Cable: Natural born monopoly?

The second quarter results are out and it appears that the cable industry is winning share in broadband, phone and TV connections and handily thwarting encroachment by the likes of Verizon and AT&T. In fact, TV and broadband service is meant to be a monopoly and cable appears to be the winner.

That's the big conclusion by a Bernstein Research note penned by Craig Moffett.

Moffett writes:

In the harsh glare of second quarter seasonality, the telcos' wired businesses suddenly look not only like they are weakening… they look like they are positively collapsing. Access line losses have accelerated to an almost 10% annual rate at AT&T, and to an almost 12% rate at Verizon. Broadband growth has virtually stopped, with DSL customers abandoning the TelCos for cable's higher speeds and bundled prices. Cost reduction efforts are beginning to meaningfully lag volume declines, pressuring margins. The second quarter has been unkind, too, to the satellite TV operators. Dish Network's 2Q subscriber loss was the first ever for a major U.S. satellite operator. And while DirecTV made its number, overall subscriber growth for the satellite category is down 65% year on year. Gross additions were down 5.9% YoY for the two companies combined. DirecTV is holding its own, but it is doing so by gaining share of a shrinking pie. Suddenly, the satellite category looks… well, wobbly.

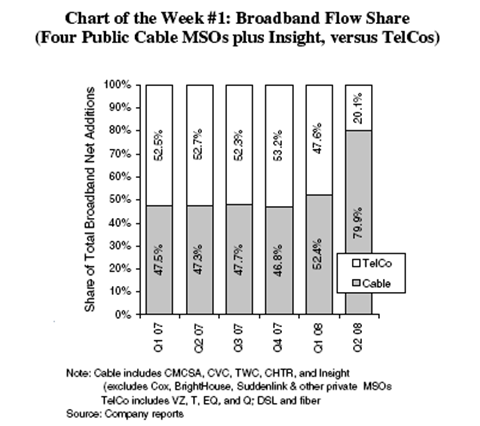

Bottom line: Cable is grabbing 80 percent of new broadband connections. Here's the tally:

Moffett notes that cable's broadband connections have been on the rise since the end of 2005 and appears to be a natural monopoly in the making. The biggest surprise is that cable has been taking its time becoming a monopoly. He notes:

The telecommunications market is, after all, a true natural monopoly market – that is, the capital required to build a network is simply too great to support more than one operator (just like the railroad business before it). And more than ever, it appears that Cable is poised to be that one network.

Moffett then goes into a little history (that we all know by know). Once upon a time there was a monopoly telephone provider--Ma Bell. Ma Bell was regulated and then broken up. Then there was the Telecommunications Act of 1996 and cable and Ma Bell's telecom offspring went at each other. Then Ma Bell began merging again with two main providers--AT&T and Verizon. However, cable--an uber network for video--kept gaining. Today, you can reasonably argue that AT&T and Verizon are primarily wireless phone companies. In the end, it's monopoly time. After all the shuffling in the broadband industry the market characteristics, which favor a natural monopoly, remain.

Moffett's take is most likely on target, but it's quite a buzzkill for those of us that would like a little more competition in the broadband marketplace. I'm fortunate in that I have Verizon's FiOS and Comcast going at it, but that's not the norm in many regions. Meanwhile, if that natural order for telecom/video/broadband service is monopoly that hints at more regulation in the future and puts the FCC's Comcast ruling in a different light as a precedent.

Also see:Comcast sees economic headwinds; Can anyone win broadband war?

Verizon’s wireless business shines; ‘Comfortable’ with FiOS adds

AT&T’s quarter hits mark; Wireless churn falls; iPhone 3G sells well