RIM's Osborne effect course set in March 2011

Research in Motion is caught in quite a pickle as its BlackBerry 10 platform is pushed out to 2013. In the meantime, RIM has to conserve cash, give away handsets and work to preserve its subscriber base---especially among enterprise customers. RIM can partially thank the Osborne Effect for its woes.

The "Osborne Effect" refers to the unintended consequences of announcing a future product ahead of its availability -- and its impact upon the sales of the current product. Adam Osborne killed the Osborne 1 computer and his company while touting a next-gen version.

How did RIM get here?

Aside from the obvious development delays, tablet flops and inability to match Apple's iOS or Android, RIM's plight can be boiled down to touting its allegedly magical next-gen OS---BlackBerry 10 formerly known as QNX---at the expense of its current products.

The reality is that few folks want a BlackBerry 7 device given that RIM has been talking up BlackBerry 10 since early 2011. Now that BlackBerry 10 won't land to 2013, RIM has essentially told the public that its current products stink and to wait for a superphone. And oh by the way, there's no upgrade path from BlackBerry 7 to BlackBerry 10 if and when it actually hits the market. RIM's only option may be to sell out to a company like Microsoft.

Gallery:

RIM's tragic marketing mistake---repeated almost quarterly---is one of the biggest reasons that the company is in one tough spot. Analysts say short of a sale---perhaps to Microsoft---RIM won't be able to get value out of its 78 million strong subscriber base.

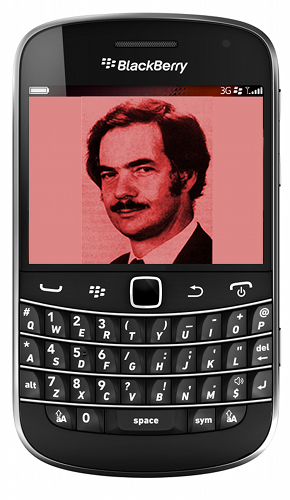

After listening to RIM CEO Thorsten Heins walk through the company's customer retention strategy, which makes sense, it's worth going back in time to see where RIM former co-CEO Jim Balsillie's penchant for yapping hurt the company. Let's roll the transcripts.

March 24, 2011 on RIM's fourth quarter earnings conference call.

Gus Papageorgiou, an analyst at Scotia Capital asked:

You're going to be releasing the BlackBerry 6.1 devices (these were later renamed BlackBerry 7 devices) and then you're saying QNX (also renamed BlackBerry 10) coming 2012. I'm just wondering if carriers are expecting QNX devices to be coming not too far behind the 6.1 devices is that going to cause some hesitation to adopt the 6.1 devices? Like, why not just wait for the QNX devices and hold off for 6.1?

Jim Balsillie - Research In Motion Co-CEO replied:

There's a time lag between the 6.1 and the QNX stuff and the certification cycle So that's point number one. And second of all, 6.1, if you saw the products, the demand in interest for those products is amazing. And so there's just enormous interest in the new products. And clearly looking at the superphone market, which is really going to be a redefined, in so many ways of capability, that's going to open up that whole aspect of future performance. But never in any of these has there been diminished interest in the new 6.1 devices.

June 16, 2011 on RIM's first quarter earnings conference call, Credit Suisse analyst Kulbinder Garcha asked:

You said a few times that QNX could get room there for the next decade or it could be the platform of choice. The one question I have is, as you start launching QNX phone or superphone next year and then start bringing it down market over time, what confidence do you have that you won't face a similar transition with respect to the demand for BlackBerry devices then and the carrier subsidies won't shift, leading maybe a significant decline in the BlackBerry OS ecosystem and demand for volumes as we go through 2012? So would that not present another risk?

Then co-CEO Mike Lazaridis answered:

That's a very good question, and we have a plan to make sure that we both continue to perfect the BlackBerry experience and make sure that that BlackBerry experience becomes available on our superphones. We are trying to very carefully navigate that transition. I think we've done probably the best job we could in the sense that we now have two very powerful platforms that are very -- you know, perfectly evolved for the kind of market that they're going after and the kind of experience they are trying to provide. And plus, at the same time, we have an opportunity to really get into the high-end, high-performance platform that will allow us to have really a common single platform in the future that encompasses smartphones as well as tablets.

Sept. 15, 2011, RIM's second quarter conference call.

Balsillie said:

BlackBerry 7 has a lot of runway that we believe can carry us through the transition to QNX-based smartphones.

Later on that call, Mike Abramsky, an analyst at RBC asked for comment on the following:

I'm just wondering if, in the big picture, there is a risk that BlackBerry 7, your overall share losses in North America, may not be helped as much by BlackBerry 7, and we might see some additional losses and perhaps even some more impact from Android before QNX starts to kick in.

Balsillie stuck to his BlackBerry 7 guns (not that he had a choice):

We've already seen a meaningful increase in sell-through and decreased churn in North American carriers who've launched BB7 handsets. And we have plans to more than double the number of models available in the US and increase the number of channels selling the products, which should further improve our position in the US. So this gives us a lot of confidence, coupled with the reviews and the competitive performance that this product has got a tremendous amount of runway and is going to serve us extremely well.

December 15, 2011, RIM's third quarter earnings conference call.

By the time RIM's December earnings came, the company was already suffering from its previous talk about how great upcoming superphones would be. BlackBerry 7 device sales were already trending below targets.

RIM CFO Brian Bidulka said:

We are certainly not satisfied with the situation in the US market. And so, we are absolutely planning a comprehensive set of marketing, advertising, and promotional plans. And you are going to see that happen imminently. We plan to be very, very aggressively promoting the BB7 value proposition to customers in the United States.

Later on the call, Credit Suisse's Garcha noted:

Some of these BB7 products have been out for a few months now. They haven't sold necessarily as well, the sell-through this quarter, you were saying wasn't that great. Next quarter, volumes go down, because of some system channel inventory. So with this marketing push, maybe there's a recovery in the quarter afterwards, but some of the products will be quite old. The market is very competitive. And it is very rare in the mobile phone industry, that if you don't get off to a good start in the first few months of the product, they actually sells very well.

Lazaridis replied:

We think it's very early, and we think these are excellent products for the market.

Balsillie and Lazaridis were ousted in January 2012.

By RIM's fourth quarter 2012 conference call, new CEO Thorsten Heins had the monumental task of reviving the company. Heins' pickle: Convince customers to buy BlackBerry 7 devices ahead of BlackBerry 10 launches.

Heins said:

We believe that ahead of the BlackBerry 10 launch and throughout the remainder of fiscal 2013, it is critical that we drive BlackBerry 7 sales to sustain the subscriber base. To do this, we plan to aggressively incentivize sales of BlackBerry 7 smartphones through the implementation of programs to both drive upgrades from older BlackBerry products to BlackBerry 7, and to onboard feature phone customers to BlackBerry 7 for their first smartphone experience.

Heins, however, later seemed to indicate that talk of future products didn't impact BlackBerry 7 sales. He said:

With BB10, we're getting ready for not just a smartphone launch; we are getting ready for a mobile computing platform for the next decade. So I think the assumption would be correct that I'm focusing mostly around the ecosystem, around BlackBerry 10, to make sure we have the right set-up for the future business of RIM. I would not expect that to be heavily influencing, for example, the BB7 portfolio right now.

June 28, 2012, RIM's first quarter and future unravel. RIM's biggest problem is that it has to squeeze more life out of the BlackBerry 7 upgrade cycle even though the OS is long in the tooth and been second fiddle to BlackBerry 10 vaporware for nearly 2 years.

Mark Sue, an analyst at RBC, asked Heins the same question that has been asked since March 2011. What will RIM do to bridge BlackBerry 7 to BlackBerry 10?

Sue asked:

It sounds like it will have to be BlackBerry 10, whatever it takes. So the question is, how do you bridge the gap between now and then? What can you do to protect your installed base outside of major price cuts so that you'll have a base to upgrade later? And also, what else can you do to reduce your cost structure because with the announcement it does seem like you're getting to the bones of things. I'm not sure what other options you might have.

Heins' answer:

We intended to have BlackBerry 10 launched later this year. Now we move into calendar Q1. We still are in the process, as I described, to aggressively put BlackBerry 7 into the market. We still have a lot of BlackBerry 5, BlackBerry 6 out there. And we also have in those regions where we are very strong in the entry level and mid-tier smartphone portfolio, we just recently launched Jazz series, as I said in my text. And we're seeing quite some good pickup on that. So I expect that to help us in the next quarters. And to stay relevant in those markets and have offering for our customers in this market. And in enterprise, as I said, we are still upgrading our enterprise customers towards BlackBerry 7, making good progress with this. I expect us to be successful in bridging this gap and protecting our installed base through those measures.