NetSuite surprises: launches manufacturing edition

NetSuite today launched a manufacturing edition, accompanied by its trademark flourish and fanfare:

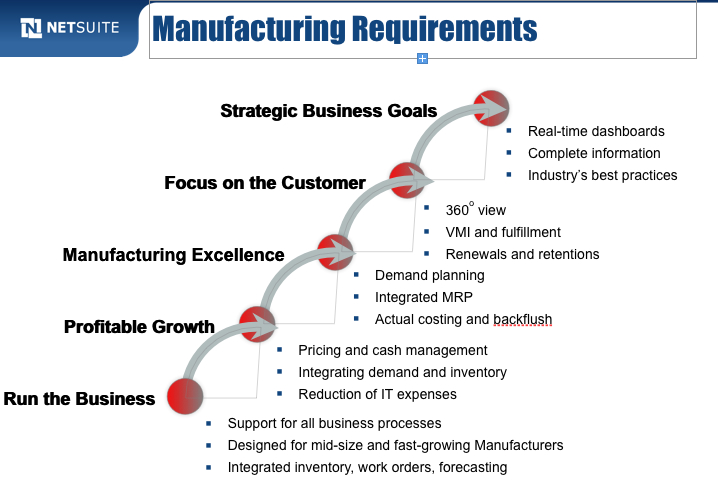

...the first and only cloud manufacturing suite designed to help fast-growing and mid-size manufacturers run their global business operations with greater agility and visibility, including comprehensive support for the multi-company, multi-plant, multi-location and multi-currency enterprise. Key functionality in NetSuite’s new manufacturing solution includes multi-site planning and management, material requirements planning (MRP), production management, engineering change control (ECC), shop floor control and work-in-progress (WIP) management.

At a first pass this looks extraordinarily impressive albeit the central message I heard from the company is that 'it's in the cloud.' Having something delivered differently cuts no ice with me unless there are clear and demonstrable benefits.NetSuite then started quoting benefits from customers Xtellent and Certicell along with showing a graphic of the 300 plus manufacturers they count in their customer portfolio.

The reason I see it as extraordinary is because manufacturing systems take a lot of development. They're big, ugly (in a size and depth way) requiring a lot of programming. The fact NetSuite is including MRP was a surprise as this is only the second time I'd heard of a SaaS/cloud player venturing into these waters. The other example is Plex, about which both Brian Sommer and I have been writing recently.

See also: The Future of ERP: SAP, Plex and Rootstock - Brian Sommer

Plex Online - SaaS Manufacturing - Dennis Howlett

It is interesting that Brian mentions Rootstock:

Rootstock, like Plex, has its roots on the shop floor, not the back office. In Rootstock’s case, the product uses the NetSuite applications (e.g., Financials, CRM and HR) while building out their own core products. If my notes from SuiteCloud are correct, the Rootstock software has 2995 custom fields, 93 database/tables and 202 suite-lets.

See what I mean by complex?

It turns out that for NetSuite Manufacturing Edition, the company has OEM'd Rootstock's IPR. NetSuite's role is to define, sell, and support the complete, combined solution. Once I understood that, then it was obvious why NetSuite is able to come to market with such a complete solution from nowhere. It's an interesting approach to partnering and one that suggests NetSuite was not ready or willing to take the acquisition plunge with all the attendant management headaches that implies.The flip side is that it must be supremely confident in what Rootstock is doing.

As an aside, I ran this arrangement past Frank Scavo whose understanding of this sector is far superior to my own. Like Brian, he is impressed on what he's heard so far about the Rootstock offering.

Net-net, the way this deal is structured and represented should mean a win for all concerned. NetSuite gets to apply its marketing pizazz to a fresh segment with a product that is getting noticed. Rootstock gets new fee potential and avoids the oft seen snafu of 'Rootstock who?' in short list selections. NetSuite retains its market positioning as a cloud player more suitable for service industry type deals but now has a credible play into mid-range discrete manufacture. NetSuite can now point to a more balanced and broader portfolio of offerings which will be welcomed by both market and financial analysts.

It doesn't go unnoticed that in launching this solution, NetSuite continues to take playful pokes at SAP. (see graphic below and compare with SAP's long running 'Best Run' campaigns.)

I'm not overly keen on this kind of thing. Perhaps NetSuite is hoping that potential customers won't have been through a major airport in recent times and seen the many customer examples SAP uses as examples of 'Best Run.' Or maybe that they will have seen the ads but be curious.

Tucked inside the presentation I saw was mention of outsourced manufacture and the ability to get 'visibility of contract manufacturer’s progress of production.' Another colleague, Phil Fersht recently ran a two-parter on NetSuite as a Business Process as a Service (BPaaS) player, interviewing Zach Nelson, NetSuite CEO providing the body of copy. In the second part, Phil asks about market imperatives for BPaaS. Zach's response is predictable but intriguing:

So the Tata’s of the world and the people that are really tied to the SAP boat-anchor will begin to acknowledge that even though they have a lot of business with SAP, the customer wants a cost reduced environment, and something that is faster to deploy...

Giggles aside, BPO has been a game of labor arbitrage that ends up in a war of mutually assured destruction in a race to the bottom. Recent interest in outsourcing processes and manufacture has led to cost increases in certain territories. This translates into to a never ending game of shuffleboard as companies move production and resources from one location to another, chasing the best cost equation. Having a cloud solution offers a distinct advantage in these situations because apart from regulatory differences, the underpinning application does not require re-implementation. If NetSuite plays this card carefully, it could be positioned as a preferred offering for mid-sized businesses in those circumstances.

Cost weighs heavily in these deals and NetSuite is coming out the gate for Manufacturing Edition sold as a module at $2,499/month plus $99/user/month. That's competitive for modest sized shops while continuing NetSuite's strategy of climbing the food chain.

Overall, there is much to like.

- The solution set is already in the market with reference customers that talk good numbers.

- The feature set is rich enough to get NetSuite and Rootstock into deals that previously might have been difficult.

- Marketing gets a boost that should help oil some squeaky wheels.

- Potential customers now have real options with real prices attached that challenge the traditional providers. They will either adapt or fade away.

- The core influencers NetSuite has to persuade, i.e. industry and financial analysts should have little difficulty getting on the same page.

What we now need to see are a flow of success examples with metrics attached.