Can eBay's payment strategy carry it through auction makeover?

EBay has the right idea about putting its marketplace unit - comprised of sites such as eBay and StubHub - into revamp mode, as it told analysts during a meeting yesterday. For the fourth quarter, the unit saw sales slip 16 percent from a year earlier. But sales in the payment unit - made up of properties such as PayPal and Bill Me Later - saw sales jump 11 percent from a year ago.

Blame the slow growth in the marketplace unit on whatever you'd like - bad economy, increased competition, slowed consumer spending. The fact of the matter is: the online auction business, pretty much created by eBay, just ain't what it used to be.

Just the other day, I wrote about Swoopo, a somewhat questionable auction site where anyone who places bids - whether they win or lose the auction - has to pay a 75-cent bidding fee everytime that virtual bidding paddle is raised. Love it or hate it, Swoopo is giving auction lovers what they want - the chance to win great, out-of-this-world bargains on still-in-the-box items - in a way that eBay didn't. It gave them an alternative. And while Swoopo's business hasn't seen big growth numbers, it also hasn't seen a decline.

Yes, eBay has great free cash flow - $2.3 billion in 2008. But I still have concerns about its outlook for the payments unit. At its analysts meeting yesterday, the company put a lot of faith in its payment unit - saying that the PayPal service should double in size in the next three years, processing between $100 billion and $120 billion in annual payments by 2011.

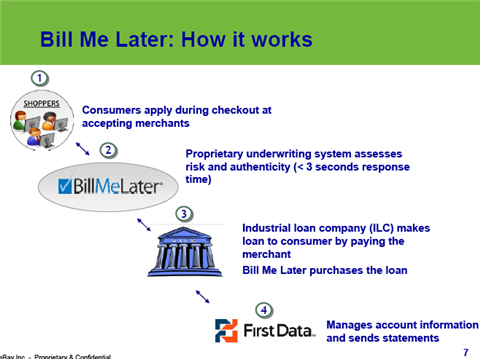

The problem is that PayPal is still tied to spending and largely, that spending is tied to eBay - though the company said it plans to spread its wings further into the marketplace. More troublesome is the role of Bill Me Later. Back in October, when eBay announced the acquisition for $820 million in cash and $125 million in outstanding options, times were different. The economy, while clearly on a dangerous path back then, still had not reached the crisis point that it has in 2009. Back then, Larry Dignan wrote in a post about the company's plans for Bill Me Later:

EBay also noted in a presentation that Bill Me Later’s credit model was performing well in a downturn. That’s no small issue given the current credit crunch and the fact that Bill Me Later’s model depends on assessing consumers’ ability to pay the company back. Bill Me Later CEO Gary Marino added that the company does not issue credit lines. It makes its loan decisions case by case and aims to collect interest on reasonable terms–also known as the tried and true banking model.

Bill Me Later, by definition of its name, is debt. New debt. And with so many choosing these days to either pay cash or go without, it's hard to imagine that such a service would see strong growth in the downturn. One nugget worth noting from a post about eBay's most recent quarter: "Bill Me Later has tightened its credit standards."

That's pretty much the story everywhere. Sure, I know there are some people who might use Bill Me Later to keep from providing credit card information on the Internet or maybe even to spark a cash payment - send me a bill and I'll pay you with a check. But there will be others, those who cannot afford those Jet Blue airline tickets today but really want to take the kids to Disney World, who will see it as a a form of credit.

In this economy, that just doesn't feel like the safest way to get through the storm.