Best Buy's quarter gets lump of coal: Consumer electronics sales weak

Weak television and consumer electronics sales conspired to crush Best Buy's fiscal third quarter.

Best Buy reported fiscal third quarter earnings of $217 million, or 54 cents a share, on revenue of $11.89 billion. Wall Street was expecting earnings of 61 cents a share on revenue of $12.45 billion.

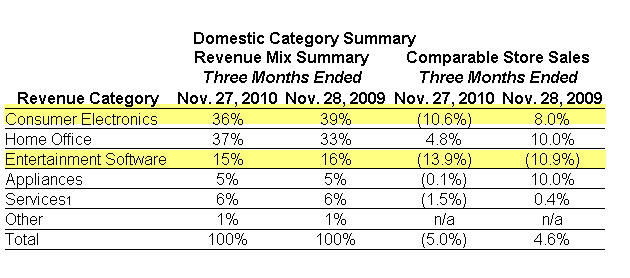

What happened? Best Buy said sales of TVs and mobile computing products---notebooks---came in lower than expected. Indeed, same store sales were down 3.3 percent in the third quarter. In the U.S. same store sales at Best Buy were down 5 percent.

A low double-digit same store decline in TVs, entertainment hardware and software crimped Best Buy's quarter. Mobile phone and tablet computer sales were decent, but overall Best Buy struggled. Competition also hampered Best Buy as the company competes with Wal-Mart and other electronics retailers such as HH Gregg, which has taken over many locations formerly owned by Circuit City.

Best Buy said in a statement:

The company estimates that its domestic market share declined 110 basis points versus the comparable period last year for the three months ended October 31, 2010. The decline was driven primarily by declines in TVs, mobile computing and gaming software. Based on fiscal year-to-date trends, the company now estimates that its domestic market share will decline for the full fiscal year as compared to the prior fiscal year.

Some key highlights from the Best Buy conference call:

- CEO Brian Dunn said online sales were up 7 percent from a year ago and 40 percent of sales are for in-store delivery. Nevertheless, that rate of growth seems to lag the likes of Amazon.

- E-reader sales and mobile sales are solid. Dunn said:

Upgrade checks were a primary driver of our Best Buy Mobile business, because so many customers have no idea that they can upgrade to a great new phone for little or no out-of-pocket expense for the hardware. We believe that Best Buy Mobile continues as a huge growth opportunity for us and will continue to contribute positively to our earnings. We estimate we have only about 5% market share and we plan to more than double that share over time. We also saw very high demand for e-readers. This is a growing category for us. We sell all three major e-reader brands and sales were very strong. This is noteworthy, because it illustrates customers' appetite to be connected and to engage in new technology.

- Best Buy decided not to play ball in the cheap TV space and is paying the price. LED TV is selling well, but 3D and connected TVs aren't. Dunn said 3DTV and connected TVs are "a little bit slower than the industry wanted it to be."

Best Buy projected fiscal 2011 earnings of $3.20 to $3.40 a share. Wall Street was expecting $3.59 a share.

Here's a look at the moving parts: