BlackBerry 10 and getting tablets right: What RIM needs to do in 2012

Facing competition from iOS and Android, what does RIM need to do to get back in the game?

2011 is likely to be a year that RIM would like to forget. The company's devices were once an executive must-have but now a series of new challengers - and increased competition from old rivals - have made it a much more difficult competitive landscape.

RIM's portion of the smartphone market diminished - shrinking to 11 per cent by the third quarter of the year, according to stats from analyst Gartner. The once mighty BlackBerry maker was relegated to fourth place - behind Google's Android, the legacy Symbian OS and Apple's iOS.

And then there were the network outages - which lasted days and required co-CEO Mike Lazaridis to pop up on YouTube in person to apologise to BlackBerry users.

"RIM's growth has slowed down an awful lot," says Daniel Gleeson, research analyst at analyst IHS Screen Digest. "Their growth last year was only 11 per cent in shipments year-on-year... whereas a few years ago you're talking about 100 per cent growth year-on-year so their growth is slowing down an awful lot."

On the plus side, RIM did finally get its first tablet out the door in 2011: the 7-inch BlackBerry PlayBook. However the slate lacked key features such as native email and RIM's baby steps into a new category already dominated by Apple's iPad have not quickened into swift strides.

In the quarter after the PlayBook launched, shipments (not sales) had dwindled to a meagre 200,000 - down from 500,000 in its launch quarter. As the year wore on, and Apple continued to sell millions of iPads, RIM began discounting the PlayBook - cementing the perception its slate had flopped. In the UK the price-tag for the basic PlayBook has now dropped to around £170.

2011 also saw RIM struggle on with its legacy smartphone operating system - a now-aging OS that looks dated next to a slick new generation of mobile OSes such as Google's Android and Apple's iOS. And as 2011 drew to a close the BlackBerry-maker had one last bit of bad news to impart: there would be no BlackBerrys running its planned new platform, BB10, until "the latter half of 2012".

This extra delay - BB10 devices had initially been slated for around the middle of 2012 - means RIM's shiny new phones are likely to be pitted against quad-core Android handsets - and the iPhone 5.

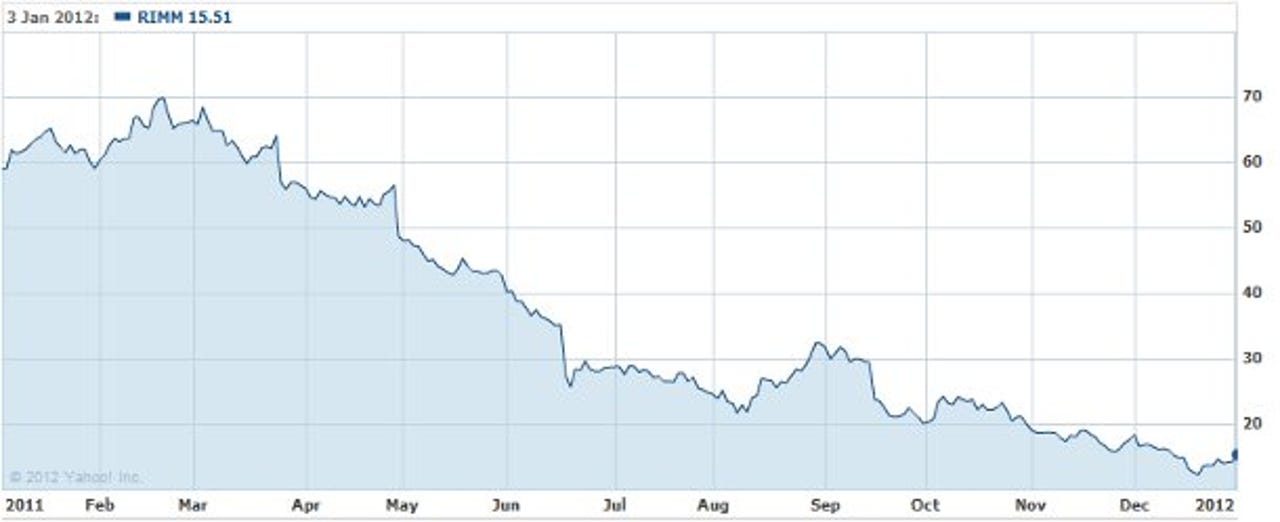

Share price is one indicator of the challeges faced by RIM: the BlackBerry-maker's share price donned skis and headed downhill: from a high of $69.69 in February 2011, it bottomed out around Christmas at $12.52.

2011: A bad year to be RIMImage: Yahoo! Finance

Where next for RIM?

All of which means RIM has a hill to climb if it is to compete with the likes of Apple and Nokia. "This year is going to be very very tough for RIM," says IHS Screen Digest's Gleeson. "They're essentially in a sort of holding pattern until BlackBerry 10 launches. Until then we won't know exactly what the precise long term prospects for them are - until we see how well the finished product actually works, how well it's received.

"Nothing seems to have changed [for RIM in recent years] - which is essentially the problem," adds Ovum analyst Nick Dillion. "I wouldn't write them off as a big player in the mobile business. [But] ...they need to pull their finger out this year and turn things around."

"The beauty of this industry is you can go from hero to zero very quickly but you can also come back," says Gartner analyst Carolina Milanesi. "There is definitely space for RIM. The question is what they want to be going forward?"

Deliver BlackBerry 10 fast

What does RIM need to do this year to get back in the game? Top of its 2012 to-do list is to deliver BB10 - this is one task it absolutely must pull off this year. While the QNX Neurtrino technology which RIM acquired back in 2010, to form the basis of its new platform, is a good place to start - Ovum's Dillon describes it as "very capable, very stable and very proven" - RIM needs to achieve something that has so far eluded it: a complete reboot, without compromising on quality, and quickly.

"[QNX] will enable RIM, from a technology point of view, to remove any issues with performance or lag, will allow them to make the most of dual-core, quad-core processors which they can't currently do with their existing platform, and, with their graphics engines they're building, allow them to do some quite smart things with the UI as well," he says.

RIM needs to be accelerating its product and technology development cycles and getting things to market quicker, he says. "Every other vendor now has either started afresh with a new platform or has replaced their platform. Microsoft has gone through that painful process most recently [with its Windows Phone OS] but RIM hasn't and they're still running on this legacy platform so they're treading water at the moment."

The BlackBerry OS has seen only incremental updates in recent yearsImage: RIM

Dillon warned that RIM's competitors are adding more and more services in to their platforms trying to make them stickier and give people more reason to stay: "Unless BlackBerry does the same it's going to become a niche player," he adds. "Definitely they need their new platform in place this year. The sooner the better. If it's not here by the end of the year they've got serious issues."

As well as QNX, in 2010 RIM also acquired user interface design company, The Astonishing Tribe (TAT) - an acquisition which Gartner's Milanesi says could help BlackBerry shine again, provided RIM can cut the umbilical cord with its own past.

"They have this jewel that they acquired in TAT - they are a great company from a UI perspective. RIM really has to let them loose and do what they need to do without thinking 'oh but this looks too different from what we have so far'. Well guess what? What you have so far works great on a keyboard, it doesn't on touch," she says. "That is going to be really, really key - because the moment you get a nice intuitive UI you're hooking consumers [on to your platform]."

The improvements RIM has made to the BlackBerry OS thus far have been just that, incremental improvements, says Milanesi. It's imperative for RIM to deliver something far more radical - and fully centred on touchscreens.

"If you look at BlackBerry 7, yes there have been some improvements but it doesn't change your experience day and night. It is an improvement, not something that will revolutionise the way people look at RIM. And I think that's what they need now - they need really to come in with a big bang," she says.

Even with a stable platform beneath it in QNX, RIM will have its work cut out to build services on top of the new platform that are compelling enough to attract a new generation of BlackBerry users. So while the delay to BB10 may not be great news for RIM's prospects, it's better to get it right than rush something half baked out the door, she adds. "They obviously didn't need [any extra delays] but, that said, it's better to get it right than not get out with something that's not going to make a huge difference.

"It's very important for them that when they launch products with BlackBerry 10 that they are complete - not like the PlayBook - so they have email functionality, they have all these things ready and running," adds IHS Screen Digest's Gleeson.

RIM need to broaden its horizons generally - to think more strategically, according to Gartner's Milanesi. For too long, the company has been thinking in terms of today's mobile world - or even yesterday's - not tomorrow's. She describes it as having been stuck in a messaging-centric rut for the past three years, adding that it needs to be asking itself "what else do consumers want to do on their devices other than just messaging?".

"RIM continues to be focused around messaging - and yes they've done some things in social that are good - but there's more to [mobile now]," she argues. "Cloud is a big, big trend... But there aren't really a lot of companies that are doing something a bit out of the box and different. And we are still at the very beginning so if you can jump on a new trend and try and lead that, that could get you somewhere.

"Collaboration [via the cloud] is going to be key - people are doing more with more devices and need to sync their documents. That kind of need is definitely there from an enterprise perspective and it will come, in time, with consumers when the cost of doing that over cellular stops being prohibitive. So adding somebody who understand that and has that vision [could benefit RIM]."

Does RIM need new leadership - as well as a new OS?

In recent weeks rumours that RIM is set to change its leadership team have resurfaced. Co-CEOs Mike Lazaridis and Jim Balsillie have been in charge for decades - and there have been rumblings of discontent from investors who believe the company's inability to innovate effectively stems from its long-serving leaders. Lazaridis founded RIM in 1984, while Balsillie joined him as co-CEO in 1992.

"Do I think they could benefit from a different leadership? Yes, absolutely," says Milanesi.

"I do think that RIM needs somebody who understands the industry and where the industry's going," she adds.

Milanesi believes such people do exist within RIM but returning confidence to investors probably necessitates a switch-out at the very top. "They do have people within RIM who absolutely get where the market is going - some of the things they're doing show that. The deal with Facebook on the integrated app and with the music on BBM. They are doing some [of the right] things."

Ovum's Dillon agrees RIM has vision in-house but stresses that it needs to get much faster at getting to where it wants to be: "If you look at their longer term vision and where they're trying to take things I think that's pretty solid now. They're heading in the right direction, they just need to accelerate that change."

Why has RIM been so slow to change?

RIM's inability to produce results as quickly as its rivals is down to the sheer scale of its competitors, according to Dillon. Replacing its entire platform and building out new software and services is a huge undertaking - and one that's obviously made easier if you command a lot of resources.

"They're not that big a company - they don't have the resources of somebody like Apple, like Microsoft or like Google, for example - they're nowhere near on that scale. So they lack the manpower and resources that the large players have, who can just keep throwing money and people at things to get them fixed," he says.

Gartner's Milanesi added: "At the moment I feel they're trying to make up for not having anything that's truly innovative by putting a lot of devices on the market and that's not going to help - it's just driving their cost high. They're coming out with a lot of different things that all pretty much look the same. There's not a lot of difference from a price perspective as well.

"You end up competing with yourself and not optimising your economies of scale - and that's a mistake a lot of companies make when they're struggling. They just bring out more to show that they're doing something. But that's not really what you need - you just need one good device."

Another thing that took up RIM's time last year was developing and launching the PlayBook. While it clearly needed to begin its transition to QNX, Ovum's Dillon says building a tablet took resources away from RIM's handset business - at a time when BlackBerry smartphones desperately needed to evolve.

"It did mean that they took their eye off their handset business somewhat," he says. "So it was necessary but maybe they could have balanced their efforts more."

Enterprise - and tablets - matter more than ever to RIM

Being stuck in the past is RIM's big problem - not least because their previous strength as a provider of devices to enterprises is now being eroded by a tidal wave of consumerisation and BYO. "People don't want to bring a BlackBerry to work - they want an iPhone or an Android," says Gartner's Milanesi.

The BlackBerry PlayBook - it's crucial RIM gets tablets rightPhoto: RIM

And, at the same time as the rise of shiny, powerful consumer devices, RIM's competitors are getting "good enough" at email and security to pass muster with many businesses and business users. "With Android, corporations still have their concerns about security - especially from an app store perspective - so they're just starting to deploy Android. But iPhone is really nicely entrenched now," she adds.

The iPad has been something of an enterprise Trojan horse for Apple - enabling it to break into boardrooms and dragging the iPhone in after it, says Milanesi. Thus, no matter how tough RIM is finding conditions in the tablet space, it really can't afford to give up.

"What we are seeing from our customers in the enterprise space is there's definitely interest in tablets and at the moment the only viable solution is the iPad. Once you let the iPad in, you let the iPhone in and that's hurting RIM," she says.

"Although it might seem a small market today, especially in the enterprise space, it's very much linked and the problem is, once you lose that customer on the tablet side you're likely going to lose it on the smartphone side too so that's really important.

"Getting the tablet market right - having a strong offering - is critical."

"All of a sudden [the iPad] was the cool item for execs to have," adds IHS Screen Digest's Gleeson. "So once the iPad and the iPhone got in then it's very difficult to not let everyone in the company use it for their business. The iPad was the foot in the door."

Despite consumerisation and BYO, enterprise users are still RIM's "core audience", according to Gartner's Milanesi. But it is running out of time here on the tablet front - and not just because of the iPad.

"RIM need to be back as a preferred supplier from an enterprise perspective - they need to do that quickly also because of Nokia and Microsoft," she adds. "Once the tablet offering comes out on Windows 8 - if it's decent enough - you will have corporations go that way and then maybe look at Windows Phone [rather than BlackBerry]."

BlackBerry PlayBook - a "huge missed opportunity"

IHS Screen Digest's Gleeson believes RIM's big misstep with the PlayBook was to ape the iPad and build a consumer-focused tablet. Instead, he says, it should have focused on what it knew well and targeted its core enterprise user-base.

"I look at the PlayBook as one of these huge missed opportunities for RIM - it had this potential that they had such a strong enterprise sector, and such a strong relationship with large corporations that they could have made the PlayBook a really really excellent enterprise tablet. Because the iPad is very much based on media consumption, it's biased towards the consumers sector - it's very, very much weighted towards that side," he says.

Communication, communication, communication

Be it marketing or customer comms, RIM has a lot of improving to do. Last year's BlackBerry network outage was compounded by a lack of official messages from RIM letting customers know what was going on and when it might all be over, says Ovum's Dillon. The company eventually got its act together - providing regular service updates and apologising to customers for the outage - but not before angering many long-time BlackBerry users.

Likewise, RIM failed to effectively communicate its apps strategy to developers, according to Dillon. The transition to a new platform means BlackBerry developers are already facing disruption but add in poor communication and there's a real risk of developers abandoning RIM for rival platforms such as Google's Android.

"They've essentially ripped out the foundation for all their existing Java programmers [who] will have to start from scratch. And they haven't communicated that message very well. There's been a lot of uncertainty around it," he says. "I think they have now come out in the open and been quite clear about what's going on, so that's a start I guess, but the issue is I think they'll struggle to keep those developers with them... because they have to basically relearn their skills from scratch."

The company also needs to talk to customers about the results of its review of network infrastructure - following last year's outages - something Dillon notes RIM has been keeping very quiet about. "They've been reviewing it internally but even if they are just reviewing it I think they need to communicate that more clearly to dispel people's fears," he says. "They're probably just trying not to talk about it until they've got something more positive, and hoping people will forget about it and carry on, but I think it is a concern now at the back of people's minds and something they can't just ignore.

"There's clearly an issue with their current infrastructure. Something they'll be reviewing with a view perhaps to decentralising it or changing the way it works altogether but they haven't communicated that as yet - and it's something they will need to do."

"They've got quite a year ahead of them," Dillon adds.