AT&T's Q1: Business revenue down but still saved by cloud, other IP services

Following reports that it is breaking into the streaming TV business, à la Netflix, AT&T published its first quarter earnings report after the bell on Tuesday.

Tech Roundup: 4G

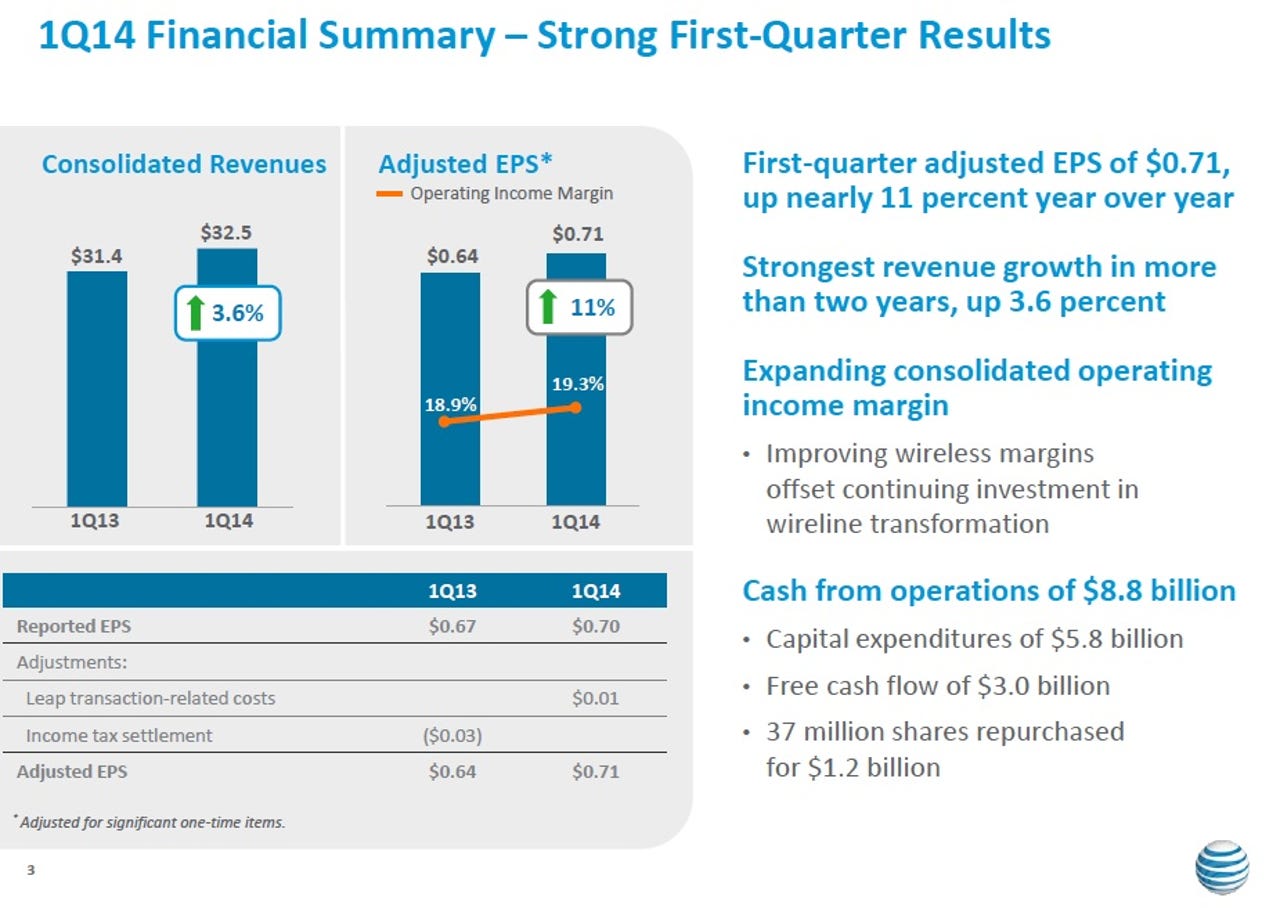

The Dallas, Texas-headquartered corporation reported a net income of $3.7 billion, or 70 cents per share (statement).

Non-GAAP earnings were 70 cents per share on a revenue of $32.5 billion, up 3.6 percent annually. AT&T boasted this was the "best revenue growth in more than two years."

Wall Street was looking for earnings of 70 cents per share on a revenue of $32.44 billion.

AT&T added 64,000 business U-verse high speed broadband subscribers during the first quarter.

Revenue from business customers overall slipped by 2.7 percent year-over-year to $8.7 billion for the first quarter.

AT&T admitted that "declines in legacy products were partially offset by continued double-digit growth in strategic business services."

It is here where AT&T is starting to pick up more revenue with a 16.1 percent uptick in Q1 on a year-over-year basis. This department includes VPN, Ethernet, cloud, hosting and other advanced IP services. AT&T boasted this line of services now account for an annualized revenue stream of more than $9 billion.

On the consumer side, AT&T added 625,000 postpaid subscribers, touted by the mobile brand as its "best first-quarter net adds in five years." Other gains included 313,000 more customers on tablets and over half a million on smartphones added during the quarter.

AT&T now retains nearly 60 million total branded smartphone subscribers and 11.3 million total U-verse subscribers (TV and high-speed Internet).

While speculating that customers are looking to "move off device subsidies to simpler pricing," chairman and CEO Randall L. Stephenson reflected on the quarter in prepared remarks:

Wireless postpaid net adds were more than twice as many as a year ago, AT&T Next sales surpassed our expectations, and we had a tremendous surge in Mobile Share plans of 10 gigs or higher. We also had our best wireline consumer revenue growth since we first introduced U-verse in 2006 as our Project VIP build continues to make progress.

For the current quarter, Wall Street expects AT&T to deliver earnings of 72 cents per share on a revenue of $33.08 billion.

AT&T followed up with guidance projecting revenue to grow by at least four percent.

Only two days into the week and it's been a busy one for the nation's second largest wireless provider.

On Monday, AT&T revealed plans to explore deployment of its petite but expanding ultra-high fiber network.

In a play that heavily ramps up the game against Google, among other Internet service providers and telecommunications companies nationwide, AT&T is now targeting 25 major metropolitan areas, equating to a little more than 100 cities and surrounding suburbs.

Much more quietly, AT&T announced that it would be adding billing software provider Amdocs and Juniper Networks, which also reported Q1 earnings on Tuesday, to the list of vendors for its User-Defined Network Cloud architecture. The pair join Ericsson, Tail-F Systems AB, Affirmed Networks, and Metaswitch Networks.

Slides via AT&T Investor Relations