Netflix's pricing backlash: Follow the money, churn rates

Netflix swapped out its pricing plans, angered customers and effectively separated its streaming movie and DVD rental businesses. Why? Netflix is betting that it has pricing power since it will have to pay higher content costs going forward.

On the surface, the math makes sense. Netflix basically raised prices. An option to get streaming video and DVD rentals in a bundle for $9.99 a month is now $15.98. In other words, one DVD rental out at a time is $7.99 a month. And the streaming service is $7.99 a month.

Following Netflix's blog post officially confirming the price changes, the customer backlash ensued. We won't recap all the comments here, but folks weren't happy. The Wall Street Journal summed it up best and noted that Netflix customers were subscribing to unlimited screaming.

The big question here is whether this screaming amounts to real damage to Netflix's brand or financials. Clearly, Netflix thinks it has the risk-reward balance on its side. Here's a look at the calculus behind the pricing decision.

It's about the revenue stupid

Netflix's pricing move is all about the money. By unbundling DVD and streaming services, Netflix is reflecting its costs better. Unfortunately for customers a bundled plan is now 60 percent higher. What's galling to customers is that they can even get a bundle discount from the cable giants---you know the companies Netflix was going to unseat.The backdrop here is content costs. Netflix has to renegotiate its Starz deal and content costs are only going up. The company knows it. Wall Street knows it. And consumers will now know it. Netflix is passing along some costs upfront.

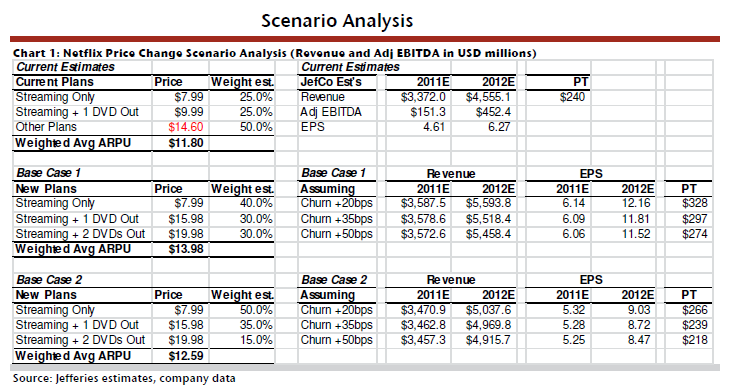

Depending on the analyst, Netflix's price changes will boost average revenue per subscriber at a nice clip. Jefferies analyst Youssef Squali said that Netflix's average revenue per unit could jump to anywhere from $12.59 to $13.98 depending on the churn increase. Today's estimate is $11.80.

Here's the model:

Piper Jaffray analyst Michael Olson has a similar scenario. "Despite potential for higher churn, our analysis leads us to expect these changes to result in higher ARPU and profitability over the next several quarters," said Olson.

Here's Olson's take:

In either case, Netflix's price changes are all about the dollars. If subscribers get the 1 DVD at a time plan and the streaming service for $15.98 instead of $9.99 Netflix comes out way ahead.

Well then there's the churn

The linchpin to this equation is whether folks drop the DVD shipping service en masse. Olson noted:If customers choose to abandon DVD-by-mail and downgrade to the streaming-only plans, ARPU would fall, but profitability would rise and Netflix would more quickly accomplish its goal of becoming an internet streaming service. If subscribers maintain both DVD-by-mail and streaming, then ARPU will rise, and the profitability of the DVD service will also rise to be more in-line with that of streaming.

Following the money leads you to conclude that Netflix isn't going to complain if you dump the DVD plan because of costs. Officially, Netflix is committed to DVD shipments.

Netflix's churn levels, historically about 4 percent, are likely to increase. Why? There's a direct substitute for Netflix's DVD service---CoinStar's Redbox. Merriman Capital analyst Eric Wold said:

For those Netflix subscribers who still utilize DVDs, we would expect this price increase to force them to re-evaluate their subscriptions - with a potentially meaningful percentage of them canceling their subscriptions altogether. While Netflix has not detailed the number of DVD-using subscribers, management has noted that there has not been any significant number of subscribers downgrading to streaming-only plans and between 1/3 and 1/2 of new subscribers during 4Q and 1Q chose streaming-only plans - indicating that most subscribers are still choosing plans with a DVD option. With limited choices now for DVD rentals (especially with Blockbuster and other chains closing), we believe Redbox would experience a significant share of any defecting DVD-rental demand.

The catch is that Netflix's first quarter churn fell to 2.8 percent from that historical 3.5 percent to 4 percent range. In other words, Netflix can afford to let churn levels creep higher. For my economics, Redbox is the choice. The kids like the kiosk and it's $1 a movie unless you forget to return the disk. I'll keep streaming only for a bit, but the selection is lacking. A substitute for Netflix may be Amazon streaming via the Prime subscription. In either case, Netflix has forced a lot of customers to check out new options.

Related stories...

- Netflix CEO Hastings track record keeps competitive worries at bay

- Netflix finally coming to select Android phones

- Media companies start warming up to Netflix again

- CNET News: 'Dear Netflix': Price hike ignites social-media fire

- CNET News: MIT prof: Netflix has its recommendations wrong

- CNET News: Netflix bests Hulu in battle of apps