Why do some Tandberg shareholders want more from Cisco? Growth

Some Tandberg shareholders are reportedly rejecting Cisco Systems' $3 billion cash tender for the video conferencing player and the reason is clear: Tandberg is delivering heady growth in a downturn.

Shareholders that own more than 24 percent of Tandberg want to block the Cisco proposed buyout (Techmeme). Why? It's about the growth.

Tandberg released its third quarter results Thursday and management reiterated that shareholders should take the Cisco offer (statement). Executives also said that they will operate under their existing compensation packages and stay with Cisco going forward.

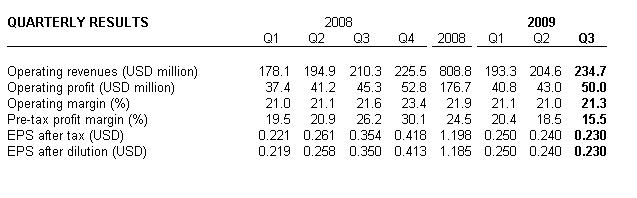

But Tandberg is a company delivering third quarter revenue growth of 11.6 percent from a year ago. Operating profit was up 10.2 percent. And these results come as many companies consider down single digits to be the new up 10 percent.

Here's a look at Tandberg's trend lines.

Cisco isn't likely to budge much unless more shareholders reject the buyout offer, but you can hardly blame a few investors for asking for more.

Also see: Polycom: A potential takeover target following Cisco-Tandberg deal