Apple's September quarter: Expect Mac unit upside

Recent signs of PC market strength are likely to translate into a happy September quarter for Apple courtesy of Mac sales.

Gartner and IDC reported that the third quarter was better-than-expected for PC sales and that bodes well for Apple. Meanwhile, NPD data is also looking good for Apple. Piper Jaffray analyst Gene Munster reckons Apple will deliver 2.8 million Macs in the September quarter.

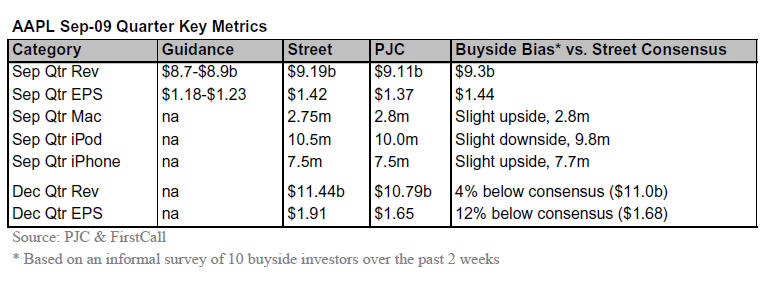

Wall Street is expecting Apple to report earnings of $1.42 a share on revenue of $9.2 billion for its fiscal fourth quarter ending Sept. 30.

Susquehanna Financial Group analyst Jeffrey Fidacaro is also upbeat about Apple's Mac potential in the quarter. He wrote:

We believe there could be upside potential to our 4QFY09 Mac unit estimates when the company reports as a result of strong trends in Apple’s U.S. business. While we estimated flat September quarter Mac units given strong June quarter seasonality, it appears Apple’s recent price cuts and revamped Mac line saw stronger than expected back-to-school demand in the U.S. We are encouraged by the positive demand elasticity Apple’s Mac business is seeing as a result, particularly as we anticipate some share gain deceleration in the near term heading into a promising Windows 7 replacement cycle for PCs.

Morgan Keegan analyst Tavis McCourt also argues that the refresh of the MacBook Pro line and the launch of Snow Leopard should power Apple higher in terms of Mac units and revenue.

Toss in the iPhone, which is garnering strong sales, and Apple should be on its way to top estimates. The key point will be the commentary about the December quarter, which analysts widely expect Apple to lowball.

Munster adds:

We believe upside to Mac and iPhone units could help Apple beat Street estimates for the Sept. quarter. We are raising our Sept. quarter numbers: Macs go from 2.7m to 2.8m units, iPhones from 7.0m to 7.5m units, yielding $1.37 on $9.1b (up from $1.24 on $8.9b). GM is up from 34.5% to 36.0%, slightly below the average over the last two quarters of 36.4%.

The one worry spot for Apple is that iPhone demand is outstripping supply, says Munster.

Other analysts agree. Oppenheimer analyst Yair Reiner writes:

The focus of our concern is the iPhone. While demand for the product appeared to run ahead of our 6M unit target, we believe component/manufacturing hiccups may have prevented Apple from fully meeting demand during F4Q09.

The big question is how many iPhones Apple would have shipped if it didn't have shortages. However, Reiner isn't exactly bearish on Apple. If the company disappoints Wall Street somehow he recommends buying shares.

Here's a look at Munster's crib sheet for Apple: