BlackBerry's transition to software near complete as Q1 hardware sales tank

BlackBerry's transition to a software and services-based business is nearly complete as the acquisition of Good Technology bolsters applications and the company's smartphone business tanks.

CEO John Chen has talked up BlackBerry's enterprise mobility management and Internet of things business fueled by QNX as device sales crater and lose money.

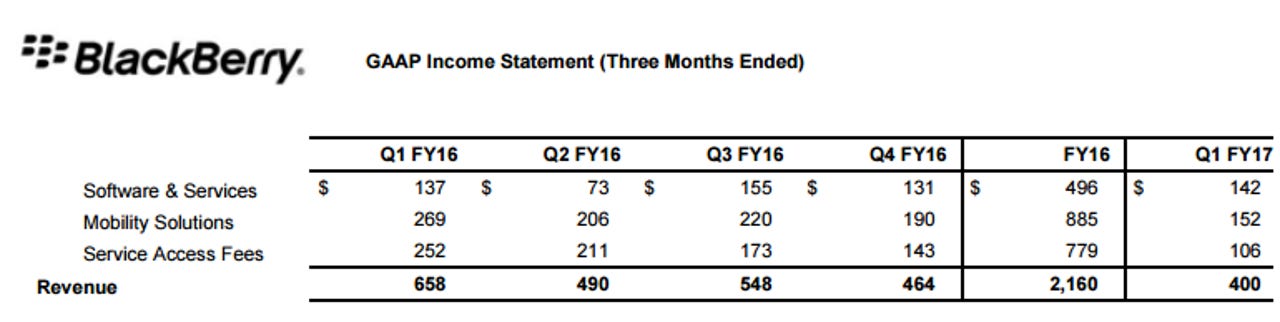

The first quarter results highlight that the shift to software has occurred already. Granted, BlackBerry's software business was beefed up by Good Technology, but revenue from applications and services and devices are roughly equal.

Here's a quick look at the trends.

The only certainty is that software and services will grow to pass BlackBerry's device business, which sits in the mobility solutions unit.

In the first quarter, BlackBerry broke even on a non-GAAP basis and forecast a smaller-than-expected loss. Revenue tanked, but software simply has better margins. In addition, BlackBerry has more visibility in the business. The device business has a role in BlackBerry, but it diminishes each quarter.

The company reported a net loss of $670 million, or $1.28 a share due to an asset write-down, restructuring charges, inventory write-down and other items. Excluding the kitchen sink of charges, BlackBerry reported non-GAAP operating income of $14 million.

Revenue for the first quarter was $424 million non-GAAP and $400 million in GAAP, down from $658 million in the same quarter a year ago. BlackBerry had total cash, equivalents and long-term investments of $2.5 billion.

Overall, the story for BlackBerry is the same as it ever was. BlackBerry has few answers for its device division and is focused on software. The good news is the transition is happening quickly because software has been beefed up as the device business craters.

Chen said on a conference call:

Device revenue was below our expectations. We're still feeling softness of the high end of the market but we have a plan and a road map to drive profitable revenue growth later in the year. In software, we perform well and continue to deliver the robust growth. Excluding IP licensing, software and services grew 131% year-over-year. This is the second consecutive quarter we more than doubled our software services revenue.

BlackBerry had about 3,300 enterprise customer orders in the first quarter.

Chen also talked up QNX and its footprint in connected vehicles. QNX is being used as middleware for in-cockpit software as well as to update autos and provide maintenance updates.

BlackBerry is also rolling out BlackBerry Radar, which tracks cargo and freight on a cloud-based Internet of things platform. BlackBerry has two proof of concept trials and is launching commercially this month. If successful, BlackBerry Radar would boost QNX more.

On the conference call with Wall Street, Chen was asked what the impact would be on software if the hardware business was nuked. The reply: "I would say some but very little."

Bottom line: BlackBerry still sees value in the hardware business. I'd be shocked if it still sees value in the years ahead.