Cognizant cuts Q3 growth outlook: Large enterprise deals take time

Outsourcing and consulting firm Cognizant cut its outlook for the third quarter and 2014 due to weaker IT spending from clients and "longer than anticipated sales cycles for certain large integrated deals."

CEO Francisco D'Souza said the company has a good strategy, but it's prudent to cut the 2014 sales growth estimate to at least 14 percent.

For the third quarter, Cognizant projected third quarter revenue to be between $2.55 billion and $2.58 billion, well below the $2.66 billion expected by analysts. Non-GAAP earnings in the third quarter are expected to be at least 63 cents a share, three cents ahead of estimates.

On a conference call, D'Souza said:

We are seeing a trend in the market towards larger integrated deals. While these deals represent a strong source of revenue for Cognizant, certain deals took longer than expected to close, leading to delays in revenue ramp-up. Second, we continue to experience weakness in certain clients in North America and the UK, that recently underwent leadership changes, a situation that we described to you last quarter. While we believe that our client relationships remain sound, we will not generate as much revenue in 2014 from some of these clients as we had previously expected.

As for 2014, Cognizant is expecting non-GAAP earnings of at least $2.54.

One example of those large integrated deals would be Cognizant's $2.7 billion, seven year deal with Health Net, which provides health benefits to 5.8 million members. In addition, Cognizant said it will have to absorb wage increases and clients are shifting their outsourcing budgets around.

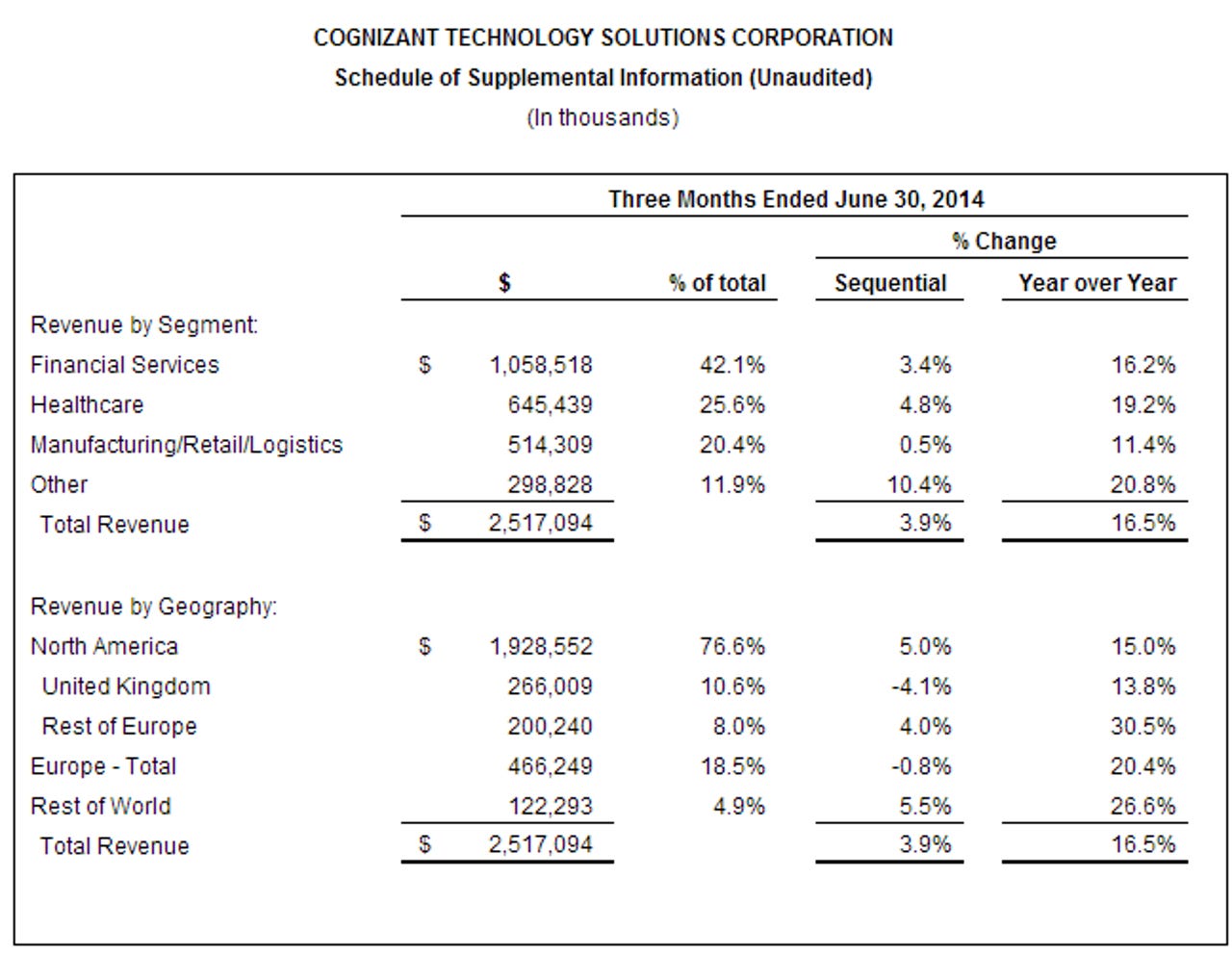

The sales outlook followed a strong second quarter. The company reported second quarter earnings of $371.9 million, or 61 cents a share, on revenue of $2.52 billion, up 16.5 percent from a year ago. Non-GAAP earnings were 66 cents a share for the second quarter.

Wall Street was expecting earnings of 58 cents a share on revenue of $2.52 billon for the second quarter.

Cognizant raised its stock repurchase program $500 million to $2 billion. The company may get a deal on those repurchases since Cognizant fell more than 16 percent in early trading.