Sprint, LightSquared enter 15-year pact for LTE

Sprint has inked a wholesale 4G LTE deal with LightSquared that diversifies the carrier's network. The agreement runs for 15 years.

For the wireless carrier, LightSquared gives Sprint an option for LTE---it currently offers 4G services via WiMax and Clearwire. The LightSquared deal falls under Sprint's Network Vision plan. Sprint said it will outline its 4G strategy Oct. 7 at its investor day.

LightSquared will pay Sprint to deploy and operate an LTE network. LightSquared will be able to sell its 4G service through Sprint and other carriers.

The terms of the deal go like this:

- Over 11 years, LightSquared will pay Sprint $9 billion in cash for spectrum hosting and network services and LTE and satellite purchase credits.

- Sprint can buy 50 percent of LightSquared's 4G capacity.

- LightSquared will save capital spending of about $13 billion over the next eight years relative to building out a network on its own.

- LightSquared will deploy the 4G network by 2015.

- There's also a 3G roaming agreement with Sprint that will kick off in 2012 when LightSquared launches its first 4G market in 2012.

The deal was expected. CNET News reported earlier this month that a deal was set.

Separately, Sprint reported a second quarter loss of $847 million, or 28 cents a share, on revenue of $8.3 billion. Sprint's quarter was like similar financial reports from the company---it was a mixed bag. The company added 1.1 million net wireless subscribers, but the bulk of them were prepaid. Sprint added 674,000 prepaid subscribers, 519,000 wholesale and 275,000 postpaid.

Meanwhile, Sprint improved its postpaid churn to 1.75 percent. Prepaid churn was 4.14 percent. Sprint ended the quarter with 52 million customers.

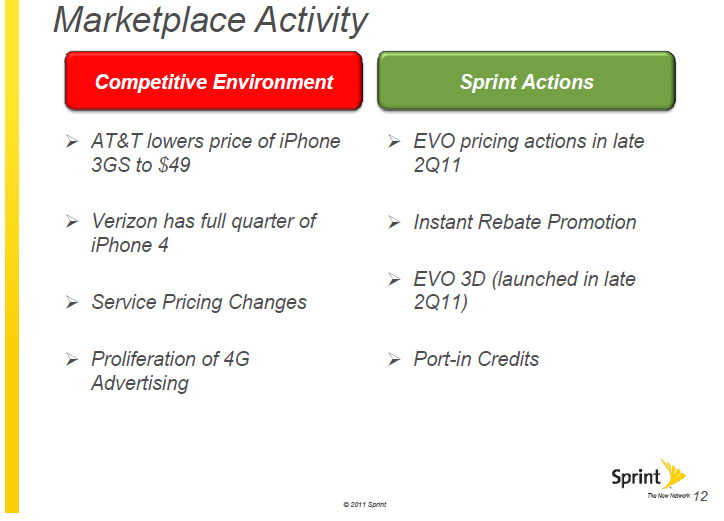

Overall, Sprint still wound up losing 101,000 net postpaid subscribers. In the end, Sprint has improved its customer service and is headed in the right direction. The problem is that Sprint needs to start delivering profits with its simplified value pricing scheme.

Here's Barclays Capital analyst James Ratcliffe on the LightSquared deal and quarter:

Sprint's 2Q11 results were mixed, with postpaid subscriber results showing the impact of challenging competitive conditions while prepaid benefited from materially better-than-expected churn. Overall revenue was in line, while wireless margins were below forecast on higher retention costs and some one-time Clearwire settlement costs. Company's announcement of a LightSquared deal was anticipated. Structurally, the deal makes sense, as it should improve scale economics on the Sprint network and help offset some of the Network Vision upgrade costs. We believe that the actual deployment of the LightSquared spectrum remains challenging, however, given GPS interference issues.

That final point is also critical. LightSquared's spectrum may interfere with GPS systems. If that's the case, Sprint's deployment may be tricky.

Related:

Sprint sets 4G plans with LightSquared: WiMax with dash of LTE