the cards.

What Comcast will do with properties ranging from Univision to NBC Sports to Hulu remains to be seen. But the giant has a huge arsenal of assets at its disposal for online and cable use. Comcast can compete directly with ESPN with Versus, NBC Sports and regional assets, it can be an interactive TV player and do just about anything. Executives also talked up wireless broadband via its partnership with Clearwire. As with all mergers on the day the deal is announced the sky's the limit. Now Comcast and NBCU just have to deliver.