'ZDNET Recommends': What exactly does it mean?

ZDNET's recommendations are based on many hours of testing, research, and comparison shopping. We gather data from the best available sources, including vendor and retailer listings as well as other relevant and independent reviews sites. And we pore over customer reviews to find out what matters to real people who already own and use the products and services we’re assessing.

When you click through from our site to a retailer and buy a product or service, we may earn affiliate commissions. This helps support our work, but does not affect what we cover or how, and it does not affect the price you pay. Neither ZDNET nor the author are compensated for these independent reviews. Indeed, we follow strict guidelines that ensure our editorial content is never influenced by advertisers.

ZDNET's editorial team writes on behalf of you, our reader. Our goal is to deliver the most accurate information and the most knowledgeable advice possible in order to help you make smarter buying decisions on tech gear and a wide array of products and services. Our editors thoroughly review and fact-check every article to ensure that our content meets the highest standards. If we have made an error or published misleading information, we will correct or clarify the article. If you see inaccuracies in our content, please report the mistake via this form.

PayPal Cashback Mastercard review: Earn unlimited rewards while you shop

PayPal burst onto the scene in 1998 and immediately made a splash in the world of e-commerce. Suddenly, bidding and selling became commonplace due to newfound ease and accessibility. PayPal is internet shopping at its best, with members able to sell new and used goods to a global audience. So, it makes sense that PayPal would have a credit card, too.

- Earn 3% cash back on PayPal purchases

- Earn 2% on all other purchases

- Earn 3% cash back on PayPal purchases

- Earn 2% on all other purchases

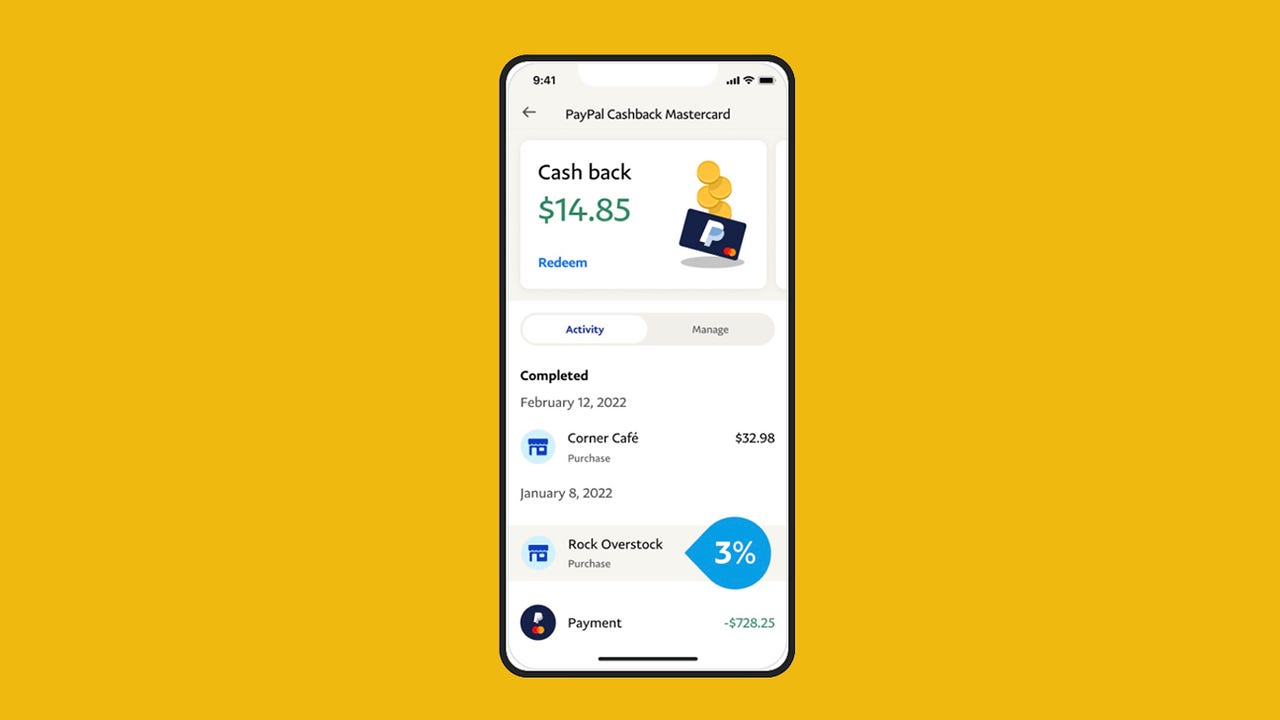

Many cards limit the type of purchases you can make or require a certain dollar amount before you can cash in on rewards. That is not the case with the PayPal Cashback Mastercard. With a flat 2% cashback on all of your purchases, you also receive 3% when you shop on PayPal.

Pros:

- Unlimited rewards with bonus

- No restrictions or categories

- No annual fee

Cons:

- No introductory APR

- No rewards bonus

PayPal Cashback Mastercard

What are PayPal Cashback Mastercard's key features?

Features:

- With the PayPal Cashback Mastercard, you receive unlimited rewards with no maximums.

- Cardholders receive 3% cashback on PayPal purchases and 2% cashback on all other purchases.

- There is no introductory offer or APR for this card.

PayPal is the perfect card for both occasional and habitual shoppers. Absent are the usual tricky and complicated rewards structures. Instead, PayPal keeps it nice and simple by offering a flat rewards system. Of course, PayPal favors its own site, so PayPal purchases earn unlimited 3% back. Even if you choose to shop outside of PayPal, you will still receive 2% cashback, making it easy to earn cashback on those everyday purchases, both big and small. There are no limits and no restrictions when it comes to the card's rewards.

Is the PayPal Cashback Mastercard the right card for you?

The PayPal Cashback Rewards Card can be an excellent fit if you are looking for a credit card that:

- Saves you extra money on the purchases you make every day

- Does not require an annual fee

- Offers a competitive APR

- Gives extra bonuses for PayPal purchases

With its exclusive PayPal rewards structure, this is a card best served for PayPal users, especially because membership is required before you can sign up for the card.

How do you apply for the PayPal Cashback Mastercard?

You must have a PayPal account in order to use the PayPal Cashback Mastercard. It's fast, easy, and free to open an account. To apply for the card, you simply visit the PayPal Cashback Mastercard website and fill out an application with the appropriate information.

What is the APR for the PayPal Cashback Card?

The PayPal Cashback Card offers a trio of interest rates based on your qualification:

- 15.74%

- 24.74%

- 27.74%

There is no introductory offer or APR.

Where can you use the PayPal Cashback Mastercard?

Bearing the Mastercard logo, the PayPal Cashback Card is accepted most everywhere for added convenience that will not interfere with that shopping spree.

What bank is the issuer for the PayPal Cashback Card?

Synchrony Bank issues the PayPal Cashback Card.

What are the PayPal Cashback Mastercard's security benefits?

PayPal was subject to a data breach in 2017, putting approximately 1.6 million users at risk.

However, by partnering with Mastercard, PayPal is able to provide cardholders with a slew of benefits and security protections, including Zero Liability Protection for fraudulent purchases, Mastercard ID Theft Protection to monitor your credit score and white-glove ID Theft Resolution.

In today's digital world, that extra assurance goes a long way.

Does the PayPal Cashback Mastercard offer customer support?

There are several ways to receive customer support for your PayPal Cashback Credit Card. Customer support is personalized based on your specific needs.

There are also other ways to receive help:

- A community forum for Q&As from other cardholders

- Resolution Center to help with questionable transactions

When you log in to your account, there are options for more personalized help specifically for your account.

Should you get the PayPal Cashback Card?

With a flat rewards system, the PayPal Cashback Rewards Card makes it easy to earn cashback on everyday purchases. It is not necessarily the best option if you do not use PayPal, but if you are willing to sign up and use your free account, you could earn big rewards on everyday purchases.

It is hard to think of anyone that would not benefit from the PayPal Cashback Credit Card. The APR could be lower, and there is a foreign transaction fee, but unlimited rewards can save you a ton of money and help you buy a few extras, too.

Are there any alternative credit cards worth considering?

The PayPal Cashback Mastercard offers a good cash back rate for every purchase, but it's designed with consumers who prefer to shop through PayPal in mind. If that's not you, consider these alternatives.

- Citi Double Cash Card: Earn 2% cash back for every purchase (1% at the time you purchase and 1% when you pay), with no annual fee. Cardholders earn their rewards in ThankYou points, but each point is worth 1 cent, so it works out to 2% cash back. Aside from offering unlimited rewards no matter where or how you shop, the card features one of the longest intro APR for balance transfers. Transfer the balance from a card that's accruing interest to this card and pay it down at no interest.

- Wells Fargo Active Cash® Card: Similar to the Double Cash, this card earns 2% cash rewards on purchases with no annual fee. However, it comes with an impressive selection of Visa Signature protections, and in addition to offering a generous intro APR offer for qualifying balance transfers, it also has a generous intro APR offer for new purchases.