RIM targets India, Indonesia in short-term revenue hit

Research in Motion has launched a 'low-cost' BlackBerry smartphone in India, as its efforts increase to balance the company's falling revenue before the next-generation BlackBerry 10 phones arrive later this year.

India has the benefit of two markets: the small yet high-end business and consumer market, and the large but low-end market. Despite the company's efforts in reaching ordinary consumers and businesses in the Western world, its plummeting stock price and poor sales are troubling the company, as it eyes up a potential sale.

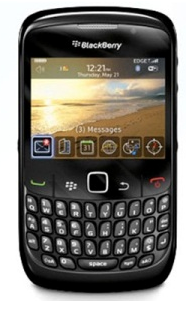

The device

RIM's shot in the lesser socio-economically viable market, along with its vast population, could be exactly what it needs to tie the company over until the next wave of BlackBerry 10 smartphones arrive in the rest of the world.

RIM has seen fast growth in the country and has rapidly expanded its smartphone offerings. Aiming towards the younger market, college students in particular, it is hoped the low-end smartphone will sell like hotcakes and generate enough for the company to keep it ticking over until the end of the year.

Targeting these young professionals with a BlackBerry branded phone is RIM's focus. The device will boast a dedicated BlackBerry Messenger key, and should appeal to the inner Generation Y's need for instant communication and messaging. It will also have FM radio technology, longer battery life, and the device will only achieve 2G connectivity. The camera will get users by day-to-day, but is far from anything to shout home about.

All these things low-end Nokia phones have had for years, but RIM is hoping to push the once 'dumbphone' super-giant aside with its QWERTY-keyboard owning, business-ready devices. The fact that the phone itself costs a few dollars per month to run --- on top of its 10,900 rupees ($210) initial cost, about the same price in Indonesia --- will be a massive selling point.

The BlackBerry maker doesn't disclose its sales figures by country, but reports that sales in North America and the UK account for more than 60 percent of its total revenue in the past three months. It barely has a presence in the Middle East or the Gulf States outside of the massively wealthy oil-rich and developed countries, such as the United Arab Emirates. These countries are next on RIM's agenda.

Safe haven

RIM is also launching the device in Indonesia in the coming weeks, its most lucrative market. There is a pattern emerging, however. RIM feels 'safe' in these two regions after smoothing over problems with the two governments, and after investing so much of its cash in the two powerhouses of the emerging market place, RIM has no option but to stay and ride it out.

Both Indonesia and India have threatened RIM with service shutdowns and network cut-offs in the past year, claiming that the devices are "too secure" and government monitoring of these networks are necessary to combating terrorism.

Indonesia's government threatened a shutdown of the BlackBerry network after the company was found to not have been "cooperative" in allowing the government in to access the data networks for its own intelligence gathering operations. The country wants to monitor its users' email and data traffic to disrupt future terrorist attacks.

The country has been on high alert since a spate of terrorist attacks since 2000, including at the Jakarta Stock Exchange and the deadly Bali nightclub bombings.

India, also with its own terrorism issues, insisted upon BlackBerry 'corporate' email spying capabilities, something RIM said it could not do. Corporate email servers are not owned nor operated by RIM, and the encryption keys are stored within the servers themselves. There is no master key, a RIM spokesperson said.

RIM eventually allowed some intelligence gathering mechanisms, such as the ability to access BlackBerry Messenger data, after it was given a deadline to comply by.

These two reasons alone make the balance of civil liberties and human rights a dilemma for ordinary citizens who value their privacy. While other devices' run directly on the networks, it was a given that their respective countries' could spy on their activities. RIM offered a safe haven to its users, while now, after facing market blackouts, found its own in the regions after bowing down to government pressure.

User base

Sales-wise, while the UK has over 8 million BlackBerry subscribers, Indonesia has an estimated 7 million subscribers. It's a drop in the ocean with a population of over 230 million, but it remains in RIM's top five countries for BlackBerry users. The company has Europe covered, Australia sorted, and North America, despite its brand problems, still possesses a eight-digit user base.

In 2011, RIM had a 15 percent share of India's smartphone market, with Nokia leading with a 38 percent share. RIM said it was "early" to the game.

Indonesia's success may not be replicated outside of the country. RIM is looking towards the lower economically-viable market in India --- taking a leaf out of Nokia's book with its low-end and high-end ranges of phones --- but if the once-was success of the BlackBerry smartphone was the brand itself, RIM may fall flat on its face again.

The brand was not was it was, and has suffered in the wake of competitors. While iPhones and Android devices have a limited presence in India and Indonesia, the brand value still holds an "I want" attitude. Just because many cannot afford the devices they want, does not mean they will fall back to the cheapest option. Brand power still holds a great deal of weight in these regions.

Now it wants more, and its efforts to target two smartphone-ready economies could be what recoups RIM's losses in the rest of the world.

Image credit: Research in Motion.

Related: