Salesforce: Competition, distractions to hamper growth?

Salesforce.com is becoming one of those companies where analysts are becoming polarized. Is the company still on a rocket ride or one that's going to be plagued by more competition and distracted by moves into new markets?

Cowen analyst Peter Goldmacher is clearly coming down on the latter side of the equation. Goldmacher cut Salesforce to underperform from neutral for the following reasons:

- Competition is closing Salesforce.com's lead. Oracle is defending the enterprise. Microsoft has traction in the midmarket and SugarCRM is gaining at the low end.

- Salesforce has juiced growth beyond a natural growth rate by investing in sales. In other words, sales productivity is about to fall.

- Distractions loom. Salesforce has jumped into collaboration, social media monitoring and collaboration. These moves have distracted Salesforce from its core business---salesforce automation.

Goldmacher's research note is an offshoot of Salesforce's billings growth miss last quarter. Goldmacher noted that the company is pushing customers to pay annually instead of monthly. That move is likely to boost small business churn. Two-thirds of Salesforce customers are billed annually and a third pays monthly. If that third resists annual payments, it's going to hurt churn.

Of the key themes behind the Salesforce downgrade, competition is the most interesting one to consider. Goldmacher said:

Salesforce had years of unfettered opportunity in front of it because the competition was caught flat footed and marginally interested in Software as a Service. However, the company succumbed to the temptation of selling big deals into the enterprise and created another sales division to sell large deals. We believe that Salesforce’s efforts to sell into the enterprise have yet to be profitable.

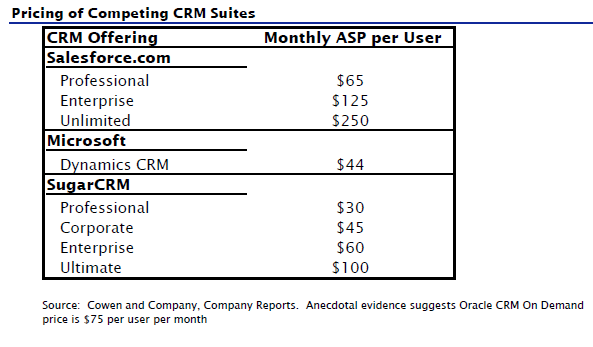

Fast forward ten years: Oracle and Microsoft are 100% engaged and CRM’s open field run is over. Additionally, open source provider SugarCRM is offering a compelling, lower cost alternative at the low end of the market. It is hard for us to imagine Salesforce enjoying a sustainable growth rate in the high-20%/low-30% range given the market maturity and change in competitive landscape. One other important point to consider is the fact that the competition is pricing its products at about half of Salesforce’s price, and the average customer uses less than 20% of the functionality in the product thereby reducing switching costs, especially at the low end.

Indeed, Salesforce is in the land of giants when it comes to competing in large enterprises. Meanwhile, SAP and Oracle are buying SaaS companies---SuccessFactors and RightNow, respectively---with the sole aim of selling the cloud through its vast sales channels.

The big question revolves around whether this Salesforce pricing will hold up:

The second theme that matters is this fact: Salesforce has grown by selling around the IT department. Its new businesses are focused on the IT department, which happens to buy SAP and Oracle and may feel left out from Salesforce's first party. Goldmacher noted:

We think it is worth mentioning that we view the PaaS business inside Salesforce as the least likely to succeed. Most of Salesforce’s products have one thing in common: the customer is a business user. In contrast, its PaaS product is sold into IT/Development. We think that Salesforce.com’s delivery model of bypassing IT to sell directly into the business has alienated IT, the buyer for its PaaS product. We believe IT has no qualms about rejecting Salesforce’s PaaS offerings in favor of other more widely adopted technologies.

In other words, IT buys Chatter, Force.com, Database.com and Heroku. Will they play along?

Related: