Netflix's debacle continues: Fourth quarter outlook horrid

Netflix acknowledges that it screwed up with a proposed breakup of its DVD-by-mail and streaming services. The company also admits it shocked users with its pricing changes. But Netflix couldn't have forecast the customer fallout as its churn rate spikes to historically high levels.

Simply put, Netflix's outlook for the fourth quarter is a debacle of epic proportions. Meanwhile, Netflix delivered a domestic churn rate of 6.3 percent, up from 4.2 percent in the second quarter. Historically, Netflix churn has been between 3.8 percent and 4.5 percent.

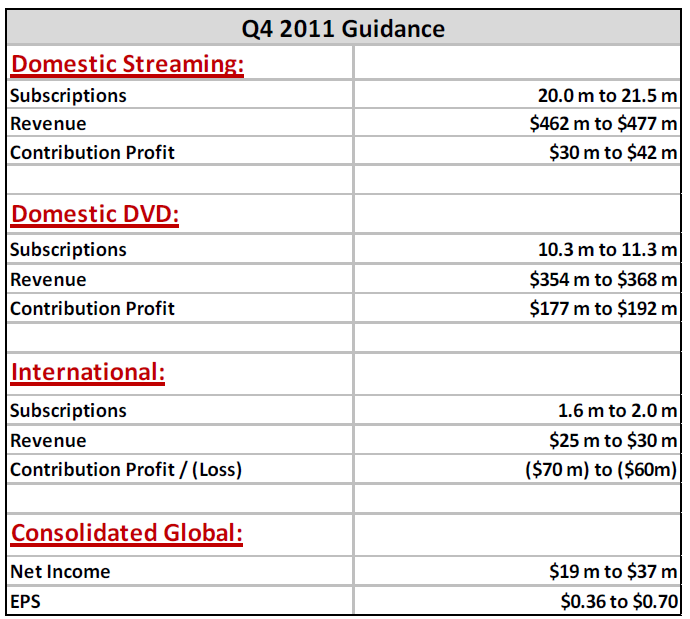

Let's roll the outlook:

Jumping to the bottom line, Netflix's outlook is way short of Wall Street estimates. Netflix's earnings range for the fourth quarter is 36 cents a share to 70 cents a share. At the top end of Netflix's revenue range the company is projecting a best-case scenario of $875 million. Wall Street is expecting earnings of $1.08 a share on revenue of $919.6 million.

"We think DVD subscriptions will decline sharply this quarter due to price changes," said Netflix in an investor letter. Netflix added that it will offer an outlook for each of its units in the future. That move highlights how Netflix is trying to quarantine the limping DVD unit.

In other words, Netflix's financial picture for the fourth quarter is worse than the third quarter, which was no picnic, but better than feared. However, Netflix lost 810,000 domestic subscribers in the third quarter. Also see: Netflix subscribers down, Wall Street disappointed

Netflix shares fell 20 percent after hours.

Netflix reported third quarter earnings of $62 million, or $1.16 a share, on revenue of $822 million. Wall Street was looking for earnings of 94 cents a share on revenue of $811.6 million. In the third quarter, Netflix lost subscribers for the first time.

"We greatly upset many domestic Netflix members with our significant DVD-related pricing changes, and to a lesser degree, with the proposed-now-canceled rebranding of our DVD service," said Netflix, who added the long-term streaming opportunity is compelling.

A look at Netflix's third quarter by the numbers:

- 21.45 million: Domestic streaming subscriptions, which was lower than expected.

- 13.93 million: DVD subscriptions.

- 23.79 million: Unique domestic subscriptions, down from 24.59 million in the second quarter.

- 810,000: Subscriber losses in the U.S.

- 7 percent: Percentage of new members that choose a $15.98 DVD and streaming plan.

- 11.8 percent: Operating margins for Netflix, down from 14.6 percent in the second quarter.

Related: Netflix's Qwikster retreat makes sense, but looks skittish

- Netflix under pressure to land streaming content deals

- Netflix split to set up Amazon streaming merger?

- Netflix’s mea culpa disaster: ‘Seems like a panic move’

- With service split, Netflix overlooks customer experience

- Netflix wrestles with innovator’s dilemma; Customers pan ‘Qwikstupid’ idea

- Netflix cuts subscriber targets: Customer rebellion or just a blip?

- Netflix, Starz to break up: One crazy ride ahead to Feb. 28

- Disney chief Iger: Digital evolving too fast for long-term content deals

- Amazon touts video titles, just as Netflix customers pick plans

- Netflix’s rough weekend: Sign of things to come through October