Banks get more from Asia's outsourcers

While cost savings is still the primary reason financial service industry (FSI) players contract work to outsourcers in Asia, functions that are being outsourced are moving up the value chain.

Michael Araneta, senior manager at IDC's Financial Insights, told ZDNet Asia in an e-mail interview, that Asia continues to present financial institutions with a low-cost alternative, especially for discrete and routine tasks.

"However, we believe the motivations [of the financial institutions] have shifted toward activities that require specialized skills, in particular, application testing or analytics," Araneta explained. "In these areas, outsourcers have developed significant experience that can serve their customers."

The first wave of outsourcing enabled banks and other FSI players gain valuable lessons from farming out voice and data networks, desktop management, self-service networks and datacenter operations. The experience has encouraged these players to outsource higher value-added IT activities, such as security and application development, Araneta noted.

"Outsourcing of activities related to HR (human resource), credit cards, checks and custody have opened new areas for outsourcing in analytics, mortgage processing and payments," he added.

Chang Chew Lik, FSI general manager at Singapore systems integrator NCS, said demand for higher level outsourcing services comes largely from institutions in the United States and Europe.

"Now, it's more specialized knowledge, quality and efficiency, and proximity to key markets that are driving them," Chang said in an e-mail interview.

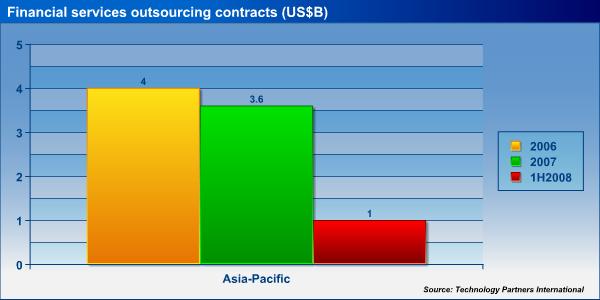

Arno Franz, Asia-Pacific partner and managing director at global sourcing advisory firm TPI, said traditional FSI outsourcing has accounted for some 20 percent to 25 percent of the total outsourcing market.

"[The traditional FSI outsourcing] market share is shrinking to less than 20 percent in the last two years, as other industry sectors such as telecommunications, are growing as a result of major inflection points, especially in the emerging markets of India and China," Franz told ZDNet Asia in an e-mail interview.

Darren Oberst, IBM's Asia-Pacific vice president of financial services and managed business process services, said outsourcing in Asia allows global FSI players to tap the region's talent pool, innovation, creativity and skills.

Among insurers, there is a lot of focus on back-office business processes, driven by new product introductions such as micro insurance, Oberst said in an e-mail interview.

"This is also driven by the need to rapidly scale up front-end distribution channels, as well as back-end policy administration services," he said.

Also, foreign banks and insurance companies entering "new growth markets" in Asia have created opportunities for the region's outsourcers. Oberst explained that, in tandem with their entrance into new Asian markets, many FSI organizations also move certain back-office activities from high-cost centers--largely in the United States, United Kingdom and Western Europe--to lower cost locations based in the new Asian markets.

"So if the financial institutions have China, India and other growth markets as part of their business strategy, soon they'll also look at them strategically as places where they can build their back-office and technology support for their operations around the world," he said.

Other countries in Asia that offer similar appeal include the Philippines and Malaysia.

Oberst said: "We've seen a lot of focus in Manila, where people are looking to put their call centers for cost and quality reasons. In Malaysia, we are seeing a lot of investment there to build on technology, and on the business process and shared services activities."

Asia's financial institutions, too, are getting on the outsourcing bandwagon, he said.

| Domestic banks and insurance companies are looking at outsourcing as the tool to help them compete with the multinationals. |

| Darren Oberst, IBM |

"We are also seeing a similar trend in domestic banks and insurance companies that are looking at outsourcing as the tool to help them compete with the multinationals. Domestic companies don't see cost as the driver, but rather, the quality, scale and the ability to grow fast and compete with multinationals."

According to Chang of NCS, the tight labor market is also attracting Asia-Pacific FSI customers in developed countries to adopt outsourcing models.

Sockalingam Muthiah, Hewlett-Packard's Asia-Pacific and Japan FSI practice director of consulting and integration services technology solutions group, noted that FSI institutions outsource to achieve three key objectives: accelerate business growth, increase efficiency, and mitigate risks.

Outsourcing activities that improve the customer experience, enable new revenue streams, reduce time-to-market and increase the share-profit per customer, allow FSI companies to accelerate business growth, Muthiah explained in an e-mail interview.

Through outsourcing, FSI players can also increase efficiency by reducing operating costs, improving operational efficiency, and enjoy greater returns on investment and shorter payback period, he said.

"Outsourcing outcomes that ensure regulatory compliance and business continuity, address security concerns and reduce operational risks, help the FSI [provider] to mitigate risks," he added.

New opportunities ahead

According to IDC's Araneta, one growth area this year in FSI outsourcing will be white labeling for transaction banking, especially trade back-office and remittance services. Akin to the original equipment manufacturer (OEM) model, a white label is a service where the service provider purchases a fully supported product from another source, applies its own brand and identity, and sells it as its own product.

"This year, we also anticipate a maturation of strategies for application development and management," Araneta added. "Here, banks will outsource not only functions such as helpdesk, support and maintenance, but also crucial activities in application development, such as testing and performance management."

Since several Australian banks have gained through the offshore captive model, whereby a company establishes its own internal offshore operation, other banks in the region will also investigate if this offers a viable and cost-effective option, he noted.

However, TPI's Arno cautioned that with the global credit crunch, increased inflation, negative stock market sentiment and reduced consumption, most FSI clients--unless they are in dire consequences--are taking a wait-and-see approach.