Analyst to Apple - Shareholders want some of that $46 billion you got stashed!!!

Toni Sacconaghi, analyst at Sanford C. Bernstein, believes that the time has come for Apple to do something constructive with that $46 billion pile it's sitting on - like give some of it to investors.

Bottom line, investors aren't getting a good enough return on the cash, Apple isn't being clear about what it's going to do with the cash, and investors are also nervous that Jobs and the board could blow it on pointless acquisitions.

Yes, it seems that a company can have too much cash.

Here's the full text of Sacconaghi's letter to Apple [emphasis added]:

Dear Apple Board,

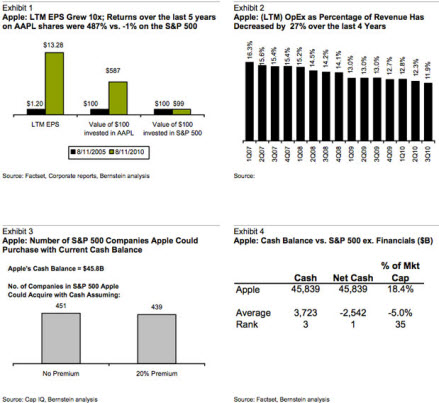

Over the last five years, Apple has done an extraordinary job in (1) creating breakthrough products such as the iPhone and iPad; (2) innovating on its existing product line; and (3) fostering a loyal and growing customer-base. Most importantly for shareholders, these actions have translated into earnings growing a stunning 10-fold, resulting in Apple's shares appreciating 487% over the last five years (2nd highest among all S&P 500 companies), while total returns on the broader market were -1% (see Exhibit 1). Moreover, the company has exercised exemplary fiscal discipline throughout this growth phase - both in controlling expenses (see Exhibit 2) and avoiding costly acquisitions; for all of these outcomes its shareholders are doubtlessly grateful.

However, in our conversations with shareholders, one common source of frustration - which is now bordering on exasperation - has been Apple's burgeoning cash balance and the company's unwillingness to return it to shareholders or discuss its vision for how the company plans to use it. Apple's cash balance is of mythic proportions - higher than the total market cap of all but 49 of the S&P 500 companies (see Exhibit 3), the highest among all US listed companies (see Exhibit 4) and growing - FCF has been $14.3B over the last 4 quarters and we expect the company to generate nearly $20 billion in FY 11. We implore you to consider returning cash to your shareholders, along with a longer-term road map for how you plan to use your cash balance and why.

A return of cash to investors makes sense for several reasons:

• Current cash levels are excessive relative to what Apple requires to run its operations. We estimate that - at most - Apple requires $10B in cash on hand to run its ongoing operations. Given its negative cash conversion cycle and strong cash flow, it may require much less, but we do appreciate the fact that the company had outstanding off-balance sheet third-party manufacturing commitments and component purchase commitments of $6.2B at the end of FQ3 10 which its cash balance may help guarantee/fund; however, even if we assume that Apple does need $10B to operate the company, that still leaves $36B of excess cash.

• Prevailing returns on cash are very low, destroying shareholder value. Apple earned 0.76% interest on its cash reserves vs. an implied expected return of ~11% on the stock - this large negative spread on cash indicates that holding onto excess cash is eroding shareholder value. Moreover, several academic studies point to a high correlation between return of cash and long term shareholder returns.

• A return of cash would create financial discipline and alleviate investor concerns about a potentially imprudent acquisition. Apple's burgeoning cash balance creates the perception that the company may spend it on large acquisition(s) that shareholders believe might be value-destroying longer-term. While we acknowledge that Apple has been disciplined in this regard, with a history of making relatively small acquisitions for talent and technology only, this investor concern is longer- term and based on what has historically transpired at other companies. A return of cash and/or a transparent policy around use of cash would help alleviate this investor concern and ensure financial discipline on current and future management teams at the company.

• A return of cash to shareholders could attract a new class of investors. While Apple is widely owned today, there are investment managers with mandates that they invest only in dividend-paying stocks. Additionally, some investors are ideologically opposed to investing in companies that lack a clear policy on cash usage. Furthermore, several investors have told us that they discount Apple's large cash balance when valuing the company given that return of cash is neither imminent nor certain.

• Dividends or share repurchases could potentially lead to multiple expansion and/or higher EPS. Given that 20% of Apple's market cap is currently invested in cash at low interest rates, it is harmful to shareholder returns. Return of a portion of this cash along with the articulation of a clear cash-usage policy would likely lead to a multiple expansion as shareholders' expectations of having a claim on the excess cash becomes more clear. Moreover, if Apple chose to use some of its cash to buy back stock it would translate into higher earnings per share (EPS).

Three broad options exist for a return of cash: (1) a one time dividend; (2) ongoing dividends, and (3) share repurchases. We believe that investors' bias - even in the face of changing tax laws - is for Apple to institute a regular dividend coupled with buybacks, but we would encourage Apple to engage and poll its investor base and potential shareholders to more systematically gauge sentiment. The majority view among shareholders we have spoken with is that a one-time dividend would be least desirable.

Our analysis indicates that a 4% dividend would have consumed about 65% of Apple's trailing 4-quarter free cash flow, leaving $4.5+ billion in excess cash for corporate needs, acquisitions and share repurchases. Even if Apple's earnings multiple expanded by 50%, a 4% dividend would amount to an estimated 71% of cash generated in FY 11, leaving $5+ billion in excess cash, above and beyond your existing cash balance of $46 billion. We note that a 4% dividend yield would not be unprecedented among technology companies; we think Apple should be a leader in returning cash to its shareholders and a 4% dividend yield would rank it among the top 10 technology companies (see Exhibit 5). Exhibit 6 provides expected cash flow payout ratios on alternative dividend rates.

A $30 billion share repurchase (65% of your current cash balance) would lower Apple's shares outstanding by 13%, effectively boosting EPS by a similar amount. Apple could consider ongoing repurchases in the open market, or an accelerated share repurchase (ASR), which has been used recently by other large cap tech companies, including HP and IBM (see Exhibit 7). Exhibit 8 provides a sensitivity analysis of the size of buyback vs. share count reduction, based on Apple's current stock price.

Given Apple's powerful cash generation, arguably both a dividend and share repurchase could be done in parallel. Using our assumptions of a 4% annual dividend and $30B immediate buyback, Apple would still retain an estimated $25 - $30 billion in cash on its balance sheet at the end of FY11, providing ample financial flexibility.

Perhaps most importantly, we encourage Apple to engage in an ongoing dialogue and be more transparent with shareholders about cash usage. As Board members, you are legal stewards of shareholders' interests, and our conversations with shareholders suggest that they have not been fully heard on this issue.