Infor next steps, an unsurprising IPO

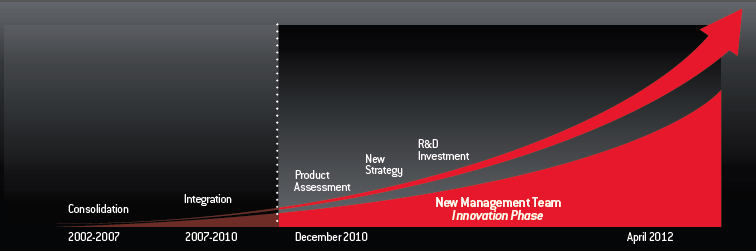

Ever since Charles Phillips tipped up as CEO at Infor in 2010, the question on many colleagues minds has been: what next? This is the company that spent 2002-7 rolling up the tier two players Oracle was not interested in acquiring. In the process Infor lost top line revenue momentum, bumbled along servicing a debt mountain but did 'ok.' This week, we started to see the first fruits of Phillips' labors as he not only gave credit to his new management team for upping revenues and profit but also talked at length about the fact Infor is now building its own applications and a new future.

Prior to the main sessions, I bumped into Paul Hamerman, analyst at Forrester saying of the forthcoming conference: 'This should be interesting' to which he replied: 'Yeah, what next for a $2.8 billion revenue company that hasn't developed a product of any note.' Phillips put that argument to bed very quickly, talking about the outcome of Infor's ION development effort.

ION can best be described as light weight middleware that helps integrate systems at the data level via an XML transport. While heavyweight vendors might scoff at the idea, customers I spoke with were more than happy. "It took us one week to implement," said Dale Brittan, CIO Brewster Dairy Inc, the US's largest manufacturer of Swiss cheese. Asked for more detail, Brittan said that one week was the amount of time it took the company to figure out how data needed to be organised in order to become capable of integration. Other analysts reported hearing similar customer stories. The overall message was loud and clear - Infor provides what it terms 'unbreakable' integrations and upgrades via ION.

Elsewhere, customers talked about the value being delivered from Inforce Everywhere. From Infor's blurbs:

"Inforce Everywhere taps into the social, mobile and open capabilities of Force.com and Chatter to deliver unmatched collaboration and communication across the enterprise."

Julia Klein, CEO CH Briggs, a distribution specialist in the construction industry said their Inforce implementation took eight weeks. "We are not so interested in the social media part of things. We saw the opportunity to leverage the many years of ERP data we hold to give us speed in understanding what's going on in the business. That makes a real difference because managers are seeing trends in real time. In the past we could get to the data but it took time, we had to arrange meetings and so on. Now we get actionable at the point when it's needed."

Again, that story is repeated.

So what we have is a company that has rolled up many well known names like GEAC, SmartStream, Lawson and others but is now leveraging that entire portfolio via ION to both extend the applications and provide good reasons for its customers to remain wedded to ERP - regardless of vintage - while offering access to new technologies that deliver the kinds of value we normally associate with pure play cloud, mobile and social apps vendors. It was particularly interesting to hear the company has made investments in design specialists who are improving the user experience while maintaining the integrity of the information available to users.

This will be a horror show to technology purists but it demonstrates an attention to the pragmatic mid tier business that wants the new but doesn't want the disruption of rip and replace.

However, it is the future that interests me and as executives talked up their mobile story - which is still in its infancy - and the ability to deploy applications through a hybrid cloud approach, I was left wondering where Infor will find the hordes of developers it needs to truly take this company forward at sustainable double digit growth. It was a question I put to Phillips and which he kind of side stepped.

While he acknowledged that the applications the company needs for tomorrow need building by a different class of SI, I didn't hear a commitment to creating an infrastructure that might compare with Salesforce.com's platform play. That was disappointing. On the mobile front, while I heard plenty of encouraging noises about new applications, it is not clear to me how Infor provides an attractive package that entices iOS developers, for example. In fairness, Infor itself recognises that the speed at which mobile is moving makes bet placing for this category very difficult. I get that.

Phillips has the opportunity to do something genuinely fresh in the market. His team has delivered on what was promised to investors, has restructured company finances to allow for more acquisitions and successfully onboarded an executive teams that delivers. That buys a lot of flexibility behind the closed doors of a private company.

With a twinkle in his eye and a smile on his face, Phillips said: "I really want to build business networks." The hint one can draw is that more acquisitions are on the way but they will be different to those of the past. Apart from mainstream product tuck ins, now is the time when Infor puts its foot on the gas of developing deep functionality for the verticals it serves while growing the addressable market. Ray Wang, CEO Constellation Research concluded: "This is the strategy Charles wanted to follow at Oracle - consolidate and then build out." [Disclosure: I am a board advisor to Constellation.]

Not only does it make a great deal of sense as a move that protects the customer base, it is the first time I have heard an articulated vertical market strategy which sounds credible.

It is therefore hardly surprising that in the executive Q&A that a representative from Golden Gate, Infor's principal investor said that Infor's future: "Probably lies in an IPO," while careful to stress the long term nature of investors' commitment to the company.

Of course nothing is that simple and many questions remain about how Infor gets to where it says it wants to be. One customer for example expressed concern about the way Infor is changing its pricing model to one that is processor based: "That stinks of Oracle," this CIO said.

But in the end I was impressed with Phillips relaxed approach, his emphasis on meaningful transparency and a clarity of vision that I have not seen with this company for many a year. While other vendors may stress the new, Infor is taking a more subtle approach. It is one that keeps customers onside with what they already have, while promising them a viable future. That's a good story all the way around. It is certainly one to watch.