Verizon touts 'high-quality' customers as retail subscriber growth disappoints

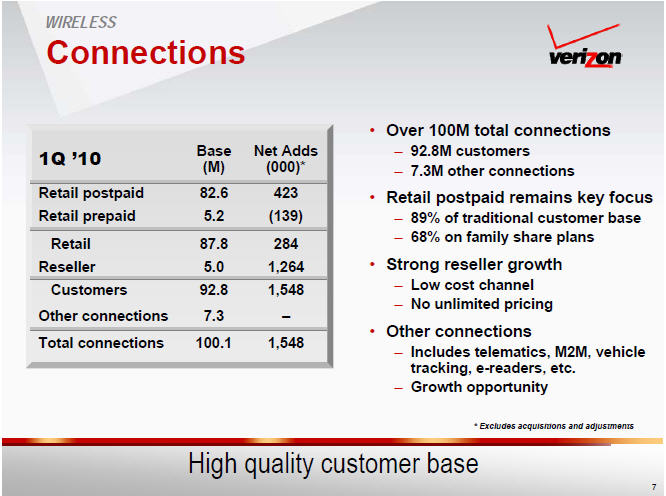

Verizon's first quarter earnings met expectations on both the top and bottom lines Wednesday as the company added 1.5 million net wireless customers to end with a total of 92.8 million subscribers. However, the tally for the highly coveted retail customer fell short of expectations.

The results from the telecom giant come a day after AT&T's earnings, which were better than expected. Verizon on Thursday showed fewer net customer additions in the first quarter than 1.9 million added by AT&T. AT&T has been playing up service for connected devices like e-readers, but Verizon hasn't talked up those type of gadgets as much.

Verizon's added 423,000 retail post paid customers, which was short of estimates. For instance, Reuters put estimates for Verizon at 582,000 retail postpaid customers in the quarter. AT&T added 512,000 retail postpaid customers in the first quarter. In any case, it appears U.S. subscriber growth is slowing.

Reading between the lines of Verizon's statement it appears that the company is taking a jab at AT&T's connected device strategy. The company said it "continued to grow its high-quality retail (non-wholesale) customer base" and then added that it had "the most retail customers of any U.S. wireless provider."

Verizon reported net income of $2.28 billion, or 14 cents a share, in the first quarter, down from $3.2 billion, or 58 cents a share, a year ago. However, Verizon took a charges of 42 cents a share related to lower tax benefits due to the health care bill (34 cents a share), activities to prepare for a spinoff of wireline assets (4 cents a share), pension settlement losses (3 cents a share) and Alltel merger integration costs (1 cent a share). Factoring out all of those moving parts, Verizon matched Wall Street estimates of 56 cents a share.

Revenue for Verizon was $26.9 billion, up 1.2 percent from a year ago. That tally was in line with expectations. Like AT&T, Verizon said it was seeing the economic recovery pickup up with better demand in business markets. In a statement, CEO Ivan Seidenberg said:

"Customer demand for broadband, such as a growing demand for wireless data, has improved revenue trends, and we are beginning to see signs of economic recovery, particularly in business markets."

By the numbers:

- Verizon had 87.8 million retail customers, up 4.4 percent from a year ago. The total customer count was 92.8 million at the end of the first quarter.

- Retail postpaid churn was 1.07 percent in the first quarter. Retail churn was 1.46 percent and total churn was 1.4 percent.

- Verizon said it had 7.3 million machine-to-machine, e-reader and telematic connections at the end of the first quarter.

- Wireless retail service revenue was $13.4 billion, up 5 percent from a year ago. Data revenue was up 25.6 percent from a year ago to $4.5 billion.

- Verizon added 185,000 net FiOS Internet additions with 168,000 net FiOS TV additions. Verizon ended with 3.6 million total FiOS Internet subscribers and 3 million for FiOS TV.

- Total wireline broadband and video revenue was $1.7 billion in the first quarter, up 22 percent from a year ago.

- Strategic enterprise services---security, IT and networking---delivered revenue of $1.6 billion, up 4.2 percent from a year ago.

- Verizon said that capital spending will range from $16.8 billion to $17.2 billion in 2010.