Best Buy's earnings, outlook shine: Home office sales boom

Best Buy's fourth quarter earnings were better than expected and the consumer electronics retailer sounded the all clear signal on demand as it raised its annual outlook.

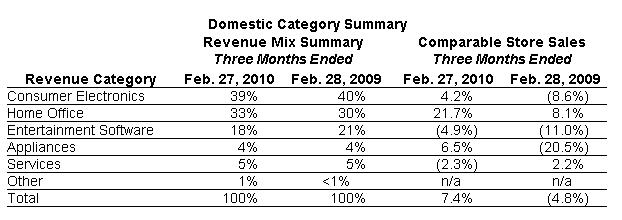

The company reported fourth quarter earnings of $779 million, or $1.82 a share on revenue of $16.55 billion, up from $14.7 billion a year ago. Wall Street was expecting earnings of $1.79 a share on revenue of $16.07 billion. Same store sales were up 7 percent in the fourth quarter (statement).

For fiscal 2010, Best Buy reported earnings of $3.10 a share on revenue of $49.7 billion, up 10 percent from a year ago. Online revenue for the year was about $2 billion. The company ended the year with $1.8 billion in cash.

Best Buy has been gobbling up market share and harvesting the profits from the demise of rivals like Circuit City. Best Buy still faces a threat from Wal-Mart and other retailers moving into electronics, but is delivering the results.

As for fiscal 2011, Best Buy projected earnings of $3.45 a share to $3.60 on revenue of $52 billion to $53 billion, up 5 percent to 7 percent from a year ago.

By category, Best Buy said sales of notebook PCs and flat panel TVs were solid. But like other Best Buy quarters, the real boom is due to folks outfitting home offices. PC makers are increasingly targeting small and mid-sized businesses (SMBs) and accidental entrepreneurs that have been forced out of corporate America. SMBs are the belle's of the tech economy ball right now. See:

- PC makers drool over SMBs; What will win over the accidental entrepreneur?

- SMB IT spending will be slow to rebound

- SAP ecosystem: going direct for SMBs

- The scary side of freelancing: the inadvertent freelancer

- The Inadvertent Freelancer (part 2): How to Sell

- The Inadvertent Freelancer (Part 3): Pre-Sales Homework

- The year ahead: Five moving parts behind a 2010 tech recovery

Indeed, Best Buy's aame store sales were up 21.7 percent for the fourth quarter in the home office category, which was one of the few consistent growth categories for Best Buy for the last eight quarters.